What are Wage Records?

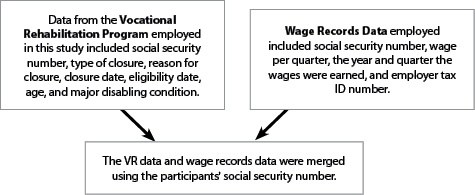

Wage records are an administrative database used to calculate UI benefits for employees who have been laid off through no fault of their own. By law, each employer who has covered employees must submit tax reports to the state showing each employee's wage. The required information on this tax report includes social security number (SSN) for each covered employee, year, quarter, and wages earned in the quarter1. The Wage Records Database contains approximately 90% of Wyoming wage earners. Wage records from surrounding states are available, but the amount of historic data is limited. The Wage Records Database also has limitations. Some employment groups are excluded, including most production agricultural workers, federal employees, railroad workers, and the self-employed. For an introduction to wage record applications see Glover (2003). R&P’s Wage Records Research web page contains many examples of such applications (http://doe.state.wy.us/LMI/wagerecords.htm).

1 Gosar, W. M. (1995). Wyoming Unemployment Insurance Wage Record summary statistics: A new way to look at Wyoming. Wyoming Labor Force Trends, 32(5). From http://doe.state.wy.us/LMI/0595/0595a2.htm