Survey Results

A good

indicator of whether an employee will  be

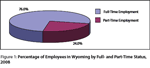

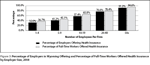

offered benefits is full-time or part-time work status. Figure

1 shows that in 2008 just over three-fourths

(76.0%) of employees held full-time positions while the other 24.0% worked

part-time.

be

offered benefits is full-time or part-time work status. Figure

1 shows that in 2008 just over three-fourths

(76.0%) of employees held full-time positions while the other 24.0% worked

part-time.

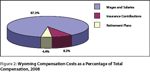

Total compensation refers to the amount of money an employer spends on wages

combined with the amount spent on other benefits. Contributions to  insurance

plans and retirement plans represent the majority of total compensation other

than wages. In 2008, 4.4% of total compensation consisted of contributions

to retirement plans and 8.3% went to insurance costs (see Figure

2).

insurance

plans and retirement plans represent the majority of total compensation other

than wages. In 2008, 4.4% of total compensation consisted of contributions

to retirement plans and 8.3% went to insurance costs (see Figure

2).

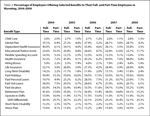

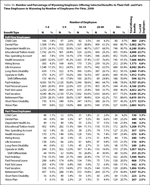

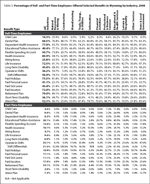

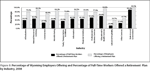

Table 2 shows the proportion of employers

that offered benefits to their  employees by full- and part-time status.

In all cases, a greater proportion of employers offered benefits to full-time

employees than to part-time employees. In 2008 paid holidays was the

benefit most often offered to full-time employees (55.6%) followed by

paid vacation (55.2%), and health insurance (44.0%). Approximately 39.1%

of employers offered retirement benefits to their full-time employees.

In comparison, the benefits most often offered to part-time employees

included shift differentials (25.3%), paid holidays (18.6%), and retirement

plans (15.2%). Only 6.4% of employers offered their part-time employees

health insurance.

employees by full- and part-time status.

In all cases, a greater proportion of employers offered benefits to full-time

employees than to part-time employees. In 2008 paid holidays was the

benefit most often offered to full-time employees (55.6%) followed by

paid vacation (55.2%), and health insurance (44.0%). Approximately 39.1%

of employers offered retirement benefits to their full-time employees.

In comparison, the benefits most often offered to part-time employees

included shift differentials (25.3%), paid holidays (18.6%), and retirement

plans (15.2%). Only 6.4% of employers offered their part-time employees

health insurance.

Table 3a shows the number of employees that were offered

benefits in 2008 by firm size for full- and part-time employees. The

largest firms offered the largest number of benefits to both full- and

part-time employees. Of the  166,611 full-time employees who were offered

health insurance, 114,030 worked in firms with 50 or more employees,

while only 5,030 of those working for firms with 1-4 employees were offered

the same benefit. Similarly, 115,056 full-time employees working for

the state’s largest firms received retirement benefits compared to 4,604

working for the state’s smallest firms.

166,611 full-time employees who were offered

health insurance, 114,030 worked in firms with 50 or more employees,

while only 5,030 of those working for firms with 1-4 employees were offered

the same benefit. Similarly, 115,056 full-time employees working for

the state’s largest firms received retirement benefits compared to 4,604

working for the state’s smallest firms.

Similarly, more part-time employees working for large firms were offered benefits than those working for small firms. Out of 65,573 part-time workers in the state, 21,690 were offered retirement benefits; more than three-fourths (16,499) of whom worked for large firms. In contrast, only 511 of those working part-time for firms with 1-4 employees were offered retirement benefits. Only 6,455 of 65,573 part-time employees in the state were offered health insurance benefits during 2008. Of those, 5,028 worked for firms with 50 or more employees.

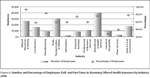

The percentage of employers offering health insurance increased with the

number of employees, as did the proportion of employees who were offered

the benefit (see Figure 3). Among

firms with 1-4 employees, 32.0% of  employers offered health insurance and

36.7% of employees in firms this size were offered the insurance. In comparison,

91.3% of employers with 50 or more workers offered health insurance and

it was offered to 94.6% of employees in firms this size.

employers offered health insurance and

36.7% of employees in firms this size were offered the insurance. In comparison,

91.3% of employers with 50 or more workers offered health insurance and

it was offered to 94.6% of employees in firms this size.

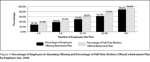

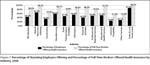

The same pattern occurred for retirement benefits (see

Figure 4). Approximately 28.3% of the smallest firms (1-4 employees)

offered this benefit to their employees and approximately one-third (33.4%)

of  employees in firms this size were offered the benefit. For the largest

firms (50+ employees), 88.6% of firms offered retirement benefits and

94.4% of their employees were offered a retirement plan.

employees in firms this size were offered the benefit. For the largest

firms (50+ employees), 88.6% of firms offered retirement benefits and

94.4% of their employees were offered a retirement plan.

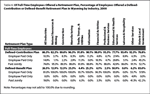

Table 3b shows

a larger proportion of large firms offered their

employees benefits compared to smaller firms. In general, the smallest proportion

of firms offering benefits were those with 1-4 employees and that proportion

increased as firm size increased. For example, 17.4% of firms with 1-4 employees,

38.8% of firms with 10-19 employees, and 80.7% of firms with 50 or more employees

offered dental plans to their full-time employees. In 2008, 32.0% of firms

with 1-4 employees offered their full-time employees health insurance compared

to 91.3% of firms with 50 or more employees. Just over one-quarter (28.3%)

of small firms offered retirement plans to their full-time employees while

88.6% of large firms offered this benefit.

employees benefits compared to smaller firms. In general, the smallest proportion

of firms offering benefits were those with 1-4 employees and that proportion

increased as firm size increased. For example, 17.4% of firms with 1-4 employees,

38.8% of firms with 10-19 employees, and 80.7% of firms with 50 or more employees

offered dental plans to their full-time employees. In 2008, 32.0% of firms

with 1-4 employees offered their full-time employees health insurance compared

to 91.3% of firms with 50 or more employees. Just over one-quarter (28.3%)

of small firms offered retirement plans to their full-time employees while

88.6% of large firms offered this benefit.

The results were similar for part-time employees. Fewer firms offered benefits to part-time employees, and larger firms offered benefits more often than smaller firms. Only 3.7% of firms with 1-4 employees offered health insurance benefits to part-time employees while nearly one-quarter (23.4%) with 50 or more employees did. Less than 1 in 10 (9.5%) small firms offered retirement benefits to part-time employees, compared to 43.8% of the largest firms.

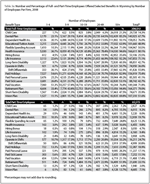

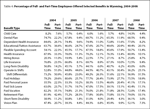

In 2008, the benefit offered to the greatest percentage of full-time  employees

was health insurance (80.9%, Table 4), followed by retirement plans (79.0%),

and dependent health insurance (77.0%). The benefits most often offered to

part-time employees were retirement plans (33.1%), followed by shift differentials

(31.5%), and educational/tuition assistance (20.1%).

employees

was health insurance (80.9%, Table 4), followed by retirement plans (79.0%),

and dependent health insurance (77.0%). The benefits most often offered to

part-time employees were retirement plans (33.1%), followed by shift differentials

(31.5%), and educational/tuition assistance (20.1%).

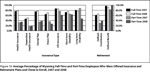

Table 4 also shows trends over time in the percentage

of employees that were offered benefits. In general, the percentage of

full-time employees offered benefits increased from 2007 while the proportion

of part-time employees offered benefits either  declined or did not change.

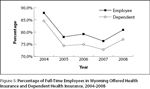

As shown in Figure 5, the proportion of full-time employees offered health

insurance benefits increased in 2008, as did the proportion of full-time

employees who were offered dependent health care benefits.

declined or did not change.

As shown in Figure 5, the proportion of full-time employees offered health

insurance benefits increased in 2008, as did the proportion of full-time

employees who were offered dependent health care benefits.

The number and percentage of employees offered benefits varied widely by

industry (Figure 6). Some industries were more likely to offer a more generous

benefits package than others. It is likely that the seasonal nature  of

the specific industry drives the benefit structure. For example, it may

not be as cost effective to offer benefits to a seasonal work force in

leisure & hospitality

or construction as it is for a more permanent work force found in educational & health

services or state & local government. Benefits may also be used to attract

employees to growing industries such as natural resources & mining.

of

the specific industry drives the benefit structure. For example, it may

not be as cost effective to offer benefits to a seasonal work force in

leisure & hospitality

or construction as it is for a more permanent work force found in educational & health

services or state & local government. Benefits may also be used to attract

employees to growing industries such as natural resources & mining.

As shown in Table 5, the percentage of full- and part-time

employees who were offered benefits varied by industry with certain benefits

more prevalent in some industries. For example, although child care was

offered to only  14.3% of full-time employees across all industries, 35.9%

of full-time employees in natural resources & mining were offered this benefit, followed

by 26.2% in educational & health services. Similarly, firms in natural

resources & mining and manufacturing offered short-term disability benefits

to a greater proportion of full-time employees (68.7% and 53.6%, respectively)

compared to all industries (36.1%). State & local government and firms

in natural resources & mining offered health insurance benefits to the

largest proportion of full-time workers (98.2% and 94.1%, respectively).

State & local government also offered retirement benefits to the greatest

proportion of full-time workers (99.5%) followed by educational & health

services (94.8%).

14.3% of full-time employees across all industries, 35.9%

of full-time employees in natural resources & mining were offered this benefit, followed

by 26.2% in educational & health services. Similarly, firms in natural

resources & mining and manufacturing offered short-term disability benefits

to a greater proportion of full-time employees (68.7% and 53.6%, respectively)

compared to all industries (36.1%). State & local government and firms

in natural resources & mining offered health insurance benefits to the

largest proportion of full-time workers (98.2% and 94.1%, respectively).

State & local government also offered retirement benefits to the greatest

proportion of full-time workers (99.5%) followed by educational & health

services (94.8%).

Firms

in natural resources & mining offered a large

proportion of their full-time employees most of the benefits included

in this survey. Figures

7and 8 show that approximately

9 of 10 employees (94.1%) were offered

Firms

in natural resources & mining offered a large

proportion of their full-time employees most of the benefits included

in this survey. Figures

7and 8 show that approximately

9 of 10 employees (94.1%) were offered  health insurance and retirement

plans (89.1%). There were only three benefits these firms did not offer

to more than half of their employees: paid personal leave (23.1%), paid

sick leave (21.4%), and child care benefits (35.9%).

health insurance and retirement

plans (89.1%). There were only three benefits these firms did not offer

to more than half of their employees: paid personal leave (23.1%), paid

sick leave (21.4%), and child care benefits (35.9%).

The proportion of employees in the construction industry who were offered benefits was lower than the average for all industries. While 80.9% of employees in all industries were offered health insurance, only 62.8% of construction employees were. Similarly, 79.0% of all employees received retirement benefits compared to 68.4% of those working in construction. The percentage of employees in construction who were offered dependent health insurance was 59.0%, compared to 77.0% for all industries.

An above-average proportion of manufacturing employees were offered health insurance (88.1%) and retirement benefits (84.2%). Approximately 83.3% of these employees were offered dependent health care as well. Manufacturing firms offered 93.6% of employees paid holidays, and 85.4% were offered paid vacation time.

Trade, transportation, & utilities includes a wide variety of firms; retail stores, trucking companies, and electrical power plants. In 2008, 78.4% of employees in these firms were offered health insurance, which was similar to the average for the state (80.9%). A slightly lower-than-average percentage was offered retirement benefits (72.8%) and 74.2% were offered dependent health insurance.

More full-time employees in the information industry were offered health insurance (84.6%) and retirement benefits (84.5%) than the state average (80.9% and 79.0%, respectively). More than three-fourths of these employees were offered dependent health insurance plans and a similar proportion (74.7%) were offered vision plans.

Compared to full-time workers in all industries, employees in the financial activities industry were more likely to be offered most of the benefits. Approximately 86.0% in this industry were offered health insurance benefits, 80.6% were offered dependent health care benefits, and 81.6% were offered retirement benefits. A greater-than-average proportion of these employees also were offered a dental plan (81.3%), a vision plan (70.6%), and paid vacation time (73.9%).

The professional & business services sector includes a wide range of firms including temporary help agencies, engineering firms, landscaping & snow removal services, and law offices. Compared to the average for all industries in Wyoming, full-time employees in this industry were somewhat less likely to be offered many benefits. An estimated 76.5% were offered health insurance, 68.3% were offered dependent health benefits, and 77.9% were offered retirement benefits. Paid holidays were offered to 87.7% of these employees, and paid vacation time was offered to 60.3%.

The educational & health services industry includes both private and public employers, such as school districts, hospitals, doctor’s offices, and colleges and universities. They include a full range of employer sizes, ranging from very small to very large. Overall, full-time employees in this industry were more likely to be offered health insurance (92.7%) compared to the state average. They were also more likely to be offered retirement benefits (94.8%) and dependent health benefits (89.3%).

Leisure & hospitality is a highly seasonal industry that includes hotels, restaurants, and museums. This industry offered benefits to the smallest proportion of full-time employees compared to the state average. Just over half (51.0%) of full-time workers in this industry were offered health insurance benefits and 39.7% were offered retirement benefits. Approximately 43.1% were offered dependent health care benefits, 38.8% were offered paid holidays, and 59.3% were offered paid vacation time.

Other services includes businesses such as automotive repair services, hair salons, membership organizations, and commercial laundries. Only 52.9% of full-time employees in this sector were offered health insurance benefits compared to the state average of 80.9%. Likewise, 47.7% of these employees were offered retirement benefits compared to the average of 79.0%.

Full-time employees working in state & local government were very likely to be offered benefits. Nearly all employees in this sector were offered health insurance (98.2%) and retirement benefits (99.5%). Full-time employees were also very likely to be offered other benefits such as paid holidays (99.9%) and paid vacation time (86.5%), dental plans (83.3%) and vision plans (85.6%), and dependent health insurance (97.6%).

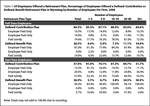

Table 6 provides details on the types of retirement

plans offered by  employers. There are two basic types of plans: defined-contribution

and defined-benefit. In a defined-contribution plan, employees and/or

employers make specific contributions, such as a certain percentage of

wages from each pay period. Benefits from this type of retirement account

typically depend on the amount contributed and the investment’s performance.

Defined-contribution plans are generally designed to be flexible and

portable. An example of this type of account is a 401K account.

employers. There are two basic types of plans: defined-contribution

and defined-benefit. In a defined-contribution plan, employees and/or

employers make specific contributions, such as a certain percentage of

wages from each pay period. Benefits from this type of retirement account

typically depend on the amount contributed and the investment’s performance.

Defined-contribution plans are generally designed to be flexible and

portable. An example of this type of account is a 401K account.

In comparison, defined-benefit plans provide a set amount of benefits after retirement based on a set formula. Defined-benefit plans include pension plans where the benefits are related to the employee’s years of service and highest salary. Sometimes employers offer both a defined-benefit plan and a defined-contribution plan.

Overall, defined-contribution plans (86.3%) were offered to full-time employees more often than defined-benefit plans (26.5%), but there was some variation among industries. For example, 83.0% of full-time employees in state & local government and 50.9% of educational & health service employees were offered defined-benefit plans. In contrast, those in leisure & hospitality (0.0%), professional & business services (2.5%), and trade, transportation, & utilities (4.4%) were least likely to be offered this type of plan. A majority of full-time employees in all industries were offered a defined-contribution plan.

Employees in larger firms were more often offered defined-benefit

retirement plans than those in smaller firms (see Table

7).

Among full-time employees, 34.0% of those working for firms with 50 or

more workers were offered a defined-benefit retirement plan. Only 8.4%

of full-time workers employed by firms with 1-4 employees were offered

this benefit. Figure 9 shows that among all size classes,

retirement plans than those in smaller firms (see Table

7).

Among full-time employees, 34.0% of those working for firms with 50 or

more workers were offered a defined-benefit retirement plan. Only 8.4%

of full-time workers employed by firms with 1-4 employees were offered

this benefit. Figure 9 shows that among all size classes,  more than 90%

of employees were offered a defined-contribution retirement plan, and

it was offered to more than 80% of all employees.

more than 90%

of employees were offered a defined-contribution retirement plan, and

it was offered to more than 80% of all employees.

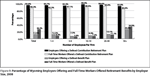

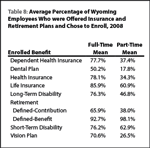

The average percentage of employees in the state that

chose to enroll in insurance and retirement plans is shown  in Table

8.

More than three-fourths of employees (78.1%) chose to enroll in health

insurance and more than three-fourths (77.7%) chose to enroll their dependents.

A greater percentage of full-time employees enrolled in defined-benefit

plans (92.7%) than in defined-contribution

in Table

8.

More than three-fourths of employees (78.1%) chose to enroll in health

insurance and more than three-fourths (77.7%) chose to enroll their dependents.

A greater percentage of full-time employees enrolled in defined-benefit

plans (92.7%) than in defined-contribution  plans (65.9%). Employees are

often automatically enrolled in defined-benefit plans by their employers. Figure

10 shows that enrollment

rates between 2007 and 2008 for full-time employees increased for health

insurance, dental insurance, and for defined-contribution plans. However,

enrollment declined somewhat for defined-benefit plans.

plans (65.9%). Employees are

often automatically enrolled in defined-benefit plans by their employers. Figure

10 shows that enrollment

rates between 2007 and 2008 for full-time employees increased for health

insurance, dental insurance, and for defined-contribution plans. However,

enrollment declined somewhat for defined-benefit plans.

Part-time employees were most likely to enroll in defined-benefit retirement plans (98.1%), short-term disability insurance (62.9%), and life insurance (60.9%). Only 34.3% of part-time employees chose to enroll in health insurance and 37.4% enrolled in dependent health insurance. A greater proportion of part-time employees in 2008 enrolled in health insurance, dependent health insurance, dental insurance, defined-contribution plans, and defined-benefits plans than in 2007.

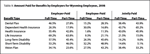

Table 9 shows how benefits are paid. Just over half

(55.4%) of health  insurance premiums offered to full-time employees were

fully paid by employers, while dependent health insurance premiums were

more often paid jointly (43.7%). Employers paid fully for approximately

69.2% of life insurance premiums and 57.5% of long-term disability insurance

but only 34.1% of vision plans were employer-paid.

insurance premiums offered to full-time employees were

fully paid by employers, while dependent health insurance premiums were

more often paid jointly (43.7%). Employers paid fully for approximately

69.2% of life insurance premiums and 57.5% of long-term disability insurance

but only 34.1% of vision plans were employer-paid.

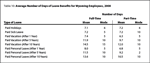

Full- and part-time employees received similar days

of paid holiday (7.1 days and 7.2 days, respectively, see Table

10).

When paid sick time was  offered, both full-time and part-time employees

were offered an average of 7.2 days during 2008. After 10 years, full-time

employees were eligible for an average of 14.5 days of paid vacation

leave while part-time employees were eligible for an average of 12.0

days.

offered, both full-time and part-time employees

were offered an average of 7.2 days during 2008. After 10 years, full-time

employees were eligible for an average of 14.5 days of paid vacation

leave while part-time employees were eligible for an average of 12.0

days.