Wyoming Labor Force Trends

December 2024 | Volume 61, No. 12

Click Here for PDF

Return to Table of Contents

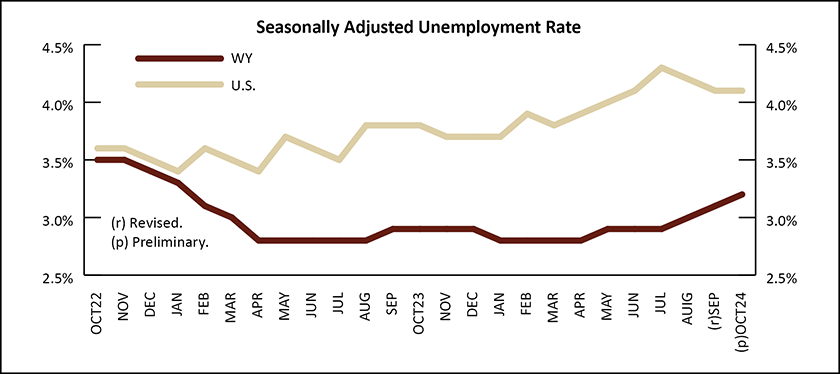

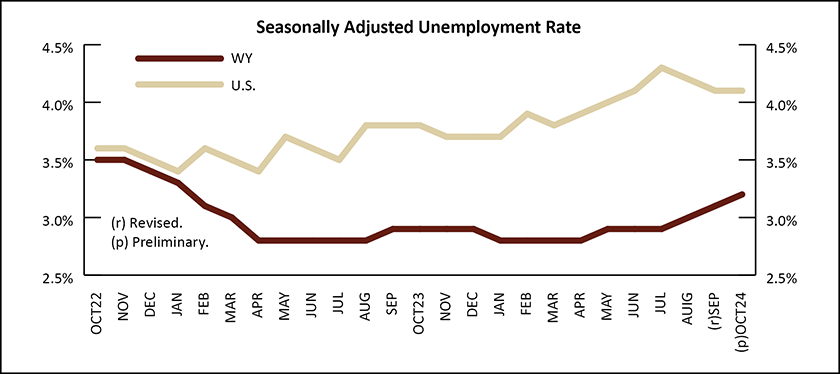

Wyoming Unemployment Rises to 3.2% in October 2024

by: David Bullard, Senior Economist

The Research & Planning section of the Wyoming Department of Workforce Services reported that the state’s seasonally adjusted1 unemployment rate edged upward from 3.1% in September to 3.2% in October. Despite its recent increases, Wyoming’s unemployment rate remains much lower than the U.S. unemployment rate of 4.1%.

From September to October, county unemployment rates followed their normal seasonal pattern and increased. Unemployment rates often rise in October as cooler weather brings seasonal job losses in leisure & hospitality, construction, and professional & business services. The largest unemployment rate increases occurred in Teton (up from 1.6% to 2.6%), Niobrara (up from 2.0% to 2.6%), Carbon (up from 2.7% to 3.2%), and Sublette (up from 3.0% to 3.5%) counties.

From October 2023 to October 2024, jobless rates rose in all 23 of Wyoming’s counties. These increases, while modest, suggest a somewhat greater supply of labor around the state. The largest increases in unemployment were reported in Big Horn (up from 2.4% to 3.4%), Carbon (up from 2.2% to 3.2%), Uinta (up from 2.6% to 3.5%), and Weston (up from 1.6% to 2.5%) counties.

The lowest unemployment rates in October were found in Crook County at 2.3%, Albany County at 2.4%, and Converse County at 2.4%. Sublette County and Uinta County tied for the highest unemployment rate at 3.5%.

Current Employment Statistics (CES) estimates show that total nonfarm employment in Wyoming (not seasonally adjusted and measured by place of work) rose from 295,100 in October 2023 to 298,200 in October 2024, an increase of 3,100 jobs (1.1%).

R&P's most recent monthly news release is available at https://doe.state.wy.us/LMI/news.htm.

Hire Wyo

Hire Wyo