Unemployment Insurance Benefit Payments Show Recovery Slowed in 2013

The number of total Unemployment Insurance (UI) benefits expenses and UI recipients decreased in 2013 from the previous year, but the reductions in percentages were much smaller than in the previous two years. Both of these UI statistics were still at least twice their pre-downturn averages from 1997 to 2007.

After the most recent economic downturn that lasted from first quarter 2009 (2009Q1) to first quarter 2010 (2010Q1), Wyoming’s UI covered employment showed a consecutive 12-quarter increase from 2010Q4 to 2013Q3 (the most recent available data via the Quarterly Census of Employment and Wages) — slow but steady growth. The over-the-year quarterly growth of employment in 2013 averaged only 0.3%, much flatter than 2012’s average growth rate of 1.4%. Wyoming’s unemployment rate by the end of the year dropped to 4.4% from 4.9% a year earlier. This article examines some of the unemployment insurance statistics for a better understanding of Wyoming’s economy.

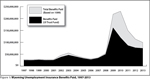

Statewide UI Benefit Expenses

In 2013, the Wyoming Department of Workforce Services, UI Division, paid a total of $99.6 million in UI benefits to unemployed workers. This is a 12.5% decrease from the previous year’s level ($113.8 million), but more than triple the average in pre-downturn years ($30.3 million), and the fifth highest since 1997 (when comparable data were first available; see Figure 1). Among the total benefits paid, nearly one-fourth (24.5%) were paid by the federal Emergency Unemployment Compensation (EUC) funds and other reimbursable UI programs (such as the Federal UI program that provides benefits to federal employees). The other three-fourths (75.5%, or $75.1 million) were from the state UI trust fund and paid to Wyoming-liable claimants as regular UI benefits. Regular UI benefit expenses only decreased by 3.0% from 2012’s level ($77.5 million), much smaller than the past three years (-25.7% in 2010, -27.6% in 2011, and -10.7% in 2012). The annual average UI benefits paid from the state UI Trust Fund for the pre-downturn normal years was $27.7 million. In sum, Wyoming’s UI program has experienced a continued reduction in UI benefit expenses from 2010 to 2013. However, the speed of the recovery was slower in 2013, and the benefit expenses level was still much higher than the pre-downturn average.

Industry Distribution of UI Benefit Expenses

Nearly one-third (30.1% or $30.01 million, see Figure 2 and Table 1) of the total UI benefits in 2013 were paid to those who worked in the construction industry. Those from the accommodation & food services industry collected 9.8% or $9.6 million, followed by those from the mining industry with 8.5% or $8.4 million. In comparison with 2012, in which all industries except mining experienced double-digit decreases in UI benefit expenses from the previous year, 11 of 21 industries had double-digit decreases in 2013. Of the other industries, two increased UI benefit expenses in 2013, six decreased less than 5%, and two decreased less than 10%. This mixed picture indicates that Wyoming industries were facing different economic changes in 2013.

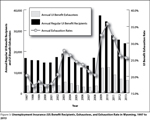

UI Benefit Recipients and Exhaustees

Figure 3 shows the historical trends of Wyoming UI benefit recipients, exhaustees, and exhaustion rates from 1997 to 2013. Statewide, a total of 23,854 unemployed workers received UI benefits in 2013, down 6.9% from the previous year’s level (25,617 recipients in 2012). This also marked four years of continued decreases since the peak year of 2009 in which 37,251 unemployed workers received UI benefits. This indicates that the state’s economy has been gradually improving with fewer layoffs each year. There were also fewer UI recipients who exhausted their eligible regular UI benefits: a total of 6,098 UI exhaustees in 2013 compared with 6,725 exhaustees in 2012, a 9.3% decrease.

Compared with the pre-downturn normal years’ annual average (14,927 UI recipients and 2,984 exhaustees), 2013’s data was still 59.8% higher than the normal UI recipients’ level and more than double the normal level of exhaustees.

Out-of state UI recipients made up nearly one fourth (23.6%) of the total UI recipients in Wyoming in 2013 (see Figure 4). Laramie, Natrona, and Fremont were the top three counties with the largest share of UI recipients, with 11.9%, 11.4%, and 6.5%, respectively. Six counties had more UI recipients in 2013 than in 2012, while in 2012, only one experienced an increase. The other 11 counties continued to have fewer UI recipients than in the previous year.

The exhaustion rate is the number of exhaustees divided by the number of UI recipients in the year. It indicates the difficulty unemployed workers face in finding new jobs and usually is higher during economic downturns. The statewide UI exhaustion rate dropped to 25.6% in 2013 from 26.3% in 2012. It was 35.8% in 2010, the highest since 1997. The pre-downturn normal year average was 20%.

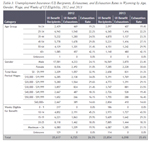

Six industries in the state sent the same number or more unemployed workers to collect UI benefits in 2013 than in 2012 (see Table 2) while all other industries experienced a decline in UI recipients. The nonclassified group had the largest increase, 55.8%, followed by other services (14.8%), public administration (10.5%), and manufacturing (9.1%). Utilities and management of companies & enterprises had the same number of recipients as they had a year earlier.

In 2012, every industry showed a decrease in the UI benefit exhaustion rate compared with the previous year, but in 2013, nine industries showed an increase. This might indicate that the re-employment opportunities in 2013 in some industries had no improvement or were somewhat worse than in 2012.

Agriculture had the highest exhaustion rate (34.7%) in 2013, followed by educational services (34.4%), nonclassified (34.4%), and information (34.1%). A little more than one-third of the unemployed workers from these four industries had exhausted UI benefits before getting re-employed. The high exhaustion rates for some industries such as agriculture and educational services may have been directly related with industry seasonality. Utilities had the lowest exhaustion rate (17.9%).

Table 3 shows demographic data on UI recipients and the relationship with UI exhaustion rates. For example, the data show that the older the worker, the higher the exhaustion rate, which indicates that, in general, older unemployed workers had more difficulty finding re-employment than younger individuals in Wyoming. Females were more likely to exhaust their UI benefits than were males. The table also shows that the higher wages an individual made before layoff, the lower the UI exhaustion rate. A higher pre-layoff wage would also make an individual qualify for more weeks of UI benefits. As a result, more weeks of eligibility for UI benefits were also linked with a lower exhaustion rate. The only exception was the group with fewest weeks (0 to 9 weeks) of eligible UI benefits, which showed an exhaustion rate of zero. Individuals in this group may have had much higher pressure to find jobs quickly and could have been willing to take any jobs they could get.

In sum, statewide UI benefit expenses and the number of UI recipients decreased in 2013, which indicate that fewer layoffs happened statewide compared with the previous year, and that Wyoming’s economy continues to improve from the most recent downturn. However, the speed of the recovery slowed in 2013 compared with 2012. This is consistent with the UI-covered employment trend, which had much flatter growth in 2013 than a year before. Some industries even sent more unemployed workers to collect UI benefits in 2013 than in 2012. The level of UI benefit expenses and the number of UI recipients were still much higher than the average in the pre-downturn years of 1997 to 2007.

Current and historical data from Wyoming’s UI claims, benefits paid, tax revenue, and UI Trust Fund balance can be found online at http://doe.state.wy.us/LMI/ui.htm.

Principal Economist Sherry Wen can be contacted at (307) 473-3812 or sherry.wen@wyo.gov.