Federal Expenditures in Wyoming: Still an Important Part of the State's Economy

The federal budget has been in the news recently as the Senate, House, and President Obama have struggled to agree on appropriate spending levels. How much of the federal budget comes to Wyoming and what effect does it have on the state's economy? This article provides a brief overview of federal spending in Wyoming, how federal spending compares to tax collections in the state, and the statistical relationship between federal spending and job growth.

In fiscal year 2009 (October 2008 through September 2009) the federal government spent $6.3 billion in Wyoming (U.S. Census Bureau, 2010). This can be divided into several components. The largest category was grants at $2.6 billion, followed by retirement & disability ($1.6 billion) and other direct payments for individuals ($1.2 billion). The smallest categories were procurement ($0.3 billion) and salaries and wages ($0.7 billion).

The federal government makes grants for many different purposes. Within Wyoming, the agencies that distributed the most grant money in 2009 were the Department of Interior ($1.1 billion in grants), the Department of Health and Human Services ($487 million in grants), the Department of Transportation ($485 million in grants), and the Department of Education ($213 million in grants). When the Department of Interior makes payments such as coal lease bonuses and federal mineral royalties to state and local governments, these are considered grants.

Retirement & disability spending includes Social Security, federal employee retirement and disability benefits, and selected Veterans' Administration programs. Other direct payments include Medicare, health insurance for federal workers, unemployment compensation, and food stamps. Wages & salaries refers to federal government salaries and wages, including the Department of Defense and Postal Service. Procurement occurs when the federal government purchases goods or services within the state.

Figure 1 shows federal expenditures in Wyoming by component over the past several fiscal years. The largest increases during this time frame were grants and other direct payments. Procurement, the smallest component of federal expenditures, decreased from 2000 to 2009.

Relative Size of Federal Expenditures

To put the $6.3 billion in federal spending in context, it can be compared  to other measures of Wyoming's overall economy. Figure 2 shows the components of personal income for Wyoming in 2009. Wages & salaries are by far the largest component, comprising 40.9% of personal income (BEA, 2011). The next largest components are dividends, interest, & rent (28.0%) and current transfer receipts (12.8%), which includes Social Security payments, unemployment compensation, and veterans' benefits.

to other measures of Wyoming's overall economy. Figure 2 shows the components of personal income for Wyoming in 2009. Wages & salaries are by far the largest component, comprising 40.9% of personal income (BEA, 2011). The next largest components are dividends, interest, & rent (28.0%) and current transfer receipts (12.8%), which includes Social Security payments, unemployment compensation, and veterans' benefits.

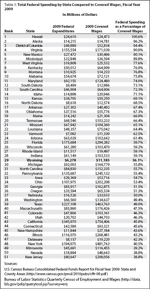

The largest source of data on wages and salaries is Unemployment Insurance (UI) covered wages. In calendar year 2009 Wyoming UI covered wages totaled $11.2 billion (BLS, 2011). Table 1 ranks the 50 states and the District of Columbia on the size of federal expenditures compared to their total UI covered wages. In 1996, Wyoming ranked 15th, but by 2009, Wyoming had fallen to 29th, suggesting that the state may be relatively less dependent on federal expenditures than it was in the past (Bullard, 1997). It should be noted that the nation was in a recession during most of fiscal year 2009, which tends to increase government expenditures while wages decrease.

How does federal spending in Wyoming compare to the amount of federal taxes collected in the state? Table 2 shows that in fiscal year 2009, the federal government  collected $3.8 billion in taxes in Wyoming (IRS, 2009). In other words, the federal government spent $2.4 billion more in Wyoming than it collected in taxes. In 2009, there were only five states where the federal government collected more revenue than it paid out in expenditures. Wyoming ranked 22nd among the 50 states and the District of Columbia for net inflows of federal dollars.

collected $3.8 billion in taxes in Wyoming (IRS, 2009). In other words, the federal government spent $2.4 billion more in Wyoming than it collected in taxes. In 2009, there were only five states where the federal government collected more revenue than it paid out in expenditures. Wyoming ranked 22nd among the 50 states and the District of Columbia for net inflows of federal dollars.

Another way to look at the relationship between federal spending and tax collections at the state level is the ratio of inflows to outflows, which can be expressed in dollars. By that measure, Wyoming received $1.64 in federal spending for each dollar in federal taxes paid. In contrast, Delaware received $0.59 in federal expenditures for each dollar of federal taxes, and Hawaii received $3.65 in spending for each dollar of taxes. Regardless of the measure used, Wyoming ranked near the middle of the 50 states and received more dollars in federal spending than was collected in taxes.

Statistical Model

In 1997 Research & Planning (R&P) published a statistical model suggesting that growth in federal spending in Wyoming accounted for approximately one-fourth of growth in nonfarm employment in the state and that an increase of $1 million in federal spending in the state was associated with an employment increase of 39 people (Bullard, 1997). Now, with several more years of data available, the statistical model has been updated.  Analysts ran a linear regression with the year-to-year change in nonfarm employment as the dependent variable and the year-to-year change in federal expenditures in Wyoming as the independent variable. The results (shown in Table 3 indicate that change in federal expenditures explained about one-10th of the change in nonfarm employment and that growth of $1 million in federal spending was associated with an employment increase of 14 jobs. In short, it appears that federal spending has a smaller effect on the state's economy than previously thought. This may be related to the strong growth in the state's energy sector from 2003-2008.

Analysts ran a linear regression with the year-to-year change in nonfarm employment as the dependent variable and the year-to-year change in federal expenditures in Wyoming as the independent variable. The results (shown in Table 3 indicate that change in federal expenditures explained about one-10th of the change in nonfarm employment and that growth of $1 million in federal spending was associated with an employment increase of 14 jobs. In short, it appears that federal spending has a smaller effect on the state's economy than previously thought. This may be related to the strong growth in the state's energy sector from 2003-2008.

It should be noted that the employment projections produced by R&P have the implicit assumption that growth in federal spending will continue as in the past. If future federal spending deviates significantly from historical patterns, this could cause employment to be higher or lower than projected levels.

Conclusion

In summary, federal expenditures make up a large proportion of Wyoming's economy. The federal government spends more in Wyoming than it collects in revenue, and federal spending in the state is a significant predictor of employment growth. Others, such as the Northeast-Midwest Institute (2011), and the U.S. Government Accountability Office (2011) have acknowledged the importance of federal spending and track federal spending by state. R&P has periodically addressed the issue of federal spending because of its significance to Wyoming. Despite the prevalence of political rhetoric surrounding issues of federal spending, R&P recognizes that there are impartial ways of presenting factual material on this issue and hopes to continue to do so in the future.

Senior Economist David Bullard can be reached at (307) 473-3810 or david.bullard@wyo.gov.

References

Bullard, D. (1997). "Federal expenditures in Wyoming: A partial explanation of our stagnant economy." Wyoming Labor Force Trends, 34(6). Retrieved April 6, 2011, from http://doe.state.wy.us/LMI/0697/0697a2.htm

Bureau of Economic Analysis. (2011). State income and employment summary —Wyoming. Retrieved May 11, 2011 from http://www.bea.gov/regional/spi/

Bureau of Labor Statistics. (2011). Quarterly Census of Employment and Wages. Retrieved April 6, 2011 from http://data.bls.gov/pdq/querytool.jsp?survey=en

Government Accountability Office. (2011). Following the Money: GAO's Oversight of the Recovery Act. Retrieved May 11, 2011 from http://www.gao.gov/recovery/

Internal Revenue Service. (2009). Internal Revenue Service Data Book, 2009. Retrieved May 2, 2011 from http://www.irs.gov/pub/irs-soi/09databk.pdf

Northeast-Midwest Institute. (2011). Flow of Federal Funds to States. Retrieved May 11, 2011 from http://www.nemw.org/index.php/flow-of-federal-funds

U.S. Census Bureau. (2010). Consolidated Federal Funds Report for Fiscal Year 2009: State and County Areas. Retrieved May 2, 2011, from http://www.census.gov/prod/2010pubs/cffr-09.pdf