Current Employment Statistics Preliminary Benchmark: Downward Revision to Construction Offsets Upward Revisions

Related Tables and Figures

Nationally, monthly Current Employment Statistics (CES) estimates are much scrutinized and covered widely in the press by many who seek clues about the direction of the economy and its impact on job opportunities (U.S. Bureau of Labor Statistics, Associated Press, and Rampell). However, monthly national and state estimates are preliminary and sometimes subject to substantial benchmark revision. Consequently, they should not be over-interpreted, but rather, put into context to be truly useful. That context involves understanding the source of benchmark revisions and relying on that data source as a guide in interpreting current estimates.

The CES program is a sample-based survey of approximately 1,300 employers in Wyoming. Survey data are used to make monthly employment estimates, which are published in Wyoming Labor Force Trends. Earlier this year, the Bureau of Labor Statistics (BLS) centralized the program and took over production of these estimates, a function previously performed by state agencies throughout the country, including analysts at Research & Planning (R&P).

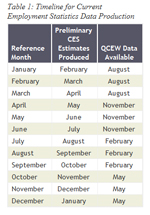

At the end of each year, employment estimates are revised (or benchmarked) to a near-universe count of employees from the Quarterly Census of Employment and Wages (QCEW) program. QCEW data are based on quarterly employer unemployment insurance tax filings. Table 1 shows the approximate timeline for data production in the CES program. For example, estimates with the reference month of March are produced in April. Four months later, in August, the QCEW data for March becomes available. In past years, in March, when the annual benchmark was released QCEW data were used through third quarter and survey data were used to produce estimates for fourth quarter. The BLS has announced its intention to only benchmark through second quarter as part of the process of centralization. This means that next March, when the benchmark is released, only the first six months of 2011 will be based on QCEW universe counts of employment, and the second half of the year will be based entirely on CES survey data.

For many years, when R&P produced the estimates, analysts would make periodic ad hoc adjustments to current monthly estimates based on QCEW data from earlier quarters. For example, analysts would notice that the published estimates were higher than the QCEW in fourth quarter, and they would make adjustments to the subsequent first quarter. The purpose of such adjustments was to use all available information to make the best possible estimates and minimize the benchmark revision. One objective of the program is to minimize benchmark revisions. Large revisions to monthly estimates lead to customers discounting current estimates. The BLS, however, relies solely on the sample for the third and fourth quarters and does not adjust the estimates based on QCEW data. This tends to result in larger benchmark revisions the following spring.

The overall benchmark revision to the Wyoming CES for March 2011 was very small (-358 jobs, or -0.1%). However, at the individual sector level, some revisions were quite large. Table 2 shows that in March 2012, when the benchmark is published, employment in the construction sector will be revised down by 2,381 jobs (-11.6%). This large negative revision was mostly offset by positive revisions to retail trade, other services, educational & health services, and leisure & hospitality.

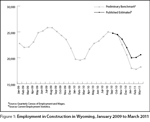

Reviewing time-series data for construction reveals that from October 2010 to January 2011 revised employment fell much more steeply than the published employment estimates (see Figure 1). It is often difficult to develop accurate estimates of construction employment in Wyoming because of the effects of large one-time construction projects such as pipelines and power plants. For more discussion of recent job losses in the construction sector, see Bullard (2011).

Retail trade employment will be revised up by 689 jobs (2.5%). Figure 2 shows that the published estimates decreased from February to March while the benchmark series increased. An upward revision to retail trade may suggest broad improvement to the state’s economy. If overall employment and wages increase, this often results in more retail sales and higher employment in this sector.

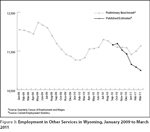

The CES program underestimated employment in other services by 556 jobs (5.1%). It appears that increased oil & gas activity in Wyoming pushed employment up in this sector. There were a number of firms engaged in repair and maintenance of industrial machinery that support Wyoming’s oil & gas development that had employment increases in fourth and first quarters. While the CES published estimates decreased every month from October 2010 to March 2011, the only noticeable decrease in the benchmarked series was in January 2011 (see Figure 3).

Employment in educational & health services will be revised up by 554 jobs (2.1%). This sector continued to grow during the state’s recent downturn (see Figure 4). It is particularly troubling to see the published estimates move in a different direction from the revised series. This is especially apparent in November 2010 and March 2011, when the published estimates decreased and the revised series increased.

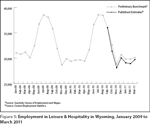

Leisure & hospitality employment was higher than originally estimated (398 jobs, or 1.3%). Figure 5 shows that the published estimates were consistently lower than the revised series. The CES sample often exaggerates the seasonal pattern of this sector. In other words, estimates based solely on the sample tend to be too high in the summer and too low in the winter.

Overall, the revision to the statewide CES estimates was quite small, mostly because positive revisions to some sectors offset negative revisions to others. Employment in construction will be revised down by nearly 2,400 jobs (-11.6%).

References

Bullard, D. (2011, October). Detailed covered employment and wages for first quarter 2011: modest growth continues. Wyoming Labor Force Trends, 48(10). Retrieved December 14, 2011 from http://doe.state.wy.us/LMI/trends/1011/qcew.htm

Rampell, C. (2011, December 2). Jobless rate dips to lowest level in more than 2 years. New York Times. Retrieved December 14, 2011, from http://www.nytimes.com/2011/12/03/business/economy/us-adds-120000-jobs-unemployment-drops-to-8-6.html

U.S. Bureau of Labor Statistics. (2011, December 2). Employment situation news release. Retrieved December 14, 2011, from http://stats.bls.gov/news.release/empsit.toc.htm

Washington Post. (2011, December 2). Unemployment rate falls to 8.6 percent in November, raising hopes for growth. Retrieved from http://www.washingtonpost.com/business/economy/us-unemployment-rate-falls-to-86percent-in-nov-120k-jobs-added/2011/12/02/gIQAFKZeKO_story.html