Do Claimants Stay on Workers' Compensation Longer During Tough Economic Times?

See related Tables and Figures

The research presented in this article tests the hypothesis from the Research & Planning (R&P) section of the Wyoming Department of Workforce Services that participants in the workers' compensation system may have incentives to prolong the duration of workers' compensation longer in a sluggish economy than during times of economic expansion.

Several studies conducted since the recent Great Recession have analyzed the effect of providing additional weeks of unemployment insurance (UI) eligibility. Researchers attempted to identify the effect of extended benefits on two outcomes:

- Do workers stay on unemployment longer because the duration of payments is increased, and

- Do workers stay on unemployment because there is no employment available?

Mazumder (2011) found that the extension of unemployment insurance benefits during the recent economic downturn can account for a roughly 1 percentage point increase in the unemployment rate, with a preferred estimate of 0.8 percentage points. Mazumder added, "this effect is also likely to be reversed over the coming years, as the extensions are removed in response to an improving labor market."

The Research & Planning (R&P) section of the Wyoming Department of Workforce Services found that re-employment rates in Wyoming decreased during the state's economic downturn in 2009 (Leonard, 2010). The re-employment for men fell from 77.2% in 2005 to 57.8% in 2009, suggesting that male workers had difficulty finding re-employment.

The research presented in this article by R&P considers a similar issue with the workers' compensation program and tests the hypothesis that claimants stay on workers' compensation longer in a sluggish economy than during times of economic expansion. This discussion primarily focuses on the incentives of workers' compensation claimants; other factors influencing the duration and cost of workers' compensation claims will be discussed in a later article.

Unlike the duration of participation in the unemployment compensation program, under which the federal government provided additional emergency benefits during the economic downturn, workers' compensation duration is independent of economic conditions. The maximum duration of eligibility for the various types of workers' compensation benefits changes very rarely. Therefore, the maximum duration of benefits is considered fixed for any given workers' compensation claim (although there are rare exceptions).

The research also considers whether the age of a worker during the time of injury influences the duration of the claims. The null hypothesis is that age at the time of injury does not influence the duration of claims. Because of the advanced age of Wyoming's workforce (Liu, 2012, and Gallagher, 2011), this may have important policy implications regarding the cost of the program to employers, the workers' compensation fund, and the impact of lost wages on the workers.

Workers' Compensation Program Background

Workers' compensation programs were designed to provide benefits to injured workers while employers would face limited liability. Generally, payments to injured workers are structured so "that the total disability benefits paid are not a disincentive for recovery and return to work" (Clayton, 2003). Wyoming is one of four monopolistic states where employers can purchase insurance only through the state workers' compensation fund. There are also industry subsectors that are not required to carry workers' compensation insurance, such as food & beverage stores, telecommunications, and legal services.

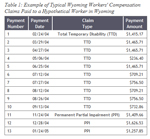

The overwhelming majority of workers' compensation claims are medical only claims, meaning there is no disability or impairment compensation paid on the claim (see Example 1). From first quarter 2004 (2004Q1) to second quarter 2010 (2010Q2), 81.7% of workers' compensation claims were medical only claims.

Example 1:

- Medical-Only Claims

- A worker gets a minor cut on a finger, receives medical attention, and misses no days of work.

Types of Claims

Only temporary total disability and temporary partial disability claims are examined in this article. The methodology used in this analysis can be found online here.

Temporary total disability (TTD) payments are made when injured individuals are totally unable to work, and they are generally paid two-thirds of their monthly salary. There are exceptions:

- Workers with higher than the statewide average wage can only receive a maximum of the statewide average wage. During 2012Q1, Wyoming's statewide average monthly wage was $3,549.

- Workers who make equal to or less than 30% of the statewide average wage receive 100% of their usual wage (Schuetz and Warton, 2012).

Workers are eligible for a maximum of 24 months of temporary total disability payments, although exceptions are made in some cases that may extend this limit up to 36 months.

Example 2:

- A Claimant's Pay

- An employee earns $1,000 per month before the accident, then comes back to work in a restricted capacity at $300 per month. Workers' compensation will pay 80% of the $700 difference.

Total monthly payment:

$300 + 0.8*$700 = $860.

Temporary partial disability (TPD) payments are made when an employee returns to light duty work at reduced wages. Workers' compensation will pay 80% of the difference between the pre-injury wage and the light duty wage (see Example 2).

Claimants are generally eligible for 24 months of temporary total disability, or a combination of temporary total disability and temporary partial disability payments; under certain circumstances, this eligibility can be increased to 36 months. If a claim only has total partial disability payments, then the worker is restricted to a maximum of 12 months of eligibility.

Workers' compensation payments are not taxed. Therefore, even if a worker is earning two-thirds of his usual salary, his actual take home pay will not drop by one-third. In some cases, a worker's take home pay may actually increase.

It is common for a claim to have both temporary total disability and temporary partial disability payments (see Table 1). For example, a worker may be on temporary total disability for several weeks after an accident and then return to work on light duty (temporary partial disability). After medical treatment and rehabilitation, the worker is able to return to work at his or her pre-accident level.

Incentives of Participants

The majority of workers will experience a decrease in wages while receiving workers' compensation disability payments. This provides an incentive to return to work as soon as workers are medically cleared to do so. Also, workers who are receiving workers' compensation payments may not be eligible for employer-sponsored benefits, such as health insurance; this also provides an incentive to return to work.

Higher-wage workers have a greater incentive to return to work as soon as possible because their loss of earnings during temporary total disability is proportionally greater than lower wage workers.

Conversely, those workers earning 30% or less of the statewide average wage have little financial incentive to return to work quickly. Their take-home pay may actually increase because workers' compensation payments are not taxed, and many workers in this wage range are not receiving any benefits from their employer.

The employer has an incentive to get the employee back to work in a limited capacity because the employer's insurance premium rate will not be affected. If an employee refuses a legitimate offer to return to work in a limited capacity, TTD payments will be reduced by two-thirds.

In Wyoming, there is no requirement that the employer must maintain a position for the worker to return to once the worker has recovered from the injury. The Family Medical Leave Act does require that the employer provide 12 weeks of job-protected leave (DOL, 2012). Therefore, workers of all salary ranges have an incentive to return to work as soon as possible if there is uncertainty regarding the worker's job security.

Claimants face several factors that affect their decision to return to employment, and the claimant may not have total control over these circumstances. For example, medical professionals certify whether a claimant receives disability payments, set and update the period in which disability payments are received, and decide when a claimant can return to work in limited or full capacity. The Workers' Compensation Division of the Wyoming Department of Workforce Services has the right to make a final determination on eligibility for TTD benefits.

Example 3:

- Claimants Returning to Work

- A worker is injured and is receiving temporary total disability payments. His employer informs him a month into his rehabilitation that there is no longer a position for him. If the employment outlook is poor, the worker may have an incentive to stay on workers' compensation as long as possible. However, if job opportunities are plentiful, there is more of an incentive to re-enter the job market quickly.

The claimant does have control over some factors, however. For example, a claimant may attempt to rehabilitate more or less vigorously depending on his motivation regarding returning to work (see Example 3).

Alternative explanations exist for an increase in the duration of workers' compensation claims, such as job availability, age, and severity of injury. Also, changes in statutes affecting compensation could adjust participants' incentives.

Doctors may have an incentive to keep workers in the workers' compensation program to maintain patient levels and revenue. Research of the Louisiana health care market by Bernacki and Xuguang (2008) concluded that workers' compensation claims managed by a particular statewide provider network were lower in cost and duration than providers not in that network. Bernacki and Xuguang found that after accounting for lost time, claims with attorney involvement exhibited "consistently higher medical, indemnity, and claims handling costs, as well as increasing claim duration." Butler, Hartwig, and Gardner (1997) found "that doctors in health maintenance organizations (HMOs) have a greater tendency to classify claims as compensable under workers' compensation than do other physicians."

Finally, workers' compensation insurance agencies (particularly in states that provide state-run workers' compensation programs) cannot quickly change the number of claim analysts in response to changes in initial claim requests, thereby affecting the time in which claims are expedited. Workers' compensation funds follow industry standards for processing claims in a timely manner.

Claims and the Economic Downturn

Wyoming entered into an economic downturn in November 2008, which lasted until December 2009. Total non-farm employment has not recovered since the end of this downturn. In October 2008 (the month before Wyoming's downturn began) total non-farm employment in Wyoming was 300,400. In February 2012, total non-farm employment was only 288,600, a 3.9% decrease.

The only industries that showed a substantial increase in employment were education and health services (U.S. Bureau of Labor Statistics, 2012). Therefore, while Wyoming's economic downturn has technically ended, employment prospects in the majority of industries have not returned to pre-downturn levels.

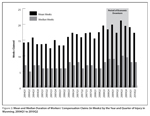

The average duration of claims (temporary total and temporary partial disability portion) across all industries from November 2008 to December 2009 was 16.2 weeks and the median duration was 7.0 weeks (see Figure 1). The mean and median duration of claims peaked during the period of economic downturn and subsequently began to drop, although not to pre-downturn levels (see Figure 2).

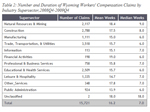

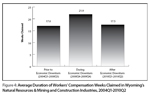

Table 2 displays the mean and median duration of workers' compensation claims by major industrial sector during the recent economic downturn. The financial activities, information, and unclassified sectors were excluded from this analysis because fewer than 200 cases were observed in these categories. The natural resources & mining sector had the highest duration of claims (18.4 weeks), while public administration experienced the lowest duration (13.9 weeks).

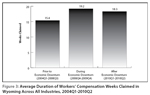

Figure 3 shows the mean duration of workers' compensation claims was significantly higher during the period of economic downturn (19.2 weeks) than during the period prior to the downturn (15.4 weeks). The duration of claims following the downturn (18.3 weeks) was not significantly different from the duration during the downturn. This is not surprising, given the large drop in employment opportunities during the downturn and in the post-downturn period to some extent. For example, since the end of Wyoming's economic downturn (January 2010) through February 2012, the state has lost 1,700 construction jobs.

Two industries that experienced major decreases in employment from October 2008 to February 2012 were construction (-38.9%) and natural resources & mining (-25.3%). These two sectors were combined for this portion of the analysis to provide at least 200 observations in each time interval. From 2004Q1 to 2008Q3, the average duration of claims in the natural resources & mining and construction industries was 17.0 weeks (see Figure 4). During the period of economic downturn, the average duration increased to 21.9 weeks, and then dropped back down to 17.5 weeks during the first two quarters of 2010.

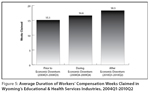

The only industry that did not show a significant increase in mean claims duration during the economic downturn was educational and health services (see Figure 5). This was the only major industry to experience steady gains in employment during Wyoming's economic downturn.

Age of Workers' Compensation Claimants

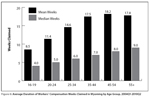

Another objective of this research was to examine the impact of a worker's age at the time of injury on mean claim duration. As anticipated, the mean duration of workers' compensation claims tended to increase with age (see Figure 6). Given the advanced age of Wyoming's workforce, these findings have implications for the workers' compensation fund (possible funding shortfalls), employers (higher workers' compensation rates), and employees (an increase in lost wages due to the longer duration of claims).

Future Research

R&P plans to follow this introductory paper with further analysis in order to examine the relationship between workers' tenure with an employer, or within the industry, on the frequency, duration, and cost of workers' compensation claims.

Future studies by R&P may examine whether an employee who files a workers' compensation claim is more or less likely to be retained. Future research may also compare the duration of claims for workers with multiple claims over their work history to the duration of claims for people with single claims.

References

Bernacki, E.J., and Xuguant (Grant), T. (2008). The relationship between attorney involvement, claim duration, and workers' compensation costs. Journal of Occupational & Environmental Medicine, 50(9). Pp. 1013-1018.

Butler, R.J., Hartwig, R.P., and Gardner, H. (1997). HMOs, moral hazard and cost shifting in workers' compensation. Journal of Health Economics, 16(2). Pp. 191-206.

Clayton, A. (2003/2004). Workers compensation: a background for social security professionals. Social Security Bulletin, 65(4).

Gallagher, T. (2011). How do we establish need? Pp. 13. Retrieved May 31, 2012, from http://doe.state.wy.us/LMI/presentations/Health_Care_Summit_06142011.pdf

Leonard, D. (2010). Tracking workers' re-employment after job loss. Wyoming Labor Force Trends, 47(11). Retrieved June 7, 2012, from http://doe.state.wy.us/LMI/1110/a1.htm

Liu, W. (2012). State of Wyoming Department of Administration and Information Economic Analysis Division. Summary of the 2010 Census for Wyoming. Retrieved May 4, 2012, from http://eadiv.state.wy.us/demog_data/pop2010/2010_Census_Summary.pdf

Mazumder, B. (2011, April). How did unemployment insurance extensions affect the unemployment rate in 2008-10? Chicago Fed Letter.

Schuetz, W., and Wharton, W. Workers' compensation analysts for the Wyoming Department of Workforce Services. Personal interviews. November 2011 to May 2012.

U.S. Bureau of Labor Statistics. Current Employment Statistics. Employment, Hours, and Earnings – State and Metro Area. Retrieved May 3, 2012, from http://bls.gov/data/

U.S. Department of Labor. Retrieved May 25, 2012, from http://www.dol.gov/whd/fmla/