Evaluating the Wyoming Unemployment Insurance System and Comparing it with the U.S. Average and Neighboring States (Tables and Figures)

| Three Recession Years and Calculation Year |

Total Annual Benefit Paid (in thousands) a |

Trust Fund Year Ending Balance (in thousands) b |

Total Covered Wages (in thousands) c |

Cost Rate d = a/c |

Reserve Ratio e = b/c |

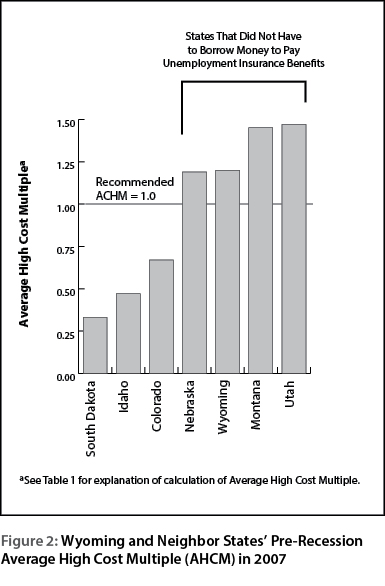

AHCM at the End of 2007 f = e/average d |

|---|---|---|---|---|---|---|

| 1983 | 74,511 | 2,646,925 | 0.0282 | |||

| 1986 | 61,866 | 2,609,179 | 0.0237 | |||

| 1987 | 50,813 | 2,356,640 | 0.0216 | |||

| 2007 | 243,500 | 8,304,399 | 0.0293 | |||

| Average: | 0.0245 | |||||

| AHCM: | 1.20 |

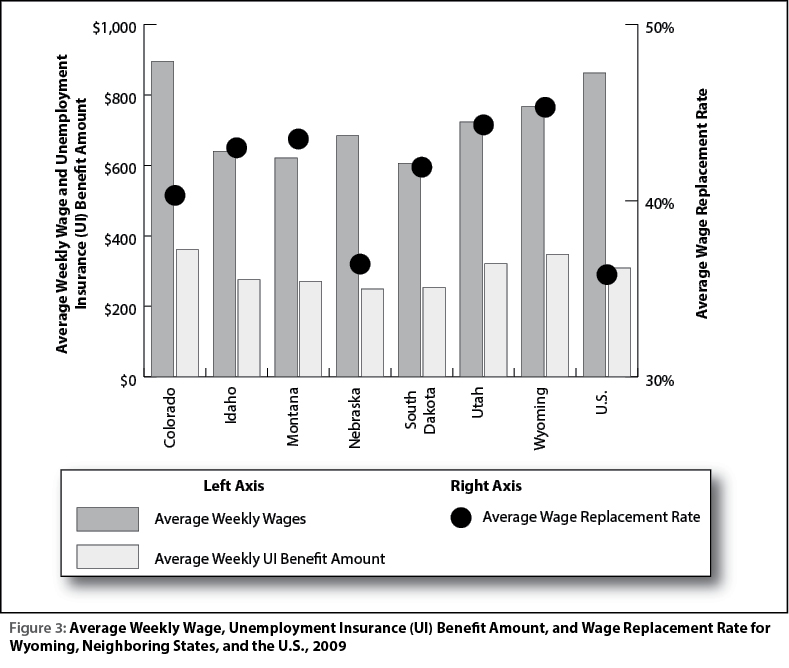

| Year | Colorado | Idaho | Montana | Nebraska | South Dakota | Utah | Wyoming | U.S.A. |

|---|---|---|---|---|---|---|---|---|

| Data Source: ET Financial Data Handbook 394 Report: http://www.ows.doleta.gov/unemploy/hb394/hndbkrpt.asp | ||||||||

| aThe total annual UI tax revenue divided by the same year total UI covered wages. | ||||||||

| 1999 | 0.32 | 0.77 | 0.87 | 0.18 | 0.20 | 0.34 | 0.70 | 0.56 |

| 2000 | 0.27 | 0.76 | 0.70 | 0.23 | 0.20 | 0.24 | 0.65 | 0.53 |

| 2001 | 0.26 | 0.80 | 0.71 | 0.28 | 0.19 | 0.27 | 0.58 | 0.51 |

| 2002 | 0.26 | 0.82 | 0.74 | 0.35 | 0.19 | 0.29 | 0.39 | 0.54 |

| 2003 | 0.31 | 0.84 | 0.74 | 0.45 | 0.20 | 0.37 | 0.39 | 0.64 |

| 2004 | 0.55 | 0.85 | 0.81 | 0.45 | 0.21 | 0.61 | 0.55 | 0.77 |

| 2005 | 0.70 | 0.94 | 0.76 | 0.61 | 0.22 | 0.79 | 0.65 | 0.82 |

| 2006 | 0.59 | 0.99 | 0.76 | 0.68 | 0.22 | 0.75 | 0.77 | 0.75 |

| 2007 | 0.47 | 0.76 | 0.78 | 0.47 | 0.28 | 0.52 | 0.66 | 0.66 |

| 2008 | 0.40 | 0.50 | 0.60 | 0.40 | 0.30 | 0.30 | 0.60 | 0.60 |

| 2009 | 0.40 | 0.90 | 0.60 | 0.40 | 0.30 | 0.30 | 0.60 | 0.60 |

| 2010 | 0.50 | 1.90 | 1.00 | 0.90 | 0.70 | 0.40 | 1.20 | 0.80 |

| 2011 | 0.90 | 1.90 | 1.20 | 0.80 | 0.50 | 0.90 | 1.50 | 0.90 |

| 2012 | 0.86 | 1.92 | 1.25 | 0.63 | 0.42 | 0.88 | 1.56 | 0.93 |

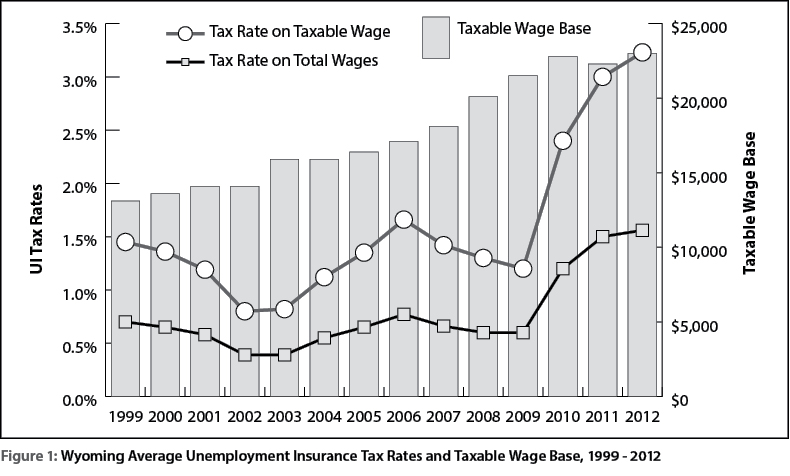

| State |

Taxable

Wage Base |

Tax Rate

on Taxable Wages (%) |

For a Part-Time and Minimum Wage Workera | For A Full Time Worker With Annual Wage of $33,200 or Morec | ||

|---|---|---|---|---|---|---|

| Cost | Rankb | Cost | Rank | |||

| Colorado | $10,000.00 | 1.60 | $120.64 | 1 | $160.00 | 5 |

| Idaho | $33,200.00 | 1.30 | $98.02 | 2 | $431.60 | 1 |

| Montana | $25,100.00 | 0.90 | $67.86 | 6 | $225.90 | 3 |

| Nebraska | $9,000.00 | 1.30 | $98.02 | 2 | $117.00 | 6 |

| South Dakota | $10,000.00 | 1.00 | $75.40 | 5 | $100.00 | 7 |

| Utah | $27,800.00 | 0.60 | $45.24 | 7 | $166.80 | 4 |

| Wyoming | $21,500.00 | 1.20 | $90.48 | 4 | $258.00 | 2 |

| aUsed 2009 federal minimum wage of $7.25 per hour and worked 20 hours a week for the whole year (52 weeks). This comes to an annual wage of $7,540 (= $7.25 * 20hrs/w *52 weeks). If an individual’s annual wage was less than the state taxable wage base, the individual’s wage was used in the calculation. For example, Colorado with tax rate of 1.6% in 2009: UI cost was $7,540 *1.6% = $120.64 to the employer on this individual. | ||||||

| bRanked from 1 (highest cost) to 7 (lowest cost). | ||||||

| c$33,200 was the highest taxable wage base among seven states in 2009, it was used in this example as an individual’s annual wage. For a worker who made equal to or more than his/her state’s taxable wage base, his/her employer would only pay UI tax based on the taxable wage base amount. In other words, any over taxable wage base part of the wage is not taxable. For example, Colorado with a UI tax rate of 1.6% and taxable wage base of $10,000 in 2009, the employer would pay UI tax of $160 ($10,000 x 1.6%) for this individual who made a total of $33,200 annual wage or more. | ||||||