Wyoming Labor Force Trends

January 2024 | Volume 61, No. 1

Click Here for PDF

Return to Table of Contents

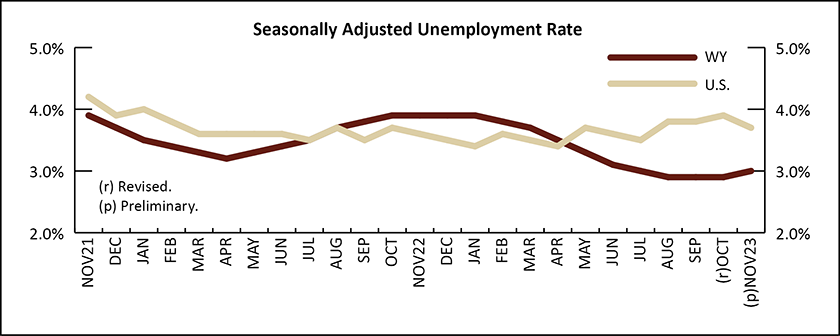

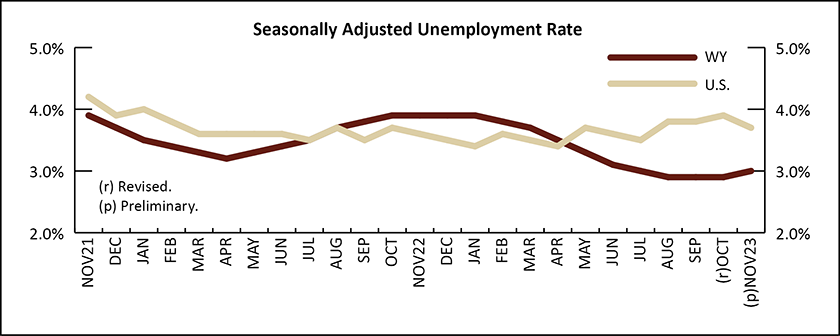

Wyoming Unemployment Rises to 3.0% in November 2023

by: David Bullard, Senior Economist

The Research & Planning section of the Wyoming Department of Workforce Services reported that the state’s seasonally adjusted1 unemployment rate rose slightly from 2.9% in October to 3.0% in November. Wyoming’s unemployment rate was much lower than its year-ago level of 3.9% and lower than the current U.S. unemployment rate of 3.7%.

From October to November, all county unemployment rates followed their normal seasonal pattern and increased. Unemployment rates often increase in November as cooler weather and a seasonal slowdown in tourist activity cause job losses in many different sectors. The largest increases in unemployment occurred in Teton (up from 2.0% to 3.7%), Big Horn (up from 2.6% to 3.5%), and Park (up from 2.3% to 3.2%) counties.

From November 2022 to November 2023, unemployment rates fell in 22 of Wyoming’s 23 counties. Hot Springs County was the exception. Its unemployment rate increased marginally from 2.8% in November 2022 to 2.9% in November 2023. The largest decreases occurred in Carbon (down from 4.0% to 2.9%), Niobrara (down from 3.5% to 2.5%), Teton (down from 4.5% to 3.7%), and Fremont (down from 3.9% to 3.1%) counties.

Teton County, at 3.7%, had the highest unemployment rate in November. It was followed by Big Horn County and Sublette County, both at 3.5%. The lowest unemployment rates were found in Weston County at 2.2% and Converse and Crook counties, both at 2.4%.

Current Employment Statistics (CES) estimates show that total nonfarm employment in Wyoming (not seasonally adjusted and measured by place of work) rose from 284,800 in November 2022 to 293,200 in November 2023, an increase of 8,400 jobs (2.9%).

R&P's most recent monthly news release is available at https://doe.state.wy.us/LMI/news.htm.

Hire Wyo

Hire Wyo