Dynamics of Unemployment Spells: A Look at the Trends Before, During, and After the Great Recession

See related tables and figures

This article examines how pre- and post-unemployment wages differ among different genders and age groups, and how these earnings are affected by educational attainment. In addition, this article looks at trends in post-unemployment wage progression, or how a person's wages grow after he returns to work after a spell of unemployment.

The main objective of Unemployment Insurance (UI) benefits is to counteract unemployment effects on economic activity, assist in sustaining households affected by a job loss, and finance the search for work. During the national Great Recession that lasted from December 2007 to June 2009 (NBER, 2010), Wyoming's UI trust fund paid $140.7 million in benefits in real dollars annually. But what happens to an individual's earnings when he or she returns to work after a spell of unemployment? Which groups' earnings were most substantially impacted after receiving UI benefits?

Using the Wyoming Department of Workforce Services' Research & Planning (R&P) administrative databases, this article explores the dynamics of unemployment spells from 2007 to 2009. The data covers the period from 2007 to 2011, allowing analyses to be conducted before, during, and after the Great Recession that lasted from December 2007 to June 2009. This recession period is defined by the National Bureau of Economic Research (NBER), a non-profit organization that, among its other activities, is best known for publishing start and end dates of recessions on a national scale. There is no known comparable measure of recession duration for individual states.

Persons are considered unemployed if they are currently jobless, looking for work, and are able to work. Individuals who leave the labor force voluntarily or who are not actively seeking employment are not considered unemployed. During the Great Recession, Wyoming's UI trust fund was able to remain solvent even after paying $140.7 million in benefits annually in real dollars (Wen, 2009). Many states were unable to maintain solvency in their UI trust funds and needed to borrow money from the federal government, ranging from Delaware's $63 million to California's $9 billion.

During this period in Wyoming, males were laid off more frequently than females, and mining and construction were the two industries most affected by the economic downturn; the number of UI claims increased across all educational backgrounds (Wen, 2010). To help demonstrate the effects of UI benefits on the economy, Leonard (2010) estimated that 990 jobs were retained in Wyoming's economy in 2009 due to the counter-cyclical effect of UI claim payments. UI benefits are meant to be temporary, sub-wage replacements for workers who are involuntarily unemployed (Advisory Council on Unemployment Compensation, 1996).

Even during this economic downturn, Wyoming employers continued to hire new workers. Through its New Hires Job Skills Survey, R&P found that Wyoming employers added 112,065 new hires from fourth quarter 2009 (2009Q4) to third quarter 2010 (2010Q3; Knapp, 2012). The New Hires Job Skills Survey is designed to collect data on the demographics, benefits, skills, wage rates, and the gender wage gap for jobs hired in Wyoming. Data on new hires can be found online at http://doe.state.wy.us/LMI/newhires.htm.

The fact that Wyoming employers continued to hire new workers during this period shows that Wyoming's labor market is dynamic and flexible even during tough economic times. Data on unemployment spells provide insight into how easily the labor market allows people to respond to shifting economic trends and changes in the demand for labor.

Literature Review

The demographic variables associated with unemployment have been widely researched. Several studies have found that older workers who have been unemployed for long periods have greater difficulty in finding employment than younger workers or older workers who experience only short-term unemployment (Levin-Waldman, 1997; Mendenhall, Kalil, Spindel, & Hart, 2008). The suggested explanation is that employers are looking to reduce the cost of worker salaries and are opting to employ younger workers with different skill sets. Older workers may be in a high-level position at the time of their unemployment (e.g., managers, executives) and finding employment at that level again may be difficult in a competitive economy.

Elsby, Hobijn, Sahin, and Valletta (2011) found that in the U.S. during the Great Recession, older workers were less likely to become unemployed than younger workers. However, when older workers lost their jobs, they tended to stay unemployed for longer periods. The authors also pointed out that during the recovery period, unemployment duration widened between older and younger workers, with younger workers finding jobs at a faster pace.

Chan and Stevens (1999) used data from the University of Michigan Health and Retirement Study (HRS) taken in 1992, 1994, and 1996 and found that for workers 50 years of age or older, the reemployment wage was significantly lower than previous earnings. The authors commented that as the unemployment duration of older workers increases, their likelihood of dropping out of the labor force or accepting lower-paying jobs also increases. It appears that older workers might accept lower-paying jobs in order to help offset reductions in retirement savings.

Age is not the only factor that has been shown to be a determinate of the length of unemployment. The differences in gender and unemployment spell duration have been extensively studied, especially for males. Females have been under-represented in many studies due to the perception that males are the primary wage earners (Bartell & Bartell, 1985; Dew, Bromet, & Schulberg, 1987).

Kulik (2000) compared males and females on the level of intensity of job searches of unemployed individuals. She found that males spent more time searching for employment and that females were more likely than males to turn down employment due to family commitments. Further, females were less likely to accept employment due to unfavorable working conditions or if the position was more masculine in nature. These results suggest that females may have less time to devote to job searches and instead spend more time taking care of family compared to their male counterparts. During the Great Recession and subsequent recovery, both males and females experienced a decline in employment; however, males began to find jobs during the recovery, while employment for females continued to decline (Elsby, et al., 2011).

Finally, education has been shown to be a factor in the duration of unemployment. According to Levin-Waldman (1997), who used U.S. Census Bureau Current Population Survey data in 1993, those individuals who experienced long-term unemployment were more likely to have at least a college degree than those who experienced short-term unemployment. This result may be due to these individuals' unwillingness to accept a lower wage, and they also may not feel as much financial pressure to find a job immediately compared to individuals with less education.

Many studies have focused on the wage differential after an individual becomes reemployed after a period of unemployment. The labor market functions differently than markets related to goods, money, or other exchanges. The labor market deals with the supply and demand of human activities and is governed by the unique characteristics (e.g., psychological and sociological) of human beings. Reemployed workers who shift between high-paying employment to low-paying service employment affect the reemployment wage, which produces decreased incomes (Couch & Placzek, 2010; Farber, 1997).

The lowest wage level at which an individual is willing to accept a job (reservation wage) has been shown to vary depending on certain factors. Ahn and Garcia-Perez (2002) used data from the Spanish Labor Force Survey regarding the length of unemployment and a person's willingness to accept a lower wage. The authors found that younger individuals were more likely to accept lower wages than older individuals. Further, individuals with higher educational attainment were less likely to accept lower wages.

However, as the length of unemployment increased, younger people and those with higher education changed their attitudes regarding wages and were more likely to accept lower paying jobs than older people. Using data from the German Socio-Economic Panel, Grun, Hauser, and Rhein (2010) found unemployed individuals who re-entered the workforce even at low quality jobs had a higher life satisfaction than those who remained unemployed. Both of these findings suggest that as the length of the unemployment spell increases, people are willing to improve their life satisfaction by taking a job at a lower wage.

The dynamics of unemployment during good economic times vary across groups including age, gender, and education level. Disadvantaged workers during good economic times tend to be better off than when economic times are more difficult, such as during the Great Recession. Gregg and Wadsworth (2010) found that less skilled, older males were more likely to be inactive in the labor market during a recession than when times were good. However, once these individuals become inactive during a recession, they tend to stay inactive when the recovery begins because jobs are scarce and employers are looking for younger, more educated individuals. For females who become inactive during a recession, the rate of re-entry in the labor market during the recovery is slightly better than males.

Methodology

The data used in these analyses were compiled using the UI and Wage Records administrative databases and included individuals who were paid a UI benefit between 2007 and 2009. The UI administrative database includes information regarding the claimant's previous employer, gender, age, address, and education level. The Wyoming Wage Records administrative database includes all quarterly wages for approximately 92% of employees working in the state by year, quarter, and industry. R&P also has wage records for 10 partner states through 2011: Alaska, Colorado, Idaho, Montana, Nebraska, New Mexico, Oklahoma, South Dakota, Texas, and Utah.

The number of quarters between the quarter an individual was paid a UI benefit and the quarter they began earning wages again were counted and used to indicate the duration of their unemployment spell. Further, the number of weeks between the start of the quarter and when the claimant was paid was counted as well. For example, an individual who was paid a UI benefit on January 15, 2007 and began earning wages in 2008Q1 would have had an unemployment period lasting 3.2 quarters (part of 2007Q1, all of 2007Q2, all of 2007Q3, and all of 2007Q4).

To examine the wage differential before and after unemployment, wages were obtained for the same quarter one year prior, one year after, and two years after an individual was paid a UI benefit. For example, if an individual was paid a benefit in 2009Q3, wages were obtained for 2008Q3, 2010Q3, and 2011Q3. These periods were chosen to allow comparisons to be made after a reasonable amount of time had passed after receiving unemployment benefits. For the duration of unemployment, all those who did not have wages as of 2012Q2 were included in the analysis. In this article, the wage differential is the change in wages from one year prior to unemployment to two years after unemployment. Wage progression is the growth in wages from the first year to the second year after unemployment. Figure 1 presents a hypothetical example, which shows that Hypothetical Taylor was unemployed in 2009Q3. Taylor's pre-unemployment wage in 2008Q3 was $5,000, compared to a $3,500 post-unemployment wage in 2011Q3. This shows that Taylor's wage differential was -$1,500. However, Taylor experienced positive wage progression after unemployment, increasing from $3,000 in 2010Q3 to $3,500 in 2011Q3.

To accurately count the number of individuals unemployed during the Great Recession, several criteria were imposed on the data. First, nonresident employment is a defining feature of Wyoming's labor market. A nonresident is someone whose address is somewhere outside of Wyoming (e.g., another state or country). Because this article focuses on the effects of unemployment on Wyoming residents, all nonresidents were removed from the data.

Second, those individuals who were associated with a union hiring hall or were job attached and plan to return to work within 12 weeks were also excluded. A job attached individual is someone who was laid off but one whose employer has agreed to hire them back within 12 weeks. Both unionized and job attached workers have a greater chance of being re-hired, making their unemployment period shorter.

Individuals were placed into three categories based on the education level indicated in the unemployment benefits system: less than high school, high school/GED, or associate's degree or higher. Life-span development literature suggests that mid-life is defined broadly between the ages of 40 and 60 (Lachman, 2004). To get an accurate picture of older versus younger workers, individuals were placed into two age categories: 39 and younger or 40 and older.

Long-term unemployment is defined by the U.S. Bureau of Labor Statistics as an individual who experiences unemployment for more than 27 weeks. Two calendar quarters is approximately 26 weeks. For this reason, those individuals who experienced two to eight quarters of unemployment will be defined as long-term unemployed in this article. Individuals experiencing less than two quarters of unemployment will be classified as short-term unemployed.

Results

Table 1 presents the number of individuals who received UI benefits from 2007 to 2009 and have not returned to employment in Wyoming as of 2012Q2 or in one of the 10 partner states as of 2011Q4. A majority of this group were males, had a high school diploma or GED, and were older.

Several hypotheses have been formulated based on past research to understand unemployment during the Great Recession and the subsequent recovery in Wyoming. In order to test these hypotheses, an Analysis of Variance (ANOVA) was conducted with unemployment duration as the dependent variable. An ANOVA is a statistical technique used to test the mean (average) differences between and within groups. More information on this technique and how it was used in this analysis can be found online at http://doe.state.wy.us/LMI/trends.htm.

Hypothesis 1: Younger females experienced a longer duration of unemployment than younger males.

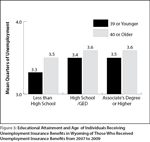

As seen in Figure 2, and consistent with predictions, younger females had a longer duration of unemployment (3.6 quarters) than younger males (3.4 quarters).

Hypothesis 2: Older males experienced a longer duration of unemployment than younger males.

Consistent with predictions, the duration of unemployment was greater for older males (3.6 quarters) than younger males (3.4 quarters).

Hypothesis 3: Younger females experienced a longer duration of unemployment than older females.

Younger females (3.6 quarters) did have a longer duration of unemployment than older females (3.5 quarters); however, this hypothesis was not supported because the difference is not statistically significant.

Hypothesis 4: Older workers with more education (associate's degree or higher) experienced longer durations of unemployment than younger workers of all education levels.

Using the same statistical technique, this hypothesis was not supported. However, Figure 3 (see page 9) shows that even though the hypothesis is not statistically supported, older workers with an associate's degree or higher did experience a slightly longer duration of unemployment (3.6 quarters) than younger workers of all education levels (3.3 to 3.5 quarters).

Hypothesis 5: For those who experienced short-term unemployment, older, more educated individuals experienced a greater decrease from pre-unemployment to post-unemployment wages than older individuals who have less education.

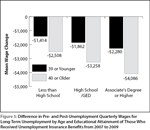

No significant difference was found for older individuals with higher levels of education having a larger decrease in wages compared to older, less educated individuals. But even though there was no statistically significant difference found, the older more educated individuals (high school/GED) did experience slightly greater decreases in wages (-$2,107) compared to older less educated individuals (less than high school; -$1,916).

Hypothesis 6: Older individuals with an associate's degree or higher experienced a greater decrease from pre-unemployment to post-unemployment wages than younger individuals with an associate's degree or higher.

Consistent with predictions, the decrease from pre-unemployment to post-unemployment wages for older individuals with an associate's degree or higher (-$2,507) was more than double the decrease experienced by younger workers with an associate's degree or higher (-$928; see Figure 4).

Hypothesis 7a: For those who experienced long-term unemployment, older individuals with an associate's degree or higher experienced a greater decrease from pre-unemployment to post-unemployment wages than older individuals with less education.

Hypothesis 7b: Older individuals with an associate's degree or higher experienced a greater decrease from pre-unemployment to post-unemployment wages than younger individuals with an associate's degree or higher.

Even though these hypotheses were not supported by a statistically significant difference, the results of this analysis did reflect the hypotheses (see Figure 5). Older individuals with an associate's degree or higher experienced a greater decrease from pre-unemployment to post-unemployment wages (-$4,086) than older individuals with a high school diploma or GED (-$3,258) or those with less than high school (-$2,508). Likewise, older individuals with an associate's degree or higher experienced a greater decrease (-$4,086) than younger individuals with an associate's degree or higher (-$2,280).

Hypothesis 8: Highly educated individuals who experienced long-term unemployment saw greater wage progression after unemployment than less educated individuals.

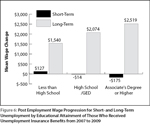

Figure 6 shows that this hypothesis was supported. Individuals with an associate's degree or higher had greater wage progression after long-term unemployment ($2,519) than those with a high school diploma or GED ($2,074) or those with less than high school ($1,540).

Hypothesis 9: Those with less education who experienced short-term unemployment saw greater wage progression after unemployment than individuals with higher levels of education.

Figure 6 shows that the analysis supported this hypothesis. Individuals with less than a high school diploma experienced greater wage progression after short-term unemployment ($127) than those with a high school diploma or GED (-$14) or those with an associate's degree or higher (-$175).

Conclusions

This article examined the dynamics of unemployment periods during the Great Recession based on gender, education level, and age. The results indicate that younger females have significantly higher unemployment durations than younger males, but no difference was found between younger females and older females. This difference may be explained by the American Recovery and Reinvestment Act of 2009 (ARRA), which was signed in February of 2009 with $105 billion being invested in infrastructure. As infrastructure jobs, such as those in the construction industry, are typically male-dominated, the number of jobs during the recovery period may have been skewed towards younger males. Past research has shown that females are less likely to take gender-atypical jobs (Kulik, 2000). Further, older males had longer durations of unemployment than younger males indicating, again, the significance of the ARRA and the types of jobs it created which may have put younger males at an advantage.

The results in this article also indicate that older individuals with a higher level of education experienced greater decreases in wages after a short-term unemployment spell compared to younger individuals with a higher level of education. This finding supports past research which indicated that younger individuals are able to find employment faster (Elsby, et al., 2011) and that younger individuals have different attitudes towards accepting jobs at lower wages compared to older individuals.

In terms of short-term unemployment, those with less education had a greater wage progression than those with a higher level of education. However, for long-term unemployment, those who had higher levels of education had significantly higher wage increases than those with less education. These findings suggest that as the unemployment spell duration increases, those with a higher level of education may have changed their attitude regarding accepting lower wages offered in the short term, which supports the conclusions of Ahn and Garcia-Perez (2002). Further, education seems to act as a buffer for those who experience long-term unemployment, as those with a higher level of education had significantly greater increases in their wages over the year compared to less educated individuals.

The real-world applications of these results are significant. Thomas (1997) found that individuals who utilize public employment agencies (such as the Wyoming Department of Workforce Services) early in unemployment experience shorter durations of unemployment than those who do not use these services or use these services later in unemployment. One of the main goals of the Department of Workforce Services is to reduce the amount of time individuals are unemployed. As shown in this article, there are several characteristics that result in higher durations of unemployment and a decreased wage after unemployment. Older individuals with higher levels of education were shown to be particularly affected by unemployment during the national Great Recession, especially in terms of wage recovery. Further, younger females may be vulnerable to longer durations of unemployment compared to males due to outside influences, such as family responsibilities and job characteristics.

The findings suggest that at the beginning of unemployment, attention should be paid to the level of education, gender, and the age of an individual, as these characteristics influence unemployment duration and wages after differing lengths of unemployment.

Limitations

Several limitations in the current article should be noted. First, education level was self-reported by the individual claimants when they first filed their claim. This information could not be verified and may be biased by reasons such as social desirability and self-promotion.

Second, these data include wages and employment duration only, with no information on the attitudes, personal characteristics and circumstances, or employment characteristics collected by R&P. Because of this limitation, no conclusions can be made as to why individuals may have turned down employment, nor does it give insight into the reasons for length of time unemployed.

Third, the variables used in this article (age, sex, and educational attainment) were not experimentally manipulated, so cause and effect should not be interpreted from the analyses. Individuals could not be randomly assigned into these groups in order to measure their wages and unemployment duration, so it cannot be stated that a higher level of education causes certain employment outcomes. Further, these variables and the outcome variables (wage and duration of unemployment) are a reflection of Wyoming's labor market and should not be generalized beyond the intended purpose, such as research on age, gender, and education.

Future Research

In this article, focus was given to gender, age, and education. It is important to examine unemployment durations by industry and occupation. Are individuals who work in certain industries before collecting UI benefits prone to longer unemployment durations? Do industries that require high skill sets or more education give people an advantage in finding work quicker? Which occupations have the longest duration of unemployment? These questions will shed light on the impact the recession had on certain industries and occupations.

Future research also may focus on those who are labeled discouraged workers. According to the U.S. Bureau of Labor Statistics, a discouraged worker is an individual who is able to work but has not been employed for at least 12 months and is no longer looking for work because of few job opportunities or little luck finding a job. Examining the characteristics of the individual and his or her interaction with the labor market would provide insight into how the individual should approach different economic booms and busts.

Finally, as no data on individual characteristics were collected, future research may focus on the specific personality traits, employment circumstances and attitudes towards certain jobs after unemployment. This type of data collection would allow for more specific research questions and answers to help public employment agencies in assisting people to find work after unemployment.

References

Advisory Council on Unemployment Compensation (1996). Defining federal and state roles in unemployment insurance: A report to the President and Congress (Y 3:2:UN 2/IN 7/2). Washington, DC: U.S. Government Printing Office.

Ahn, N., & Garcia-Perez, J.I. (2002). Unemployment duration and workers' wage aspirations in Spain. Spanish Economic Review, 4, 103-118.

Bartell, M., & Bartell, R.(1985). An integrative perspective on the psychological response of females and males to unemployment. Journal of Economic Psychology, 6, 27-49.

Bullard, D. (2011). Detailed covered employment and wages for second quarter 2010: Growth in total payroll resumes. Wyoming Labor Force Trends, 48(1). Retrieved September 18, 2012, from http://doe.state.wy.us/LMI/0111/a1.htm

Chan, S., & Stevens, H. (1999). Employment and retirement following a late-career job loss. The American Economic Review, 89, 211-216.

Couch, K., & Placzek, D.W. (2010). Earnings losses of displaced workers revisited. American Economic Review, 100, 572-589.

Dew, M., Bromet, E., & Schulberg, H. (1987). A comparative analysis of two community stressors: Long-term mental health effects. American Journal of Community Psychology, 15, 167-184.

Elsby, M.W., Hobijn, B., Sahin, A., Valletta, R. (2011). The labor market in the Great Recession-An update to September 2011. Brookings Papers on Economic Activity, 353-384.

Farber, H.S. (1997). The changing face of job loss in the United States, 1981-1995. Brookings Papers on Economic Activity, 55-142.

Gregg, P., & Wadsworth, J. (2010). Unemployment and inactivity in the 2008-2009 recession. Economic & Labour Market Review, 4, 44-50.

Grun, C., Hauser, W., & Rhein, T. (2010). Is any job better than no job? Life satisfaction and re-employment. Journal of Labor Research, 31, 285-306.

Knapp, L. (2012). Even during an economic downturn, Wyoming employers continued to hire new workers. Wyoming Labor Force Trends, 49(6). Retrieved September 18, 2012, from http://doe.state.wy.us/LMI/trends/0612/a1.htm

Kulik, L. (2000). Jobless males and females: A comparative analysis of job search intensity, attitudes toward unemployment, and related responses. Journal of Occupational and Organizational Psychology, 73, 487-500.

Leonard, D. (2010). Estimating the impact of unemployment insurance benefit payments on Wyoming's economy. Wyoming Labor Force Trends, 47(8). Retrieved September 18, 2012, from http://doe.state.wy.us/lmi/0810/a1.htm

Levin-Waldman, O. (1997). Unemployment insurance for a new age. Challenge, 40, 110-120.

Mendenhall, R., Kalil, A., Spindel, L.J., & Hart, C. (2008). Job loss at mid-life: Managers and executives face the "New Risk Economy." Social Forces, 87, 185-209.

National Bureau of Economic Research. (2010). Retrieved September 19, 2012, from http://www.nber.org/cycles/sept2010.html

Thomas, J.M. (1997). Public employment agencies and unemployment spells: Reconciling the experimental and nonexperimental evidence. Industrial & Labor Relations Review, 50, 667-683.

Wen, S. (2010). Wyoming unemployment insurance benefit payments reach record high in 2009. Wyoming Labor Force Trends, 47(2). Retrieved September 18, 2012, from http://doe.state.wy.us/lmi/0210/a1.htm

Wen, S. (2011). An overview of Wyoming's unemployment insurance trust fund and trust fund liability. Wyoming Labor Force Trends, 48(11). Retrieved September 18, 2012, from http://doe.state.wy.us/LMI/trends/1111/a1.htm