Wyoming Labor Force Trends

June 2022 | Volume 59, No. 6

Click Here for PDF

Return to Table of Contents

Average Hourly Earnings in Wyoming’s Goods-Producing Sector

by: David Bullard, Senior Economist

The Current Employment Statistics (CES) program produces estimates of average hourly earnings for private sector industries for the U.S. and for all states. The private sector economy can be broken out into two broad categories: goods-producing and service-providing. The goods-producing sector includes mining & logging, construction, and manufacturing, while the service-providing sector includes wholesale trade; retail trade; transportation, warehousing, & utilities; information; financial activities; professional & business services; educational & health services; leisure & hospitality; and other services.

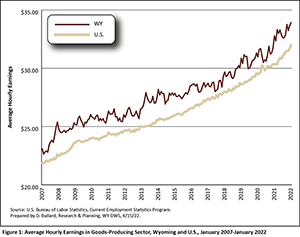

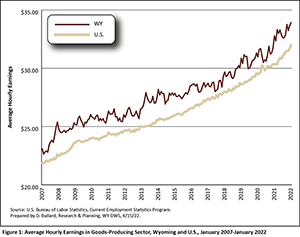

In the goods-producing sector, Wyoming consistently had higher wages than the U.S. (see Figure 1). In January 2022, Wyoming workers in the goods-producing sector earned an average wage of $33.92 per hour, while U.S. workers earned $31.98. This was a difference of $1.94 per hour and it reflects the large size of Wyoming’s mining industry and the high wages that it pays.

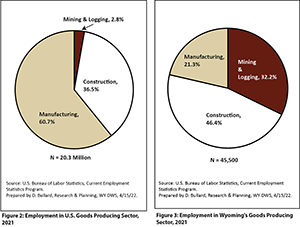

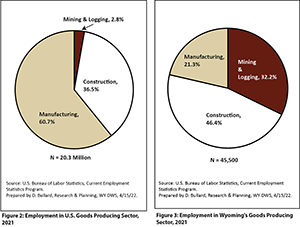

Figures 2 and 3 illustrate Wyoming employment in the goods-producing sector compared to the U.S. While the mining & logging industry only made up 2.8% of employment in the goods-producing sector nationally, Wyoming’s mining & logging industry made up 32.3%. On the other hand, manufacturing is a relatively small industry in Wyoming, accounting for 21.3% of goods-producing employment, while nationally, it accounted for 60.7%.

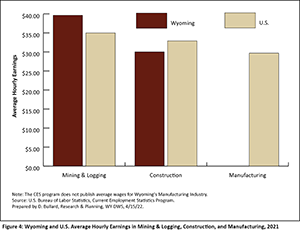

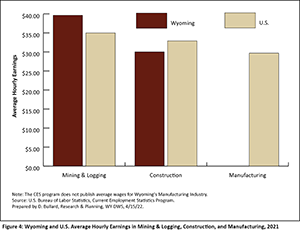

How do average wages compare across these three industries? Figure 4 shows that the 2021 annual average U.S. wages for mining & logging ($34.99) were considerably higher than U.S. wages for construction ($32.90) or manufacturing ($29.69). In Wyoming, average wages in mining & logging ($39.63) were higher than construction wages ($30.03). Because of a limited sample size, the CES program does not publish data on average hourly earnings for Wyoming’s manufacturing industry.

Together, these figures indicate that within the goods-producing sector, Wyoming employment is skewed toward the highest-paying industry (mining & logging, with nearly one-third of employment) and skewed away from the lowest-paying industry (manufacturing, with approximately one-fifth of employment). Thus, based only on the relative size of these industries, it should not be surprising that the overall goods-producing sector in Wyoming pays higher wages than the national average.

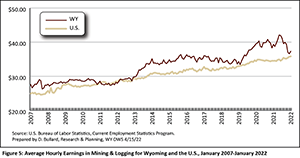

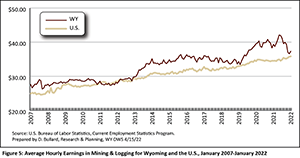

Figure 5 shows that for most of the past two decades, Wyoming’s mining & logging industry has paid higher wages than the U.S. mining & logging industry. In May and June 2021, the difference was more than $7.00 per hour. The most recent data -- for January 2022 -- show that average hourly earnings in Wyoming’s mining & logging sector were $37.33, compared to $35.84 in the U.S.

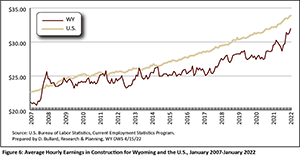

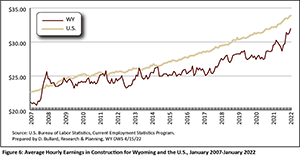

In contrast, Wyoming’s construction industry has tended to pay lower wages than the U.S. (see Figure 6). At certain times, Wyoming’s wages have lagged behind the U.S. by as much as $4.00 per hour, but in January 2022, the difference was $1.92.

To summarize, Wyoming’s goods-producing sector has consistently paid higher wages than the U.S. These higher wages are partly a function of Wyoming’s unique economic structure. Within the state, the high paying mining & logging industry accounted for nearly one-third of goods-producing employment, while nationally it only accounted for approximately three percent. Even within the mining & logging industry, wages were higher in Wyoming than in the U.S. Wyoming’s construction industry, on the other hand, has generally paid lower wages than the U.S.

Figures

.svg)

Wyoming at Work

Wyoming at Work