Potential Impacts of the Patient Protection and Affordable Care Act on Employer-Provided Benefits in Wyoming

See Related Tables and Figures

Passage of the Patient Protection and Affordable Care Act (PPACA) has generated considerable speculation about the act's full effects on employment and businesses, but scant conclusive evidence exists. When the law is fully implemented, businesses with fewer than 50 employees would not be required to provide health insurance to workers, although they may qualify for tax credits if they choose to do so. While more than 96% of firms in the Wyoming employ fewer than 50 employees, nearly three-fourths of all full-time workers in the state are employed by firms with more than 100 employees. Using data from the Wyoming Benefits Survey and other state and federal data, in addition to previous research related to health care mandates in other states, this article explores the PPACA's possible effects on employment in the state.

Extensive analyses have suggested how states will respond to the Patient Protection and Affordable Care Act (PPACA, Public Law 111-148) and implement provisions of the law, but conclusive evidence related to how these changes may affect private businesses of various sizes is scarce.

Intended to expand health insurance coverage to more working, non-elderly Americans while offsetting costs that would otherwise be shifted to state budgets, PPACA requirements vary, depending on the number of employees a company has. For example, employers with fewer than 50 employees are not required to offer health insurance to their workers. However, in the first phase of implementation (expiring in 2013), small businesses with fewer than 25 employees whose average annual wages are less than $50,000 may qualify for a tax credit to provide health insurance. For the second phase (beginning January 1, 2014, when full implementation of the law is activated), eligible small businesses that purchase insurance through a state health exchange will be provided with a tax credit, if the employer contributes at least 50% of the premium.

Conversely, medium and large businesses that employ more than 50 workers will be required to provide affordable health insurance coverage to their employees. Failure to do so will result in an assessed penalty of $2,000 to $3,000 per employee, excluding the first 30 employees. Opponents of this element of the law argue that high costs associated with providing health insurance may cause some employers to discontinue offering employer-sponsored health insurance, suggesting that businesses will instead opt to pay the PPACA penalties. The movement from private to public insurance, termed crowd-out, would drive workers to obtain coverage individually via a state-based health exchange or expanded Medicaid program based on income. Others contend employer-mandated insurance may cause reductions or eliminations of other benefits offered such as retirement, or possibly trigger shedding of jobs through layoffs or attrition.

The purpose of this study is to provide context to the possible effects of the PPACA on Wyoming's private-sector by examining employers by employment size, industry, and benefits offered to employees. From those data, this article will envision the economic implications of the PPACA on employers by exploring how they might respond to requirements given their size; will they shift costs from other benefits currently offered, reduce wages, or restructure their workforce? By extension, possible resulting impacts on the workforce will also be considered by examining the composition of the workforce, the types of jobs available in Wyoming, and the impact of nonresident workers. Suggestions for further research and strategies will also be provided.

Review of the Literature

Because mandated employer-sponsored health insurance is unfamiliar terrain for most states, there have been few examples of research on the policy impact and its effect on the behavior of businesses after they are required to offer health insurance to their workers. A recent study examined the only state example that has compiled more than two decades worth of data from Hawaii's Prepaid Health Care Act passed in 1979, which requires all private-sector employers to provide coverage to employees working more than 20 hours per week (Buchmueller, DiNardo, Valetta, 2011). Labor market indicators such as wages, employment, hours, and benefits revealed that the law increased insurance coverage for workforce groups with traditionally low rates of coverage in the voluntary market. Further, the assertion that the mandates reduce wages and employment probabilities was not proven; the changes were not statistically significant, although a greater reliance on part-time workers was a noted detectable effect.

One concern about PPACA was that employers might scale back or eliminate employer-sponsored health insurance, thereby causing a transfer to public plans. However, a study examining employer response to mandated coverage in the 2006 Massachusetts reform initiative indicated employer coverage increased, even though the consequence for not offering insurance was slight ($295 per employee) compared to the PPACA penalty (Long, Stockley, Dahlen, 2012). According to a statewide survey, 94.2% of non-elderly residents reported being covered in 2010, compared to 86.6% in 2006. The percentage reporting coverage through an employer rose from 64.4% to 68.0% over the same period. Another study (Seiber and Florence, 2010) examined the impact of an expansion of the State Children's Health Insurance Program and found an increase in dependent coverage in the small group market, with no significant movement from private plans. Consistent with those findings, Gabel and Whitemore (2008) conducted a randomized survey of 1,056 Massachusetts firms that indicated only 3% of firms were planning to drop coverage, a proportion similar to national figures suggesting that public plans will not experience a flooded market caused by crowd-out effects.

Because data related to employers' responses to mandated employer-sponsored health insurance are scarce, analyses projecting a variety of outcomes have been published. One study (Sinaiko, 2004) examined the possible effects of a proposed 2003 California play-or-pay law (SB2) that would have required employers to expand health insurance coverage for a portion of the state's working uninsured population. The study forecast labor market responses such as reduced wages, increased prices, changes in the workforce, and potential for adverse selection. Examples of adverse selection might include people who buy insurance policies knowing that their risk is greater than normal, or people in lower-risk groups (e.g., young non-smokers) leaving the risk pool because they can find less expensive alternatives. Policy analysis of SB2 examined the possible effects of an 83% to 100% shift in wages as well as cost-containment strategies that could include price increases in products and services that are relatively fixed, restructuring the workforce to reduce part-time workers (more costly to insure), using overtime more frequently instead of hiring more workers, or reducing the size of the workforce. Without an individual mandate, it was projected that fewer workers would become insured.

Methodology

Employer Size Class and Benefits Methodology

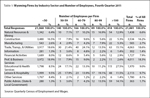

Employer requirements of the PPACA are established by firm size. To determine the number of employers in the state by size, the number of unique Unemployment Insurance (UI) accounts was queried using 2011 Quarterly Census of Employment and Wages (QCEW)1data (see Table 1). Employer size classes were defined by the number of employees in the fourth quarter of 2011 and were grouped by fewer than 50, 50-59, 60-79, 80-99, and more than 100 employees per firm. Rather than classify employers by fewer than 50 and more than 100, size categories of employers were chosen for discussion purposes to gauge the various decisions firms may apply, and determine how many businesses would potentially be involved. For example, how many firms with 50 to 59 workers that currently do not offer health insurance may be compelled to eliminate positions to maintain a firm size of less than 50 to avoid penalties and having to offer mandated health coverage?

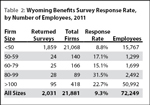

In 2011, benefits survey questionnaires were completed by 2,031 Wyoming employers including both the private-sector and state & local government (Leonard & Saulcy, 2012). In total, these employers represented 9.3% of Wyoming's firms. The results specific to the 2011 benefits survey questionnaire presented in Table 2 are actual sample responses, rather than extrapolated estimates for the entire population of employers. It should be noted that Research & Planning (R&P) uses a model that classifies business sizes by 1-4, 5-9, 10-19, 20-49 and 50+ employees to generalize responses to the entire population. Because of this, the capability to make accurate estimations of the newly defined size classifications (<50, 50-59, 60-79, 80-99, >100) for this particular study is not possible. Data presented in tables 3, 4, and 5 use generalized population estimates from 2011 benefits survey information. For a full description of the methodology to determine estimates, refer to the methods section of the Wyoming Benefits Survey (2011).

Workforce Demographics and Employment Methodology

Historical demographic data were analyzed to identify trends related to the composition of the workforce by gender, wages, proportion of nonresident workers, industry sectors, and county employment information using longitudinal labor market information collected by R&P.

Additionally, 2011 income data stratified by age, gender, and industry sector were analyzed to make reasonable approximations regarding the number of resident workers that would have theoretically met the definition of low-income and may have qualified for coverage under an expanded Medicaid program. For discussion purposes, the 2011 Health and Human Services (HHS) poverty guidelines (used to determine financial eligibility of Medicaid programs) was used to define those living in poverty at 100% of the Federal Poverty Level (FPL), or earning an annual income of $10,890 for individuals and $22,350 for a family of four. Low-income individuals, who will gain coverage January 1, 2014 under an expanded Medicaid program, will be defined as those earning an annual income of between 100% and 138% FPL. The PPACA will apply what is called a standard disregard that will exclude 5% of an individual's income, making the de facto threshold for eligibility 138% rather than 133% FPL. Using 2011 HHS poverty guidelines, that means individuals with an annual income of $15,028 (138% FPL; equivalent to a full-time job paying a minimum wage of $7.25 per hour) and a family of four earning $30,843 or less are considered low income.

Results

Employer Size Composition

In fourth quarter 2011, Wyoming had 21,881 unique and active Unemployment Insurance (UI) accounts. Of those, 21,068 (96.3%) were employers with fewer than 50 workers; 395 UI accounts were linked to employers with a workforce between 50 and 99; and the remaining 418 businesses employed more than 100 employees. Table 2 shows the distribution of firms by size and industry sector. The three largest industry sectors in terms of number of firms in the state were construction (3,534 firms, 16.2% of all firms), professional & business services (4,011, 18.3%), and trade, transportation, & utilities (4,063, 18.6%); these three sectors accounted for more than half (53.1%) of all firms in Wyoming.

Employer-Sponsored Benefits

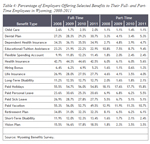

Data from the 2011 Wyoming Benefits Survey (Research & Planning, 2011) showed that among firms with more than 50 employees, 91.4% offered health insurance, and as the number of employees decreased below 50, the percentage of workers offered benefits also declined. The survey also revealed that the majority of direct compensation costs (84.6%) were tied to wages and salaries, whereas 5.0% of indirect total compensation consisted of defined-benefit and defined-contribution plans, and 10.4% was allocated to medical, dental, and vision insurance plans.

Frequencies of responses from the 2011 benefits survey were computed (see Table 1). Consistent with previous findings, full-time employees who work in firms with a workforce of more than 50 employees are more likely to work for employers that offer insurance, than are part-time workers in smaller firms with less than 50 employees (see Table 3).

Table 4 represents generalized data from the 2008 through 2011 benefits surveys to generate approximations across all employers for full- and part-time workers, while Table 5 shows the estimated percentage of workers offered selected benefits by full- or part-time working status and industry sector. Workers classified as full-time employees in construction, leisure & hospitality, and other services are less likely to receive selected benefits, whereas those employed in mining, state & local government, and educational & health services are more likely to be offered selected benefits, specifically health insurance.

Workforce

The PPACA expands access to the non-elderly workforce through several mechanisms, including the expansion of Medicaid to low-income individuals who earn incomes up to 138% of the FPL, and through health insurance exchanges that act as marketplaces for small employers and individuals to purchase coverage. In Wyoming, these reforms will have the most significant impact on the workforce as most employers will not be required to provide health insurance coverage because of firm size. Examining the composition of the workforce by wages, gender, age, industry sectors, and the impact of nonresident workers are important factors to consider.

According to Wyoming wage records, in 2011 the average annual wage in Wyoming was $32,219, with men earning $43,989 and women earning $25,719 annually (Earnings in Wyoming, 2012). The average annual wage of $32,219 was driven down due to the high proportion of nonresident workers (17.7%) who earned what was considered low income ($16,579). According to the U.S. Census Bureau's Current Population Survey (CPS), the median annual income in Wyoming is $53,236. CPS data are based on a household survey, unlike Wyoming wage records data. Table 6 summarizes 2011 earnings by gender and age. Women age 20-24 were more likely to be classified as low-income earners than were men in the same age group, mostly due to the large proportion of men in industries that pay higher wages, such as mining or construction. Excluding ages 0-19 and 65 and older, the largest proportion of low-income earners was in the 20-24 age group, with women consistently earning less in all industry sectors. Table 7 shows the number of women and men in the 20-24 age range and their average annual wages by industry. Shaded areas depict average annual wages at or around the 2011 poverty threshold of 138% FPL ($15,028). To view earnings by industry and more age categories see the R&P website; http://doe.state.wy.us/LMI.

According to Kaiser Family Foundation data, approximately 73,300 non-elderly adults in Wyoming lack health insurance, roughly 16% of the 19-64 age group (Kaiser, 2011).

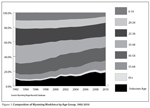

Wyoming has a higher proportion of aging workers and has seen a decline in workers less than 44 years old. Table 8 shows a substantial increase in workers of unknown age that are not Wyoming residents, and a significant reduction in younger workers, especially those in the 35-44 age group (-9.06% from 1992 to 2010). Data reaching back to 1992 provides needed context to explain the increase in workers age 55-64. In some states, this increase was due to older workers returning to the workforce due to poor economic conditions, but in Wyoming it was more likely a function of Wyoming's population aging faster than the nation, paired with an exodus of younger potential workers (Research & Planning, 2012). Figure 1 shows the changing composition of the workforce by age group from 1992 to 2010.

Nonresident Workers

Since 2006, the state has seen dramatic increases in the numbers of nonresident employees in-migrating. Nonresident workers are defined as those workers who do not have a Wyoming-issued driver's license and who work less than four quarters in the state. Jones (2002) found that nonresidents work in the state, on average, only two quarters, and likely have quarterly earnings that are significantly lower than more permanent residents.

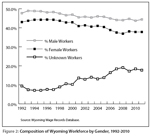

In 1992 nonresident workers composed 9.4% of the workforce. Less than two decades later that percentage has nearly doubled (18.4%): close to one-fifth of the workforce consists of nonresidents. Historical data have been collected on Wyoming's workforce by age, gender, industry, and residence status. Observing nonresident trends over the past two decades exposes significant changes in Wyoming's workforce composition, particularly as they relate to the increasing number of nonresident workers and age distribution, where workers age 44 and younger are decreasing as a percentage of the workforce and those 45 and older are increasing. Both male and female resident workers have declined as a percentage of Wyoming's workforce despite population growth (see Figure 2), but it appears women have been most impacted by the in-migration of nonresident workers. Table 9 summarizes the distribution of nonresident workers by county. Counties that rely heavily on nonresident workers are Campbell, Crook, Park, Sublette, Teton, Uinta, and Weston where industries such as natural resources & mining and leisure & hospitality are predominant.

Discussion

Employers with Fewer than 50 Workers

Small businesses with fewer than 50 workers comprise the majority (96%) of employers in the state. Hence, most Wyoming businesses will not be directly impacted by employer-sponsored health insurance provisions. There are two choices available for this employer size; either voluntarily provide health insurance to receive tax credits or place the responsibility on the workforce to purchase individual insurance through exchanges or if qualified, enroll in the state's expanded Medicaid program.

A recent initiative sponsored by the Robert Wood Johnson Foundation called Buying Value (http://www.buyingvalue.org/) "seeks to achieve better care and lower health costs for the people it represents by replacing the current volume-based purchasing model in health care with one based on quality and patient safety." Efforts like these could be key for sparsely populated states like Wyoming and help attract small employers by helping them purchase insurance for their employees, ensuring a well-populated state exchange that has the ability to thrive (Krueger, Alexander, 2011).

Employers with 50 to 99 Workers

The PPACA will likely rearrange incentives to support certain activities and strategies for firms that employ between 50 to 99 workers. Even though the 2011 Benefits Survey estimates 96% of firms that employ between 50 to 59 workers already offer health insurance, 2011 survey estimates reveal only 57.6% of those in construction and 34.6% of those employed in leisure & hospitality are offered employer-sponsored health insurance. Of the 140 firms employing between 50 to 59 employees, it is plausible that under current economic conditions, paired with the high cost of providing insurance, a modest number of jobs could be lost. Specifically, one would expect a higher probability of jobs in the 36 firms found in the construction and leisure & hospitality sectors to maintain a workforce with fewer than 50 employees to avoid penalties or the additional cost of offering health insurance. Labor market responses have documented employer reactions to offering insurance, and often there has been a false presumption of lower wages, when in fact the reaction by employers is to increase the number of working hours. Cutler and Madrian (1998) argued that health insurance costs are fixed, and as it becomes more expensive to provide, there is an employer incentive to increase hours thereby maintaining a smaller workforce. Other possible, but perhaps less likely scenarios include a shift in other benefits. For example, some employers may reduce life insurance or retirement offers to employees.

Businesses that employ between 50 and 99 workers, and in particular those with between 60 and 79 workers, may seek an advantage by dividing their company in half, applying for two separate UI accounts, and subsequently moving a portion of their employees to the new account. This could be construed as a form of what is called SUTA (State Unemployment Tax Act) dumping. The working definition of SUTA dumping involves a tax evasion scheme where shell companies are "formed and are creatively manipulated to obtain low UI tax rates" (California Employment Development Department, N.D.). When a new lower rate is obtained, payroll from the original entity with a high UI tax rate is shifted to the account with the lower rate. The entity with the higher rate is then "dumped." Related to the PPACA provision to provide coverage by firms with more than 50 workers, the actual "dumping" of the original tax entity would not occur. For example a firm with 70 employees could divide the entity into equal halves and employ 35 workers between two UI accounts, thus avoiding requirements of the law by manipulating the UI system to gain advantage from penalties. The potential gain for this strategy for companies employing 80 to 99 workers is assumed to be less than with firms with 60 to 79 workers, as it would hinder the ability for future growth.

Another potential concern for employers with 51-99 workers is that effective January 1, 2016, the small market group will be defined as 100 workers or less. This change may induce firms of this size to shift towards self-insurance prior to the change, resulting in risk separation and adverse selection against the small group market. The state should be cognizant of efforts to employ the use of loopholes to circumvent consumer protections and monitor movement into the self-insurance market; or alternatively explore proactively defining small business as up to 100 employees to align with the Federal definition prior to 2016. This will broaden the risk pool and protect against adverse selection in the small group market.

Employers with More than 100 Workers

Similar to the small employer group, businesses with more than 100 workers will face two choices: continue or start to offer employer-sponsored health insurance coverage, or pay a penalty to help cover the cost of their employees' individual coverage paid in part or whole by federal subsidies.

In 2011, it was estimated that 90.6% of employers with more than 100 workers offered health insurance. This size of employer will likely remain stable and continue to offer health benefits. The current market allows businesses to enter and exit the employer sponsored health insurance market without penalty. Therefore, it is counter-intuitive to expect that a large number of employers of this size will choose to pay penalties that offer no tax incentive or direct benefit to their employees. Health benefits are still viewed as highly attractive to job seekers and often are a driving factor in employee retention. Rather, employers currently offering benefits may explore cost containment strategies and ways to encourage employees to become healthier through the implementation of health promotion and wellness program efforts.

Speculative estimates have ranged from 1% to 10% of employers anticipating they will drop employer-sponsored health insurance. No consensus has been reached on how likely firms are to drop coverage, but based on literature related to the Massachusetts health reform initiative, a mass exodus from the health care market by employers seems unlikely. Because of a lack of consistent information, projections based on Wyoming employers will not be made.

Workforce

Because most employers in Wyoming will not be required under the PPACA to offer health insurance to employees, the burden to acquire coverage will be placed on the workforce. Data regarding low-income workers indicate men and women age 20-24 will most benefit from the PPACA by having the ability to obtain coverage through an expanded Medicaid program or through their parent's health insurance.

A review of 2011 wage earnings in Wyoming by age and industry reveals average annual wages for those age 25 to 64 to be well above 138% of the FPL of $10,890 ($10,890 * 138% = $15,028). The only group consistently near or below the 138% FPL threshold are women age 20-24. Kaiser State Health facts (2010) estimates 8% of Wyoming residents between the ages of 19 and 64 could become Medicaid eligible due to low income between 100% and 138% FPL. Tables 6 and 7 show that of 291,656 resident workers of all age groups (134,147 women, 157,509 men), there were 22,595 employees (14,562 women, 8,033 men) age 20-27 in various industries who were near or below the 138% FPL threshold. That number accounts for 7.7% of the workforce who would be income eligible under an expanded Medicaid program. However, that figure may be inflated because many 20- to 24-year-olds qualify for dependent coverage on their parent's health insurance. Further, some who are included in the 22,595 number will earn wages above the mean income listed disqualifying them from eligibility. However, many workers in other industries earn below-average wages for their industry of employment, possibly making them Medicaid eligible. Hence, the monetary impact of expansion may not be as severe as predicted and could even yield positive results. A recent study in the New England Journal of Medicine (Sommers, Baicker, Epstein, 2012) conceded that the effects of Medicaid on adult's health remains unclear, however the authors were able to show a decrease in mortality in states that had expanded their Medicaid program compared to states that had not. More specifically, Medicaid expansions were associated with significant reductions in adjusted all-cause mortality (by 19.6 deaths per 100,000 adults, for a relative reduction of 6.1%). Expansions increased Medicaid coverage, decreased rates of uninsured, decreased rates of delayed care because of costs, and increased rates of self-reported health status of "excellent" or "very good."

Another key factor is age. Wyoming's population is aging faster than the rest of the nation. In almost two decades, the state has seen dramatic decreases in those age 44 and younger and growth in residents 45 and older. This has important implications for Wyoming because Section 1201 of the PPACA allows insurers, including those in the individual and small group market, to vary rates based on family composition, geographic area, tobacco use, and age. This may directly cause higher premiums for older workers due to the age rating, and may also have an indirect impact because there will be fewer younger and healthier individuals to distribute the risk.

Lastly, the proportion of nonresident workers in the state has seen rapid growth and could present several challenges to health care delivery in the state. The primary reason for individual mandated coverage was to reduce costs across the entire population by broadening the risk pool by increasing the number of insured. However, those employed in industry sectors that have traditionally high rates of un-insured may be slow to obtain coverage. Nonresident, uninsured workers could drive up the cost of care received in Wyoming's hospitals and health care facilities.

Research, Propositions, and Hypothesis

Provisions of the PPACA will have substantial effects on Wyoming employers, workers, health care facilities, the state health department, and other state agencies and governing bodies. This analysis creates insight into further inquiry for planning and implementation purposes. R&P offers a wealth of information to inform data-driven solutions for PPACA implementation tailored to Wyoming's needs and unique challenges as a rural/frontier state. Emerging research questions, suggestions, and hypotheses for planning purposes may examine Medicaid expansion and state health exchanges, addressing workforce and employer needs, and surveillance efforts.

Medicaid Expansion and State Health Insurance Exchange

Further study should, in depth and scope, compare the percentage of workers who are unlikely to receive benefits from their employer by industry, firm size, gender, and wages. This information has tangible consequences for joint state/federal administered programs, and could be used to drive public-private partnerships to help cover more resident workers in the small group market. Other suggestions include:

-

Examine the feasibility of creating a statewide basic health program to reduce churn between Medicaid and exchanges (Hwang, Rosenbaum, Sommers, 2012) due to Wyoming's notable percentage of positions that are low-income earning, in small firms, with high turnover and short tenure that are occupied by nonresidents, youth, and women. In 2005 R&P, in conjunction with the Wyoming Health Care Commission, published an extensive study (Gallagher, Harris, Hiatt, Leonard, Saulcy, & Shinkle) titled "Private Sector Employee Access to Health Insurance and the Potential Wyo-Care Market." Although somewhat dated, this work is relevant to many of the key policy questions surrounding the creation of a state health insurance exchange and state health program efforts but should be updated.

-

Wyoming, like other rural states, may have issues adequately populating a state health exchange. Opportunities to collaborate with other states or gain policy flexibility could be examined. Alternatively, the state could explore ways to provide value-based coverage through an exchange that would enhance administrative efficiencies, and high-value based plans that are affordable could be explored (Kingsdale, 2012).

-

Conduct comprehensive analyses and modeling exercises to better understand the effects of merging the individual and small group markets and proactively expanding the definition of small business to 1 to 100 employees.

-

Rating enrollees based on health status is not allowable under the PPACA. However, consumers, especially in Wyoming given its small population and poor health status in some counties like Fremont and Carbon (http://www.countyhealthrankings.org/#app/), may experience higher-than-expected premiums, as a result of insurer risk segmentation. State regulators must ensure that the allowable geographic rating is not used as a proxy for health status. This could be addressed by passing more protective rating restrictions found at the federal level.

Addressing Workforce and Employer Needs

Conducting analysis and addressing the impact of nonresident workers on health care facilities and resources is an issue that should be investigated. Close to one-fifth of the state's workforce is supplied by nonresidents. Planning regarding the impact and the development of solutions to address the prospect of non-compliant uninsured nonresident workers and the out-migration of covered individuals to surrounding states on Wyoming health care facilities should take place. Data collection and analysis efforts should address:

-

Industries that utilize nonresident workers that have traditionally high uninsured rates, with less than 50 employees (i.e. construction). R&P has annual information by industry showing which sectors employ the most nonresident workers.

-

Industries (i.e. leisure & hospitality) and counties (Teton and Park) that employ temporary and or foreign workers in the U.S. on work visas.

Surveillance

There are numerous loopholes and ways to manipulate the law to "game" the system for advantages. Identification of legal ambiguity, active monitoring, and appropriate policy solutions should be enacted to curb practices like SUTA dumping and shifts towards self-insurance. R&P can monitor changes in unemployment insurance accounts.

Sarah Trimmer was a research intern at R&P for summer 2012. She is a master of public health candidate at Georgia State University.

References

Buchmueller, T. C., DiNardo, J., & Valetta, R. G. (2011). "The effect of an employer health insurance mandate on health insurance coverage and the demand for labor: Evidence from Hawaii." American Economic Journal-Economic Policy 3(4): 25-51.

California Development Department. (N.D.). SUTA dumping and unemployment insurance rate manipulation. Retrieved from: http://www.edd.ca.gov/payroll_taxes/SUTA_Dumping.htm

Cutler, D. M. & Madrian, B. C. (1998). "Labor market responses to rising health insurance costs: Evidence on hours worked." Rand Journal of Economics 29(3): 509-530.

Earnings in Wyoming, 1992-2011 by County, Industry, Age, & Gender. (2012). Wyoming Department of Workforce Services, Research & Planning. Average earnings by age and gender in all counties in 2011. Retrieved from http://doe.state.wy.us/LMI/earnings_tables/2012/

WR_Demographics2011/County/by_county476.html

Gabel, J. R., & Whitmore, H. (2008). "Report from Massachusetts: Employers largely support health care reform, and few signs of crowd-out appear." Health Affairs 27(1): W13-W23.

Gallagher, T., Harris, M., Hiatt, M., Leonard, D., Saulcy, S., & Shinkle, K. (2005). Private sector employee access to health insurance and the potential Wyo-Care market. Wyoming Department of Employment, Research & Planning. Retrieved from http://doe.state.wy.us/LMI/HCCFinal.htm

Hall, M. A., & Swartz, K. (2012). Establishing health insurance exchanges: Three states' progress. Washington, D.C., The Commonwealth Fund.

Health and Human Services Poverty Guidelines. (2011). Retrieved from: http://aspe.hhs.gov/poverty/11poverty.shtml

H.R. 3590—111th Congress: Patient Protection and Affordable Care Act. (2009). In GovTrack.us (database of federal legislation). Retrieved September 18, 2012, from http://www.govtrack.us/congress/bills/111/hr3590

Hwang, A., Rosenbaum, S., & Sommers, B. D. (2012). Creation of state basic health programs would lead to 4 percent fewer people churning between Medicaid and exchanges. Health Affairs 31(6): 1314-1320.

Kaiser Family Foundation. (2010). State Health Facts. Retrieved from: http://www.statehealthfacts.org/comparetable.jsp?typ=1&ind=130&cat=3&sub=39#

Kingsdale, J. (2012). "How small-business health exchanges can offer value to their future customers – and why they must." Health Affairs 31(2): 275-283.

Krueger, K., & Alexander, A. (2011). Microsimulated Impacts of the Patient Protection and Affordable Care Act on Wyoming. [White Paper].

Leonard, D. W., & Saulcy, S. (2012). Wyoming Benefits Survey, 2011. In M. Moore & P. Ellsworth (Eds.). Casper, WY: Wyoming Department of Workforce Services, Research & Planning. Retrieved September 19, 2012, from http://doe.state.wy.us/LMI/benefits2011/benefits_2011.pdf

Long, S. K., Stockley, K., & Dahlen H. (2012). Massachusetts health reforms: Uninsurance remains low, Self-Reported health status improves as state prepares to tackle costs. Health Affairs 31(2): 444-451.

Moore, M., & Glover, T. (2012). A decade later: Tracking Wyoming's youth in to the labor force. In D. Bullard, V. A. Davis, P. Ellsworth, & M. Moore (Eds.). Casper, WY: Wyoming Department of Workforce Services. Retrieved September 19, 2012, from http://doe.state.wy.us/LMI/w_r_research/A_Decade_Later.pdf

Sentell, T. (2012). Implications for reform: Survey of California adults suggest low health literacy predicts likelihood of being uninsured. Health Affairs 31(5): 1039-1048.

Sinaiko, A. D. (2004). Employers' responses to a play-or-pay mandate: An analysis of California's Health Insurance Act of 2003. Health Affairs 23(6): W4469-W4479.

Sommers, B. D., Baicker, K., & Epstein, A. M. (2012). Mortality and access to care among adults after state Medicaid expansions. New England Journal of Medicine. On-line special article.

U.S. Census Bureau. Current Population Survey, 2008 to 2010. Annual social and economic supplements. Three-year-average median household income by state: 2008-2010 and two-year-average median household income by state: 2009 to 2010. Retrieved from http://www.census.gov/hhes/www/income/data/statemedian/index.html

U.S. Department of Health and Human Services. (2012, February 2). In The 2011 HHS poverty guidelines: One version of the [U.S.] federal poverty measure. Retrieved September 19, 2012, from http://aspe.hhs.gov/poverty/11poverty.shtml

1Data for QCEW come from UI-covered employment records. Approximately 91% of employment is covered by unemployment insurance in Wyoming, making it a near-census of employment in the states (U.S. Bureau of Economic Analysis, 2011). Among the types of firms excluded are railroads and some agriculture operations. For a complete list of businesses excluded from coverage, go to the Technical Appendix of "Wyoming 2000 Annual Covered Employment and Wages" at http://doe.state.wy.us/LMI/00202pub/tech_app.htm.