What Proportion of Wyoming Workers Would be Eligible if They Lost Their Jobs?

Tables Unemployment Insurance Claims

The purpose of this research is to determine what proportion of Wyoming workers would be eligible to receive Unemployment Insurance benefits if they lost their jobs, at what benefit level, and for how long their benefits would last. This article also explores the industries in which workers are more likely to qualify for higher UI benefits, and the UI eligibility differences by age and gender.

The price of crude oil has declined for more than a year, from more than $100 per barrel to a low of $45 (U.S. Energy Information Administration, 2015). This downward trend is not likely to improve in the near future, due to an increase in supply and a decrease in international demand (Storrow, 2015) and the potential challenges from other forms of energy, such as solar and wind.

How will this drop in oil prices affect Wyoming’s economy? Will it lead to another economic downturn like the one from 2009 to 2010? If so, how well will the Wyoming Unemployment Insurance (UI) system be able to function, in terms of providing temporary financial support to unemployed workers and maintaining the labor supply in the state? The research presented in this article uses UI wage records from the most recent quarter available, third quarter 2014 (2014Q3), to explore the UI eligibility status for all individuals who worked in Wyoming in that quarter, and the potential cost of UI benefits. The UI Wage Records administrative database is managed by the Research & Planning (R&P) section of the Wyoming Department of Workforce Services. It is based on employers’ quarterly wage and employment reports to the UI tax section.

According to Wyoming Employment Security law (27-3-306), an unemployed worker must meet nonmonetary and monetary requirements in order to qualify for UI benefits. Nonmonetary criteria require individuals to: 1) have involuntarily separated from their employers or lost jobs through no fault of their own; 2) be able and available to work; and 3) be actively seeking jobs. In general, an individual can control nonmonetary eligibility criteria to some degree. For example, an individual who was laid off from a job because of budgetary cutbacks, was able to work, and continued to look for employment would meet these nonmonetary criteria.

Monetary criteria require unemployed workers to have earned sufficient wage credits during their base period. The base period is the first four of the last five completed calendar quarters preceding the one in which an unemployed worker filed an initial claim for UI benefits. There are two monetary criteria in Wyoming. First, the unemployed individual’s base period wage must be at least 8% of the statewide average annual wage (minimum wage requirement). This minimum wage requirement changes every state fiscal year, which lasts from July 1 to June 30; for fiscal year 2015, the minimum wage requirement was $3,550. Second, the individual’s total base period wage must be at least 1.4 times his or her high quarter wages in the base period (high quarter wage requirement). Individual workers have little to no control over these monetary criteria. This article only focuses on monetary criteria.

Overall UI Eligibility Situation

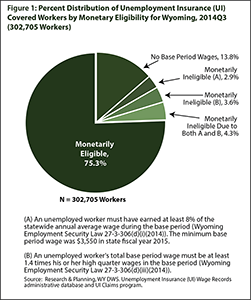

A total of 302,705 individuals worked and had wages at any time in Wyoming during 2014Q3. If they all lost their jobs in 2014Q3 and needed to apply for UI benefits (as a hypothetical worst case scenario), then nearly one-fourth of them would not qualify for UI benefits. As Figure 1 shows, 13.8% (41,908 workers) did not work and had no wages during the base period 2013Q2 to 2014Q1; 2.9% (8,873 workers) did not meet the minimum base period wage requirement; 3.6% (10,781 workers) did not meet the high quarter wage requirement; and 4.3% (13,146 workers) did not meet both minimum and high quarter wage requirements. In other words, about three-fourths of all Wyoming workers would be eligible for UI benefits if they all lost their jobs.

There were 260,797 individuals who worked in both 2014Q3 and their base period. The research presented in this article focuses on this group of workers. The other 41,908 workers who do not have base period wages may be selected for future studies.

Employment Structure by Industry

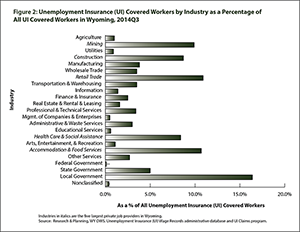

The largest percentage (16.4%) of Wyoming workers were employed by local government in 2014Q3 (see Figure 2), which includes county and city governments, school districts, hospitals, fire districts, and others. In terms of private industry, retail trade and accommodation & food services employed the highest percentage of individuals (10.9% and 10.7%, respectively), followed by mining (9.9%), construction (8.7%), and health care & social assistance (8.4%). In other words, these were the five largest private industries in Wyoming. These five industries are indicated in italics in the tables and figures that accompany this article.

UI Eligibility and Wage Replacement by Industry

Of the 260,797 individuals who worked in both 2014Q3 and their base period, 87.4% (227,997) would be monetarily eligible for UI benefits and 12.6% (32,800) would not (see Table 1). Six of Wyoming’s private industries would have more than 90% of their workers eligible for UI benefits: mining, utilities, manufacturing, wholesale trade, finance & insurance, and management of companies & enterprises. On the other hand, four private industries would have over 20% of their workers not eligible for UI benefits: administrative & waste services; educational services; accommodation & food services; and arts, entertainment, & recreation.

Table 1 also shows total wages and average weekly wage by industry, and potential total UI benefits and average weekly UI benefit amount by industry. Typically, an individual with higher wages before a job loss will find it more difficult to make up his financial losses through UI benefits (wage replacement). Wage replacement is calculated by dividing the average weekly benefit by the average weekly wage for that industry. The three industries with the highest weekly wage were mining, utilities, and management of companies & enterprises (around $1,600 per week). These were also the three industries that would have the lowest wage replacement rate if workers lost their jobs (27.4%, 28.1%, and 26.8%, respectively). The only industries in which potential weekly UI benefits could replace a little more than half of the average weekly wage (less than $600 per week) were agriculture; educational services; accommodation & food services; and arts, entertainment, & recreation.

An individual’s UI benefits, including dollar amount and duration, are based on the wages he earned during the base period. By law, the weekly UI benefit an eligible person could receive is equal to 4% of his high quarter wage during the base period. The law limits the maximum weekly benefit to 55% of the previous year’s statewide average weekly wage, which changes every year. In 2015, the maximum weekly benefit was $475. The maximum benefit an individual could receive for one year starting with the effective date of the initial claim is 30% of his base period wage, or 26 times his weekly benefit, whichever is less. The potential UI duration (the number of weeks an individual is able to receive UI benefits) is determined by the maximum benefit divided by the weekly benefit, up to a maximum of 26 weeks in a benefit year.

In general, the greater the weekly benefit amount and the longer time one is eligible for receiving UI benefits, the easier it is for workers to overcome the financial difficulties of unemployment. Increased benefits also afford more flexibility to attend reemployment services and look for jobs.

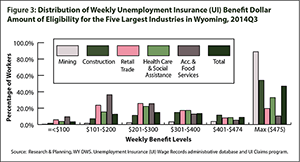

Table 2 and Figure 3 show that less than half (46.9%) of the 227,997 UI eligible individuals would qualify for the maximum weekly benefit ($475) if they lost their jobs and applied for UI in 2014Q3. Among Wyoming’s top five private industries, mining would have the highest percentage of workers (88.9%) qualify for maximum UI benefits, followed by construction (54.0%) and health care & social assistance (32.9%). In accommodation & food services and retail trade, only 10.5% and 19.6%, respectively, would qualify for the maximum weekly UI benefit.

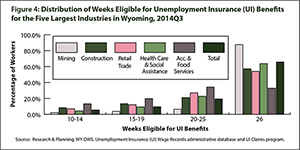

In fact, nearly half (45.9%) of those working in accommodation & food services would only qualify for $200 or less per week. In terms of UI benefit duration, 65.7% of Wyoming’s workers would be eligible for the maximum 26 weeks (see Table 3 and Figure 4). Among Wyoming’s top five private industries, mining would have the highest percentage of workers (87.5%) qualify for the maximum duration and accommodation & food services would have the lowest (32.8%).

Employment Structure by Gender and Age

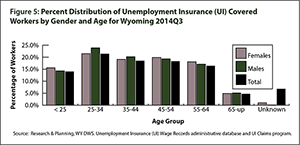

Table 4 and Figure 5 show the distribution of Wyoming workers by gender and age. A little over half (50.9%) of Wyoming workers were male, 42.7% were female, and no gender information was available for the remaining 6.4%. The age distributions for male and female workers were quite similar, with more than 75% between the ages of 25 and 64 years of age, a little over 10% younger than 25, and around 5% age 65 and older.

UI Eligibility by Gender and Age

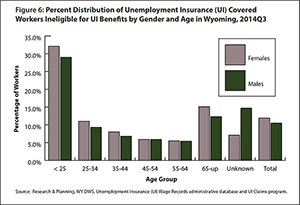

In almost every age group, a slightly higher percentage of female workers than male workers would not be eligible for UI benefits if they were unemployed (see Figure 6). For both males and females, the percentage of workers who would not be eligible for UI benefits decreases as age increases. Nearly 30% of Wyoming workers who were younger than 25 would not be eligible for UI benefits. For workers age 55 to 64, only 5.5% or less were not eligible for UI benefits. Among workers age 65 and older, 15.1% of females and 12.3% of males would not be eligible for UI benefits. Many of the workers younger than 25 are likely high school or college students who only work part-time or summer jobs with low wages. Table 4 shows that this youngest age group worked for 1.9 employers on average during the base period (the highest in all age groups) and made the lowest average weekly wage ($486). It is also likely that a larger proportion of those in retirement age (65 and older) only worked part time; the average weekly wage for this group ($763) was the second lowest of all age groups. Lower wages in the youngest and oldest age groups contribute to the higher percentages of individuals ineligible for UI benefits.

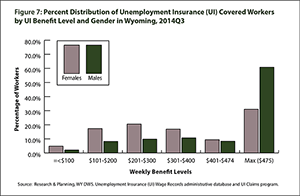

Figure 7 shows that 60.8% of male workers would be eligible for maximum UI benefits ($475 per week) compared to just 31.0% of female workers. Nearly one-fourth (22.1%) of all female workers would qualify for only $200 a week or less, compared to 10.3% of male workers. This result indicates that more female workers may work low-paying or part-time jobs.

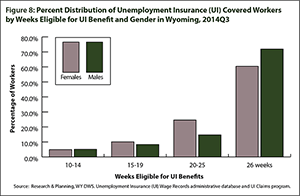

The difference in duration of UI benefits for males (71.9%) and females (60.4%) was not as large (see Figure 8).

The difference in duration of UI benefits for males (71.9%) and females (60.4%) was not as large (see Figure 8).

The average weekly wage for males was at least 66.4% higher than that for females in every age group (see Table 4). As a result, wage replacement rates from UI benefits would be much lower for male workers than females. On average, UI benefits could replace 46.0% of females’ wages when unemployed, compared to 33.0% for males.

Potential UI Benefit Cost and Trust Fund Solvency

Benefits are paid from Wyoming’s UI Trust Fund, which has two major sources of income: UI tax revenue and interest on the fund balance. All fund income and expenses are in a dynamic process and change from time to time, as does the trust fund balance.

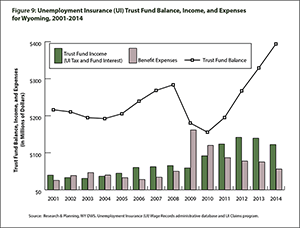

Table 5 and Figure 9 show the UI Trust Fund year-ending balance and annual fund income and expenses for 2001-2014. During that time, Wyoming’s UI program experienced two downturns associated with the national recessions from 2002 to 2004 and from 2009 to 2010. During these two downturn periods, UI benefit expenses exceed the fund’s income, resulting in a decline of the trust fund balance. In terms of UI cost, the last economic downturn was one of the costliest in Wyoming UI history (Wen, 2011). In total, $161.5 million in UI benefits were paid to claimants in 2009, more than any other year in history.

Table 5 and Figure 9 show the UI Trust Fund year-ending balance and annual fund income and expenses for 2001-2014. During that time, Wyoming’s UI program experienced two downturns associated with the national recessions from 2002 to 2004 and from 2009 to 2010. During these two downturn periods, UI benefit expenses exceed the fund’s income, resulting in a decline of the trust fund balance. In terms of UI cost, the last economic downturn was one of the costliest in Wyoming UI history (Wen, 2011). In total, $161.5 million in UI benefits were paid to claimants in 2009, more than any other year in history.

At the end of 2008 – just before the economic downturn – the UI Trust Fund balance was $283.2 million. It dropped to $155.2 million by 2010, then began to increase in 2011. By the end of 2014, the UI Trust Fund balance reached $393.4 million, the highest in history. In other words, Wyoming’s UI Trust Fund was in better shape at the end of 2014 than it was at the end of 2008, and could handle at least two years of 2009-level UI expenses, even without receiving additional UI tax revenues and interest.

Table 6 shows three different scenarios based on the 2014Q3 wage and employment structure. For example, Scenario 2 assumes that 20% of all workers lost jobs evenly across all industries and applied for UI benefits. Under this scenario, the cost for an average of 17 weeks (the average duration for 2009) would be $267.8 million, which would not cause fund solvency problems given the current UI Trust Fund balance. But if 30% of all workers lost their jobs and applied for UI benefits (as presented in Scenario 3), the cost would be $401.6 million, which could lead to a situation of fund insolvency, depending on fund income and expenses.

One of the most commonly used measures of UI Trust Fund solvency is the average high cost multiple (AHCM; Department of Labor, ETA), which is the reserve ratio (the UI Trust Fund balance divided by total UI covered wages) divided by average cost rate of three high-cost years that include either three recessions or at least 20 years’ history. The cost rate is the total amount of benefits paid in the year divided by the total covered wages in the same year. A detailed example of this calculation was presented in Wyoming Labor Force Trends in March 2014 (Wen, 2014). The Advisory Council on Unemployment Compensation recommends an AHCM at 1.0 as a safe level. The most recent UI financial report shows that Wyoming scored 1.18.

Conclusion and Future Studies

Approximately three-fourths (75.3%) of Wyoming workers would be eligible for UI benefits if they were unemployed through no fault of their own. Individuals who worked in high-paying industries or jobs would be more likely to qualify for higher UI benefits, but with a lower wage replacement rate. Female workers were more likely to qualify for lower UI benefits than male workers. Workers younger than 25 or older than 65 were more likely to be ineligible for UI benefits or eligible for a lower UI benefit than any other age groups.

Wyoming’s UI Trust Fund is currently at a solvent level and ready to face another potential economic crisis based on the reserved fund level and the past downturns cost experiences.

Future studies may address questions such as:

- Is Wyoming’s UI system offering sufficient worker protection?

- How would the 41,908 workers in 2014Q3 who were ineligible for UI benefits fare in terms of UI eligibility in the future?

- Is the quarter used for this research (2014Q3) representative of other quarters of the year, or is it affected by seasonality?

References

Storrow, B. (2015, March 28). Oil prices 101: Four questions about crude prices answered. Casper Star-Tribune Wyoming Energy Journal, April/May 2015. Retrieved September 3, 2015, from http://trib.com/business/energy/oil-prices-four-questions-about-crude-prices-answered/article_67786410-33dd-551a-99a5-28c847942a7d.html

U.S. Department of Labor, Employment and Training Administration. (2015). Unemployment insurance data summary. Retrieved September 3, 2015, from http://oui.doleta.gov/unemploy/content/data.asp

U.S. Energy Information Administration 2015. Petroleum & other liquids. Retrieved August 7, 2015, from http://www.eia.gov/petroleum/

Wen, S. (2011). An overview of Wyoming’s unemployment insurance trust fund and trust fund liability. Wyoming Labor Force Trends, 48(11). Retrieved September 3, 2015, from http://doe.state.wy.us/LMI/trends/1111/a1.htm

Wen, S. (2014). Evaluating the Wyoming unemployment insurance system and comparing it with the U.S. average and neighboring states. Wyoming Labor Force Trends, 51(3). Retrieved September 3, 2015, from http://doe.state.wy.us/LMI/trends/0314/a2.htm