A History of the Minimum Wage in Wyoming and the U.S.

This article examines the history of the minimum wage at the federal and state levels and includes the changes that have taken place over recent years.

The federal minimum wage was first established in 1938 when President Franklin D. Roosevelt signed into law the Fair Labor Standards Act (FLSA), which introduced regulations to protect American workers and created a mandatory federal minimum wage of 25 cents per hour (U.S. Department of Labor, n.d.).

During his 2014 State of the Union address, President Barack Obama asked Congress to increase the minimum wage from $7.25 to $10.10 per hour. He also promised to raise the minimum wage for federal workers to $10.10 via executive order, which was signed by the president on February 12, 2014. The president previously called on Congress to raise the federal minimum wage to $9.00 per hour in his 2013 State of the Union address.

The federal minimum wage was $5.15 per hour from 1998 to 2007. On May 25, 2007, President George W. Bush signed into law the Fair Minimum Wage Act of 2007, an amendment to the Fair Labor Standards Act of 1938. This act raised the federal minimum wage from $5.15 per hour to $7.25 per hour in three increments from 2007 to 2009 (Fair Minimum Wage Act of 2007, 2011).

Changes at the State and County Level

When the federal minimum wage is higher than the state minimum wage, the federal minimum wage applies to most workers, which is the case in 21 states. When the state minimum wage is greater than the federal minimum wage, the state minimum wage is used.

|

Table 1 shows that out of the 45 states that have a minimum wage requirement, four of the states (Arkansas, Georgia, Minnesota, and Wyoming) have a minimum wage set below the federal level. Washington, D.C. and 21 other states have a minimum wage set higher than the federal minimum wage. Effective as of January 1, 2014, 20 states have a minimum wage rate that is the same as the federal minimum wage rate. There are five states (Alabama, Louisiana, Mississippi, South Carolina, and Tennessee) that do not have a minimum wage rate requirement so the federal minimum wage of $7.25 per hour applies to most workers.

The state of Washington increased its minimum wage from $9.19 to $9.32 per hour as of January 1, 2014, remaining the state with the highest minimum wage. Oregon has the second highest minimum wage at $9.10 per hour, an increase from $8.95. All other states have a minimum wage under $9.00 per hour for 2014. Wyoming and Georgia have the lowest minimum wage set at $5.15 per hour. The next lowest is Minnesota at $6.15 per hour.

In 2014, 10 states (Arizona, Colorado, Florida, Missouri, Montana, Nevada, Ohio, Oregon, Vermont, and Washington) have a minimum wage that is tied to the consumer price index, and the minimum wages in these states are normally increased each year. Nine of these states increased their minimum wage as of January 1, 2014, with the exception of Nevada, which is adjusted in July of each year.

The federal government has no plan to index the federal minimum wage to inflation as it is in the 10 states mentioned above; the federal minimum wage is a subject of debate among Congress and the president. Adjusted for inflation, the federal minimum wage was highest at $1.60 in 1968; that amount would equal $10.95 in 2014. The U.S. Bureau of Labor Statistics consumer price index inflation calculator can be found at http://www.bls.gov/data/inflation_calculator.htm.

In some states, including Wyoming, the minimum wage rates are controlled by the state legislature. During Wyoming’s 2014 legislative session, a bill was introduced that would have raised the state’s minimum wage from $5.15 to $9.00 per hour and raised the base pay for tipped employees from $2.13 to $5.00 per hour. The bill failed an introductory vote in the House of Representatives, 51-9.

Wyoming was not the only state where legislators recently looked into increasing the minimum wage. Connecticut, New Jersey, New York, and Rhode Island passed legislation in 2013 raising minimum wages.

On January 1, 2014, Connecticut’s state minimum wage increased from $8.25 to $8.70 per hour (Jamieson, 2013). New Jersey’s state minimum wage increased from $7.25 to $8.25 per hour for non-tipped employees. Employers who are subject to the FLSA must also pay $2.13 per hour for tipped employees. Rhode Island’s state minimum wage increased from $7.75 to $8.00 per hour. All increases were made on January 1, 2014. On December 31, 2013, the New York state minimum wage rose to $8.00 per hour from $7.25, one of three planned wage increases. California Gov. Jerry Brown also signed legislation to raise the state’s minimum wage to $10.00 by 2016; the first increase to $9.00 per hour was in 2014.

San Francisco was one of the few cities and counties to raise its minimum wage as well, which will increase from $10.55 to $10.74. San Francisco had the highest municipal minimum wage in the country, until voters in the city of SeaTac, WA, approved an increase in the minimum rate from $9.19 to $15.00 for an estimated 6,000 hospitality and transportation workers. The SeaTac minimum wage went into effect on January 1, 2014. Albuquerque, NM, raised its minimum wage from $8.50 to $8.60, and the minimum wage in Bernalillo County, NM, rose from $8.00 to $8.50. The minimum wage in San Jose, CA, also increased from $10.00 to $10.15 per hour.

Wyoming’s Minimum Wage

The minimum wage of $5.15 is the lowest hourly wage that an employee working in Wyoming can legally be paid (U.S. Department of Labor, 2014). Certain occupations and employees are exempt from Wyoming and federal minimum wage regulations, including tipped workers, students in high school and college, and certain disabled workers (with a certificate from the Wyoming Department of Labor).

Under Title 27 of the Wyoming Statutes, the Legislature enacted laws that non-exempt employees are entitled to a minimum wage of not less than $5.15 per hour (Wyo. Stat. § 27-4-201, n.d.). Title 27 was changed in April 2001 and since then Wyoming has not experienced a raise in the minimum wage.

The statute states that employees specifically exempt from the Wyoming state minimum wage include:

- Any individual employed in agriculture;

- Any individual employed in domestic service;

- Any individual employed in a bona fide executive, administrative, or professional capacity;

- Any individual employed by the United States, or by the state or any political subdivision thereof;

- Any individual engaged in the activities of an educational, charitable, religious, or nonprofit organization where the employer/employee relationship does not in fact exist or where the services rendered to such organizations are on a voluntary basis;

- All employees under twenty (20) years of age may be paid $4.25 per hour for the first 90 consecutive days of employment. Thereafter they must be paid the prescribed minimum of $5.15 per hour;

- Any individual employed as an outside salesperson whose compensation is solely commission on sales; and

- Any individual whose employment is driving an ambulance or other vehicle from time to time as necessity requires but who is on call at any time.

Tipped employees by law are required to receive $2.13 as a base pay. Wyoming law defines a tipped employee as one who customarily and regularly receives $30 a month or more in tips. The employer is allowed to consider tips as part of wages. In no event can the employer pay less than $2.13 per hour to tipped employees. If $2.13 is paid, tips must bring such employees’ wages up to an average of $5.15 per hour. If not, the employer shall pay the difference to the tipped employee.

According to the statute, “Any tips that an employee or employees receive are the sole property of the employee or employees, and are not payable in whole or in part to the employer or any other person. An employer may obtain voluntary agreements from employees to engage in tip pooling.”

|

|

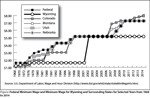

Table 2 shows the minimum wage for Wyoming, four of the surrounding states, and the federal level for select years from 1968 to 2014. Wyoming’s state minimum wage stayed at $1.60 for 13 years before being raised to $5.15 in 2002, which at that time was the same as the federal minimum wage (see the Figure). Wyoming’s minimum wage has stayed at $5.15 since. Four of the surrounding states have a higher minimum wage than Wyoming. Two of these states, Colorado ($8.00) and Montana ($7.90), both have minimum wages higher than the federal minimum wage and are among the 10 states that have minimum wages linked to a consumer price index and have steadily increased since 2007. The four surrounding states raised their minimum wages to the federal level of $5.15 in 1998; Wyoming stayed at $1.60 until 2002.

Minimum Wage and Poverty

A worker receiving the federal minimum wage of $7.25 per hour, working 40 hours a week, 52 weeks a year, will earn $58.00 per day, $290.00 per week, or $15,080.00 per year before taxes (U.S. Department of Health and Human Services, 2014). The Department of Health and Human Services has set the 2014 national poverty guideline for a family unit consisting of two people at $15,730.00 per year.

References

Fair Minimum Wage Act of 2007, 29 U.S.C. §§ 8101-8014 (2011).

Jamieson, D. (2013, December 23). 13 states will raise their minimum wage for the new year. In Huffington Post. Retrieved July 30, 2014, from http://www.huffingtonpost.com/2013/12/23/raise-minimum-wage_n_4493673.html

U.S. Department of Health and Human Services. (2014). 2014 Poverty Guidelines. Retrieved April 16, 2014, from http://aspe.hhs.gov/POVERTY/14poverty.cfm

U.S. Department of Labor, Wage and Hour Division. (2014). Minimum wage laws in the states - January 1, 2014. Retrieved July 30, 2014, from http://www.dol.gov/whd/minwage/america.htm#Wyoming

U.S. Department of Labor, Wage and Hour Division. (n.d.). Wages and the Fair Labor Standards Act (FLSA). Retrieved July 30, 2014, from http://www.dol.gov/whd/flsa/index.htm

Wyo. Stat. § 27-4-201. (n.d.). Retrieved April 16, 2014, from http://legisweb.state.wy.us/statutes/titles/Title27/T27CH4AR2.htm