Benefits Survey Highlights

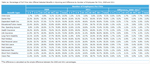

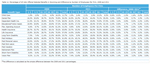

Whether employers provide benefits is strongly related to the industry and number of employees per firm. Tables 1a, 1b, and 1c illustrate the proportion of jobs offered benefits by Wyoming employers on the basis of firm size and full- or part-time status for 2008 and 2011. To understand how benefits offerings changed from 2008 to 2011, the difference in proportions between the two years is also shown. Table 1a shows the percentages for full-time jobs, Table 1b shows the percentages for part-time jobs, and Table 1c shows the percentages for all jobs.

From 2008 to 2011 for full-time jobs, six benefits were offered to fewer jobs, while nine benefits were offered to a greater proportion of jobs (see Table 1a). A smaller proportion of jobs were offered child care (-4.9%), dependent health insurance (-3.0%), health insurance (-2.9%), life insurance (-3.2%), paid personal leave (-5.4%), and retirement plans (-5.5%). Among the nine benefits offered to a larger proportion of jobs were dental plans (+2.0%), paid sick leave (+7.7%), and vision plans (+4.5%).

For the most part, larger firms in 2011 offered benefits to more of their full-time jobs than did smaller firms. Health insurance was offered to 91.8% of jobs in firms with 50 or more employees compared to 33.9% of jobs in companies with one to four employees. Likewise, firms with 50 or more employees offered retirement plans to 88.6% of jobs while companies with one to four employees offered this benefit to 31.3% of jobs.

The proportion of part-time jobs offered benefits declined substantially further than for full-time jobs, with the proportion declining for all of the benefits listed (see Table 1b). The largest declines were for retirement plans (-27.1%), educational/tuition assistance (-19.0%), and paid personal leave (-15.4%). In addition the proportion of part-time jobs offered health insurance fell by 7.4% and by 7.7% for dependent health insurance.

Similar to full-time jobs, a larger proportion of employers with 50 or more employees offered benefits to a greater percentage of part-time jobs than did smaller firms. For firms with 50 or more employees, 17.9% of jobs were offered health insurance compared to 2.1% of companies with one to four employees. Likewise firms with 50 or more employees offered retirement plans to 43.4% of their part-time jobs, while the same benefit was offered to jobs in only 6.3% of companies with one to four employees.

Seven benefits were offered to proportionally fewer jobs in 2011 than in 2008, while eight benefits were offered to more jobs (see Table 1c). From 2008 to 2011, 3.0% of all jobs lost access to health insurance, 6.5% fewer were offered retirement plans, and the proportion of jobs offered dependent health insurance fell by 2.9%. The largest increase for benefits offered was for paid sick leave (+6.4%) and short-term disability insurance (+3.3%).

Previous: Survey History & Publication Focus | Next: A Brief Intro to Health Insurance & Retirement Plans