Wyoming Labor Force Trends

October 2025 | Volume 62, No. 10

Click Here for PDF

Return to Table of Contents

Examining Millennials’ Departure From Wyoming

by: Michael Moore, Research Supervisor

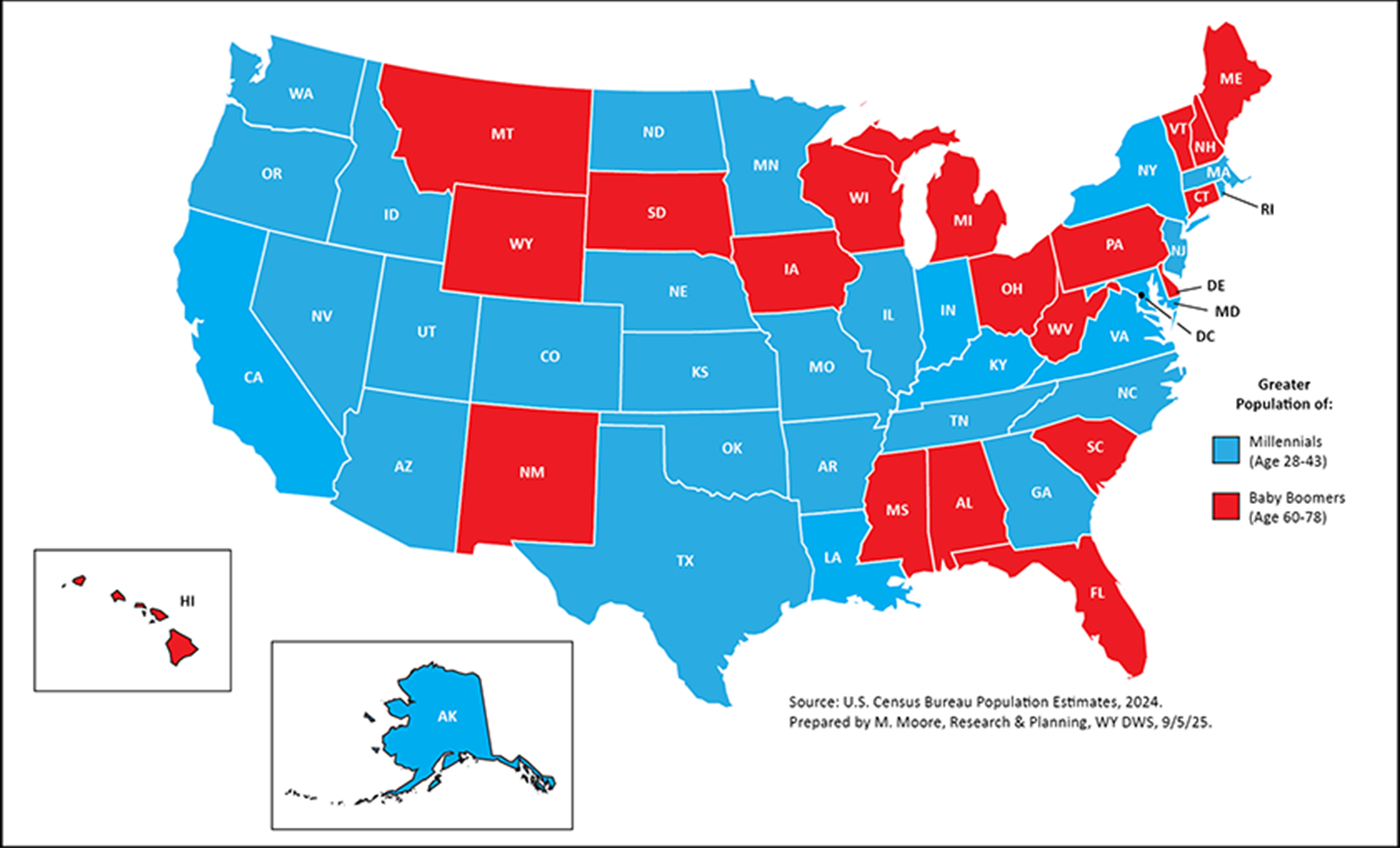

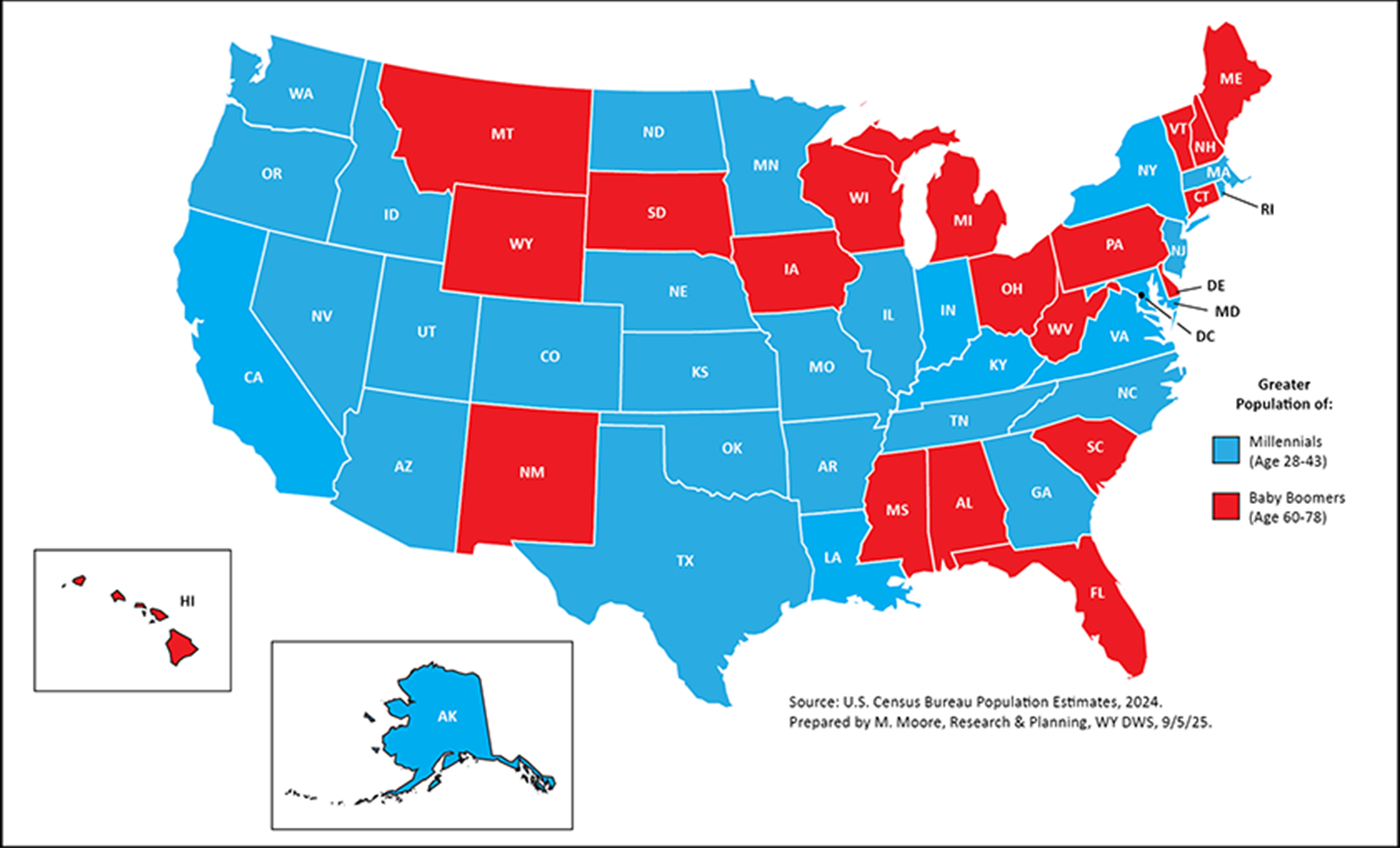

In 2024, Wyoming had a larger population of baby boomers (those born between 1946 and 1964) than millennials (those born between 1981 and 1996; see Figure 1). Despite an exodus of millennials from Wyoming each year from 2014 to 2020, Wyoming saw a small increase in its millennial population each year from 2021 to 2024.

The Research & Planning (R&P) section of the Wyoming Department of Workforce Services has published several articles on the demographics of Wyoming’s population and workforce. An article titled, “Millennials continue to leave Wyoming and its labor market” was published in the September 2021 issue of Wyoming Labor Force Trends (Moore, 2021), and this article serves as an update by including data for 2021 through 2024.

This article focuses on Wyoming’s millennial population and workforce because that generation accounts for a large proportion of prime working-age individuals. In 2024, millennials were between the ages of 28 and 43. This article looks at the change in the millennial population and workforce from 2014 to 2024, and also includes population estimates to show how Wyoming differed from surrounding states and the U.S. in terms of millennial population growth.

This article focuses on population estimates from the U.S. Census Bureau, and persons working in Wyoming at any time during the year, as prepared by R&P. Counts of persons working are based on employers’ quarterly wage and employment reports to the Unemployment Insurance (UI) tax section of the Wyoming Department of Workforce Services; these are referred to as wage records. As noted by Bullard (2015), UI covered employment represents approximately 91.5% of Wyoming’s total wage and salary employment disbursements. By linking the Wage Records database with other administrative databases, such as the driver’s license file from the Wyoming Department of Transportation, R&P is able to identify demographic information and other variables at the county and industry levels, including number of persons working, average annual wages, average number of quarters worked, average number of employers, sex, and age.

The employment data presented in this article represent the number of persons working in Wyoming at any time during the year, not the number of jobs worked. Any individual who had wages in Wyoming at any time during the year from 2014 to 2024 is included in the summary counts presented in this article, regardless of the number of quarters worked. Each individual is counted only once.

Demographic employment and wage tables are available by county and industry from 2000 to 2024 at https://doe.state.wy.us/LMI/earnings_tables.htm.

In order to provide additional context, this article also uses estimates compiled from the U.S. Census Bureau's single-year-of-age population estimates that were published in June 2025.

Results

Population Change

In 2019, the number of millennials in the U.S. surpassed the number of baby boomers for the first time (see Figure 2). This has continued each year since then, as the U.S. millennial population continues to grow, while the baby boomer population shrinks. In 2024, the U.S. had an estimated millennial population of 74.2 million, an increase of 3.7 million (5.2%) compared to 2014 (see Table 1).

According to the U.S. Census Bureau (Barrett, 2024), the 1.0% growth in the U.S. population was driven by international migration, which included a large number of millennials from other countries. The decrease in the baby boomer population is the result of individuals getting older and dying.

In contrast, Wyoming’s baby boomer population continued to outnumber millennials (see Table 1 and Figure 2). Wyoming had an estimated baby boomer population of 127,313 in 2024, compared to 122,585 millennials. From 2014 to 2024, Wyoming’s baby boomer population declined by 12.2% (17,613 individuals), while the millennial population declined by 6.3% (8,301 individuals).

Wyoming was one of 20 states with a greater population of baby boomers than millennials in 2024. Most of Wyoming’s surrounding states had a greater population of millennials than baby boomers, with the exception of Montana and South Dakota (see Figure 5).

Wyoming’s millennial population peaked in 2015 with 131,281 individuals, then decreased for each of the next five years. From 2015 to 2020,

Wyoming’s millennial population decreased by an average of about 2,000 individuals per year. Since 2022, Wyoming’s millennial population has seen moderate growth, adding an average of about 500 individuals per year.

×

![]()

Millennials Working in Wyoming

Over the last 10 years, the decrease in the number of millennials working in Wyoming was much greater than the decrease in the overall millennial population. As previously mentioned, Wyoming’s millennial population decreased by 8,301 individuals (or 6.3%) from 2014 to 2024. During that same period, however, the decline in the number of millennials working was much greater: 23,151, or 19.0% (see Table 2 and Figure 3).

Although Wyoming’s millennial population increased during each year from 2022 to 2024, the number of millennials working in Wyoming continued to decline. In 2024, the number of millennials working in Wyoming dipped below 100,000 for the first time since 2010. Millennials were between the ages of 14 and 29 in 2010, so some of them had not even entered the workforce yet.

The greater decline in millennials working than the overall population may be an indication that some millennials continue to live in Wyoming but work elsewhere. They could be commuting to a state like Colorado or Utah for work, teleworking for an out-of-state company, or participating in ecommerce that doesn’t require them to live in a particular state, or even country.

Wyoming’s economic downturn that lasted from second quarter 2015 (2015Q2) to fourth quarter 2016 (2016Q4) appears to have played a role in millennials’ departure from Wyoming and its workforce. R&P defines an economic downturn as a period of at least two consecutive quarters of over-the-year declines in average monthly employment and total wages, based on data from the Quarterly Census of Employment and Wages (QCEW).

The prolonged economic downturn from 2015Q2 to 2016Q4 was preceded by a decline in the prices of and demand for Wyoming’s energy resources, and resulted from the “substantial decline in the prices of oil, an extended period of low natural gas prices, and the erosion in the price of coal" (Gallagher, 2016). From 2015Q1 to 2017Q1, Wyoming lost 16,504 jobs, a decline of 5.9%. Wyoming’s mining sector lost 7,842 jobs, or nearly one-third (29.6%) of its total jobs (Research & Planning, 2025).

Wyoming’s 2015-2016 economic downturn was different from other downturns in that it was unique to Wyoming and other states reliant on mining jobs, particularly coal. For example, the prior downturn occurred from 2009Q1 to 2010Q1 during a period that coincided with the national Great Recession, when all states lost jobs (see Figure 4). However, while Wyoming lost thousands of jobs in 2015 and 2016, all surrounding states were experiencing substantial economic growth, and so was much of the country.

Prior research from R&P has demonstrated how younger individuals (especially males) are most likely to lose their jobs during periods of economic downturn (Harris, 2013, and Moore, 2017). When the economic downturn began in 2015, millennials were between the ages of 19 and 34, so they likely were among those who lost their jobs. From 2014 to 2017, the number of millennials working in Wyoming decreased by 11,372, or 9.3%.

Given the economic growth of Wyoming’s surrounding states in 2015 to 2016, it is possible that many working-age Wyoming millennials who lost their jobs were able to find work in another state, and did not return. This could be a topic of future research for R&P.

Conclusion

The departure of Wyoming’s youth is not new, as young adults regularly move to other areas for new experiences. As discussed in the related article in this issue of Trends, an average of 55.1% of high school seniors from any given year beginning in 2010/11 were still found working in Wyoming five years later; this proportion dropped to 46.1% 10 years after their senior year. Despite two economic downturns between 2010/11 and 2023/24, there was little variation in retention rates between each senior class.

Wyoming’s economic downturn of 2015-2016 appears to have been a turning point for some millennials. Young workers are often the most likely to lose their jobs during an economic downturn, and in 2015, millennials were between the ages of 19 and 34. From 2014 to 2024, the number of millennials working in Wyoming decreased by 19.0%, even though the overall millennial population decreased by only 6.3%. It is possible that some millennials living in Wyoming may be commuting or teleworking for an employer in another state.

References

Barrett, K. (2024, December 19). Net international migration drives highest U.S. population growth in decades. U.S. Census Bureau. Retrieved September 8, 2025, from https://tinyurl.com/3px5n5mm

Bullard, D. (2015, January). Local jobs and payroll in Wyoming in second quarter 2014: Construction leads job growth. Wyoming Labor Force Trends, 52(1). Research & Planning, Wyoming DWS. Retrieved September 16, 2025, from https://doe.state.wy.us/LMI/trends/0115/qcew.htm

Gallagher, T. (2016, April). Chapter 1: Economic analysis. Workforce Planning Report 2016, Wyoming Labor Force Trends, 53(4). Research & Planning, Wyoming DWS. Retrieved December 5, 2022, from https://doe.state.wy.us/LMI/trends/0416/a1.htm

Glover, T., and Moore, M. (2012, March). A decade later: Tracking Wyoming’s youth into the labor force. Research & Planning, Wyoming DWS. Retrieved September 16, 2025, from https://doe.state.wy.us/LMI/w_r_research/A_Decade_Later.pdf

Glover, T., and Moore, M. (2021, September). Another decade later: Tracking Wyoming's high school seniors into post-secondary education and the labor market. Research & Planning, Wyoming DWS. Retrieved September 16, 2025, from https://doe.state.wy.us/LMI/trends/0921/0921.pdf

Harris, P. (2013, May). Demographics of UI claimants: More males continue to receive benefits than females. Wyoming Labor Force Trends, 50(5). Research & Planning, Wyoming DWS. Retrieved September 16, 2025, from https://doe.state.wy.us/LMI/trends/0513/a2.htm

Moore, M. (2017, August). Wage records in Wyoming, 2000-2016: Males, younger workers were the most affected by the recent economic downturn. Wyoming Labor Force Trends, 54(8). Research & Planning, Wyoming DWS. Retrieved July 9, 2021, from https://doe.state.wy.us/LMI/trends/0817/0817.pdf

Moore, M. (2019, May). Chapter 1: Introduction — Driven by demographics and downturns: Wyoming’s 2018 labor market at a glance. 2019 Wyoming Workforce Annual Report. Research & Planning, Wyoming DWS. Retrieved May 28, 2025, from https://tinyurl.com/426yehdh

Moore, M. (2021, September). Millennials continue to leave Wyoming and its labor market. Wyoming Labor Force Trends, 58(9). Research & Planning, Wyoming DWS. Retrieved September 16, 2025, from https://doe.state.wy.us/LMI/trends/0921/0921.pdf#page=8

Pew Research Center. (2019). Defining our six generations: Your guide to America’s six living generations. Retrieved September 16, 2025, from https://tinyurl.com/59rwxdkb

Research & Planning. (2025, May). Wyoming QCEW summary statistics by industry, 2001-2024. Wyoming DWS. Retrieved September 16, 2025, from https://doe.state.wy.us/LMI/QCEW_OTY/toc.htm.

Hire Wyo

Hire Wyo