Long-Term Industry Projections for Wyoming, 2008-2018: Slow Growth Projected for Most Industries

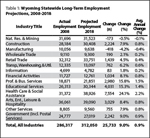

As Wyoming attempts to recover from the national recession, the state is projected to add 25,733 jobs from 2008 to 2018. The largest gains are projected to be in the healthcare & social assistance industry (7,554 jobs, an increase of 24.1%) which may grow to better serve Wyoming’s aging population.

Wyoming’s economy is projected to grow at a modest rate from 2008 to 2018, as the state and the nation contend with the economic effects of the recession that began in 2008. Wyoming is projected to add 25,733 jobs during that period, a growth of 9.0%. The average annual growth rate during that time is projected to be 0.9%, or 2,500 per year through 2018 (Knapp, 2010).

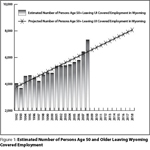

In addition to projected growth, a large number of jobs will be created annually due to Wyoming’s aging work force. An estimated 73,000 workers age 50 and older are projected to leave the work force from 2008 to 2018 (see Figure 1). This equates to 7,300 positions per year (Glover, 2010). An in-depth analysis to better understand the people leaving the work force is forthcoming from the Research & Planning (R&P) section of the Wyoming Department of Employment. R&P has previously examined this issue through its studies on succession planning, a process that helps identify areas within an organization that will not have enough workers as older employees retire (Knapp, 2009).

The current 2008-2018 long-term industry projections from R&P are substantially more conservative than previous projections for 2006 to 2016, which were based on the strong economic growth from 2005 to 2008 (Leonard, 2008).

The most recent projections show declines or slow employment growth in most industries in Wyoming (see Table 1), with the largest increases being in health care & social assistance (7,554, or 24.1%) and educational services (4,031, or 15.3%). Small decreases in employment are projected for natural resources & mining (-173, or -0.5%) and manufacturing (-418, or -4.2%).

Natural Resources & Mining

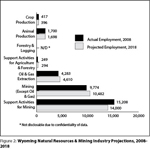

In 2008, 11.1% of all Wyoming jobs were found in the natural resources & mining industry. This industry is projected to shrink somewhat by 2018, and is expected to account for 10.1% of Wyoming’s total jobs. The support for mining activities subsector will account for the bulk of that loss (-1,208, -8.0%; see Figure 2). Minor gains in mining (except oil & gas; 708, or 7.2%) and oil & gas extraction (327, or 7.6%) offset those projected losses somewhat.

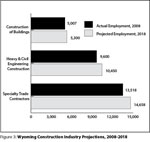

Construction

During Wyoming’s economic expansion that lasted until 2008, the construction industry grew substantially. Employment in construction peaked in 2008 at approximately 28,100. By 2009, that number had decreased to 23,900 (Current Employment Statistics).

Wyoming’s construction industry relies on seasonal help and therefore accounts for a large share of the state’s unemployment insurance (UI) claims each year. In 2009, 37,312 people received UI benefits; nearly one-third (10,756) of those came from the construction industry (Wen, 2010).

The construction industry is projected to add 2,224 jobs by 2018. The largest gain will be seen in the specialty trade contractors subsector, which is projected to add 1,140 jobs (8.4%; see Figure 3).

Manufacturing

Wyoming is projected to lose 418 jobs (-4.2%) in the manufacturing  industry, which is made up of 21 subsectors; many of those are projected to see employment declines from 2008 to 2018 (see Figure 4). The largest job losses are projected in wood product manufacturing (-205, or -36.3%), food manufacturing (-160, or -22.6%), and transportation equipment manufacturing (-117, or -24.5%). Only fabricated metal product manufacturing (139, or 8.4%) and machinery manufacturing (135, or 22.9%) are expected to see net employment gains of 100 jobs or more.

industry, which is made up of 21 subsectors; many of those are projected to see employment declines from 2008 to 2018 (see Figure 4). The largest job losses are projected in wood product manufacturing (-205, or -36.3%), food manufacturing (-160, or -22.6%), and transportation equipment manufacturing (-117, or -24.5%). Only fabricated metal product manufacturing (139, or 8.4%) and machinery manufacturing (135, or 22.9%) are expected to see net employment gains of 100 jobs or more.

Wholesale Trade

The wholesale trade industry, which ismade up of just three subsectors, is projected to add just 190 jobs (2.1%). Of the three subsectors, the only positive growth will be in the merchant wholesalers, durable goods subsector (263, or 4.5%; see Figure 5). The merchant wholesalers, nondurable goods (-40, or -1.4%) and wholesale electronic markets & agents & brokers (-34, or -10.2%) are projected to experience minor losses.

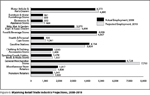

Retail Trade

The retail trade industry is projected to add 1,439 jobs (4.5%). In 2008, this industry  accounted for 11.4% of all employment in Wyoming; although the retail trade industry is projected to grow by 2018, it is projected to account for 10.9% of all jobs at that time.

accounted for 11.4% of all employment in Wyoming; although the retail trade industry is projected to grow by 2018, it is projected to account for 10.9% of all jobs at that time.

Several of the subsectors in this industry will see at least triple-digit net employment growth (see Figure 6), including general merchandise stores (1,005, or 14.9%), building material & garden equipment & supplies dealers (411, 13.3%), and motor vehicle & parts dealers (227, or 5.0%). The largest job losses are forecasted for the gasoline stations (-330, or -7.9%) and clothing & clothing accessories stores (-143, or -9.3%) subsectors.

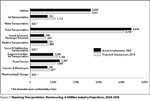

Transportation, Warehousing, and Utilities

The transportation, warehousing, and utilities industries are projected to  add 762 jobs (6.2%). The utilities industry is projected to lose 17 jobs (-0.6%) during this period (see Figure 7). The subsectors of the transportation and warehousing industry will see several losses and gains that will offset one another; for example, air transportation is projected to add 339 jobs (44.5%), while truck transportation is projected to lose 336 jobs (-7.8%).

add 762 jobs (6.2%). The utilities industry is projected to lose 17 jobs (-0.6%) during this period (see Figure 7). The subsectors of the transportation and warehousing industry will see several losses and gains that will offset one another; for example, air transportation is projected to add 339 jobs (44.5%), while truck transportation is projected to lose 336 jobs (-7.8%).

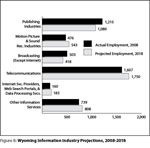

Information

The information industry accounts for a smaller percentage of the total jobs inWyoming than any other industry. In 2008, there were 4,699 jobsfound in this industry, accounting for just 1.6% of Wyoming’s jobs. The industry is projected to add 83 jobs (1.8%) by 2018, and will make up just 1.5% of all jobs.

jobs inWyoming than any other industry. In 2008, there were 4,699 jobsfound in this industry, accounting for just 1.6% of Wyoming’s jobs. The industry is projected to add 83 jobs (1.8%) by 2018, and will make up just 1.5% of all jobs.

The publishing industries subsector is projected to lose 135 jobs during this period (-11.1%; see Figure 8). The telecommunications subsector, meanwhile, is projected to add 143 jobs (9.0%).

Financial Activities

The financial activities industry is  projected to grow by 1,034 jobs (8.1%) and was one of the few industries with no projected job losses in any subsectors. The largest gains are projected to be seen in the credit intermediation & related activities (372, or 8.0%), real estate (364, or 17.2%), and insurance carriers & related agents (171, or 8.2%) subsectors (see Figure 9).

projected to grow by 1,034 jobs (8.1%) and was one of the few industries with no projected job losses in any subsectors. The largest gains are projected to be seen in the credit intermediation & related activities (372, or 8.0%), real estate (364, or 17.2%), and insurance carriers & related agents (171, or 8.2%) subsectors (see Figure 9).

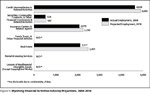

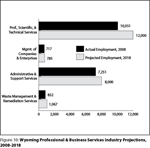

Professional & Business Services

Wyoming’s professional & business services industry is expected to add 2,980 jobs (15.8%) across four subsectors. The largest increase is projected to be in the professional, scientific, & technical services subsector (1,949, or 19.4%; see Figure 10). The management of companies & enterprises (68, or 9.5%), administrative & support services (10.3, or 1.0%), and waste management & remediation services (215, or 25.2%) subsectors also are projected to see moderate growth.

Wyoming’s professional & business services industry is expected to add 2,980 jobs (15.8%) across four subsectors. The largest increase is projected to be in the professional, scientific, & technical services subsector (1,949, or 19.4%; see Figure 10). The management of companies & enterprises (68, or 9.5%), administrative & support services (10.3, or 1.0%), and waste management & remediation services (215, or 25.2%) subsectors also are projected to see moderate growth.

Educational and Health Services

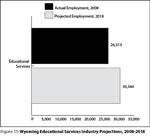

Wyoming’s educational and health services industries have seen a steady increase in jobs in the past decade, growing from 18,200 in 2000 to 25,500 in 2009. Notably, these industries have experienced no over-the-year job losses during the last decade, even during the current recession (CES).

The educational services industry is projected to add 4,031 jobs from 2008 to 2018 (15.3%; see Figure 11). In 2008, 9.2% of Wyoming’s jobs were found in this industry; in 2018, that number is projected to grow to 9.7%.

The educational services industry is projected to add 4,031 jobs from 2008 to 2018 (15.3%; see Figure 11). In 2008, 9.2% of Wyoming’s jobs were found in this industry; in 2018, that number is projected to grow to 9.7%.

By 2030, Wyoming’s 65-and-older population is projected to increase from 70,637 in 2010 to 129,463, while the 18-24 population is projected to experience a much smaller increase, from 52,516 in 2010 to 58,730 (Wyoming Department of Administration and Information).

The need to serve this aging population will create new opportunities in the health care & social assistance industry, even as its own work force ages (Jones, 2009). By 2018, this industry is projected to account for 12.5% of all jobs in Wyoming – up from 11.0% in 2008.

As a whole, the industry is projected to add 7,554 jobs (24.1%) from 2008 to 2018. Three of the industry’s four subsectors are projected to see substantial employment increases: ambulatory health care services (2,646, or 30.9%), hospitals (2,295, or 20.8%), and social assistance (1,812, or 28.4%; see Figure 12).

Note that there are three key concerns not taken into consideration in these projections. The Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act will provide health insurance to millions of previously uninsured Americans (PPACA, 2010) during the projection period; in 2008, there were 46.3 million Americans without health insurance (U.S. Census, 2009). The American Recovery and Reinvestment Act allocates billions of dollars to be used to develop a comprehensive electronic medical records system, which likely will create a variety of new jobs (American Recovery and Reinvestment Act of 2009). Finally, the Patient Protection and Affordable Care Act will address the substantial increase in demand for home health care as the baby boom generation moves into retirement by increasing the pay structure for those occupations (Patient Protection and Affordable Care Act of 2009). Home health care occupations traditionally have been lower-paying jobs; increasing the pay structure should lead to more people seeking employment in these occupations.

Leisure & Hospitality

The leisure & hospitality industry made up a significant portion of Wyoming’s total jobs in 2008 (12.6%); that trend is projected to continue into 2018 (12.5%). The accommodation (727, or 5.9%) and food services & drinking places (1,616, or 8.3%) subsectors are projected to see modest growth during this period (see Figure 13).

The leisure & hospitality industry made up a significant portion of Wyoming’s total jobs in 2008 (12.6%); that trend is projected to continue into 2018 (12.5%). The accommodation (727, or 5.9%) and food services & drinking places (1,616, or 8.3%) subsectors are projected to see modest growth during this period (see Figure 13).

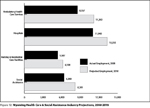

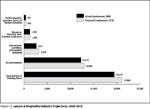

Other Services

Wyoming’s industry categorized as“other services”is made up of foursubsectors, all of which are projected to see moderate growth (see Figure 14). Of the four, repair and maintenance is expected to see the largest growth (384, or 9.0%), followed by personal & laundry services (185, or 9.3%). The religious, grantmaking, civic, professional, & similar organizations subsector is projected to add 134 jobs (6.3%), and the private households subsector is projected to grow by 52 jobs (12.3%). Overall, the other services industry will add 755 jobs (7.9%).

Wyoming’s industry categorized as“other services”is made up of foursubsectors, all of which are projected to see moderate growth (see Figure 14). Of the four, repair and maintenance is expected to see the largest growth (384, or 9.0%), followed by personal & laundry services (185, or 9.3%). The religious, grantmaking, civic, professional, & similar organizations subsector is projected to add 134 jobs (6.3%), and the private households subsector is projected to grow by 52 jobs (12.3%). Overall, the other services industry will add 755 jobs (7.9%).

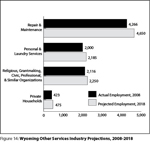

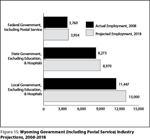

Government (Including Postal Service)

Like most other industries, government(including postal service) is projected to see modest growth, adding 2,242 jobs (9.0%). Of the three subsectors, local government, excluding education & hospitals, is projected to see the largest growth (1,553, or 13.6%; see

Figure 15). State government, excluding education & hospitals, is projected to add 697 jobs (8.4%), while federal government, including post office, is projected to grow by 194 jobs (5.2%).

Like most other industries, government(including postal service) is projected to see modest growth, adding 2,242 jobs (9.0%). Of the three subsectors, local government, excluding education & hospitals, is projected to see the largest growth (1,553, or 13.6%; see

Figure 15). State government, excluding education & hospitals, is projected to add 697 jobs (8.4%), while federal government, including post office, is projected to grow by 194 jobs (5.2%).

References

American Recovery and Reinvestment Act of 2009. Retrieved May 24, 2010, from http://www.recovery.gov/About/Pages/The_Act.aspx

Current Employment Statistics Program. (2010). Wyoming nonagricultural wage and salary employment final benchmark 1990-2008, preliminary benchmark 2009. Retrieved April 27, 2010, from http://doe.state.wy.us/LMI/CES/naanav9002.htm

Glover, W. (2010, June). Who will replace older workers leaving the work force? Wyoming Workforce Annual Report 2010, 24-25.

Jones, S. D. (2009, August). Succession Planning and Satisfaction Measures in Public Health. Retrieved May 13, 2010, from http://doe.state.wy.us/LMI/phn_09/title.htm

Knapp, L. (2009). Comparing results of 2006, 2008 succession planning surveys. Wyoming Labor Force Trends, 46(12), 4-11.

Leonard, D. W. (2008). Wyoming statewide long-term employment projections 2006-2016. Retrieved May 13, 2010, from http://doe.state.wy.us/LMI/LT_ind_0616.htm

Knapp, L. (2010). Wyoming statewide long-term employment projections 2008-2018. Retrieved April 29, 2010, from http://doe.state.wy.us/LMI/LT_ind_0818.htm

Patient Protection and Affordable Health Care Act of 2009. Retrieved May 18, 2010, from http://democrats.senate.gov/reform/patient-protection-affordable-care-act-as-passed.pdf

U.S. Census. (2009). Health Insurance Coverage: 2008. Retrieved May 18, 2010, from http://www.census.gov/hhes/www/hlthins/hlthin08/hlth08asc.html

Wen, S. (2010). Wyoming unemployment insurance benefit payments reach record high in 2009. Wyoming Labor Force Trends, 47(2), 1-13.

Wyoming Department of Administration and Information, Economic Analysis Division. (2008, July 11). Wyoming and county population projections by age: 2008 to 2030. Retrieved May 21, 2010, from http://eadiv.state.wy.us/pop/AGEPROJ_ 2030.htm