Chapter 4: Initial Unemployment Insurance Claims Increase 22.9% in 2015

Full Article from March 2016 Trends

Wyoming’s unemployment insurance claims have historically been correlated to oil, gas, and coal prices. Low energy prices have persisted for more than a year, leading to questions about Wyoming’s economic future. This chapter describes the 2015 trends in unemployment insurance (UI) claims data and compares them to the previous downturn of 2009.

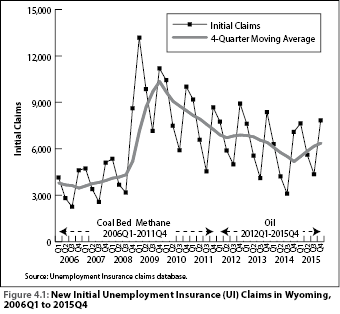

Over the last decade, Wyoming has experienced two periods of economic downturn: first quarter 2009 (2009Q1) to first quarter 2010 (2010Q1) and second quarter 2015 (2015Q2) to present. For the purposes of this article, a downturn is defined as “a period of at least two consecutive quarters when Wyoming experienced an over-the-year decrease in total wages, average monthly employment, and average weekly wage” (Moore, 2016). In this article, the term previous downturn refers to the period of 2009Q1 to 2010Q1, while the term most recent downturn refers to the period that began in 2015Q2.

|

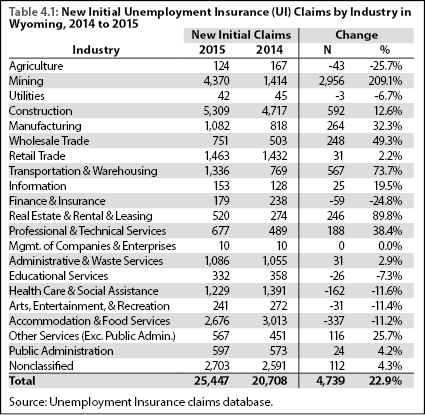

In 2015, Wyoming had 25,447 new initial unemployment insurance (UI) claims – an increase of 4,739 (22.9%) from 2014. New initial claims represent the number of workers who experienced job loss in 2015 and applied for UI benefits. As shown in Figure 4.1, the number of initial claims in Wyoming mostly decreased from prior-year levels from 2010Q1 to 2014Q4. During each quarter of 2015, the number of initial claims increased compared to the same quarter in 2014. However, the increase in claims in 2015 was much smaller than the increase that occurred in 2009. The decreased demand for natural resources and lower energy prices did not result in as many job losses in 2015 as in 2009.

From 2014 to 2015, 13 industries experienced an increase in new initial claims, while seven experienced a decrease. As shown in Table 4.1, the most substantial over-the-year increase was seen in the mining sector (2,956 more initial claims from 2014 to 2015, or 209.1%). The majority of new initial claims in mining were in oil & natural gas in both 2009 and 2015 (87.1% and 91.5%, respectively), with coal mining comprising 4.4% in 2009 and 2.7% in 2015. An article discussing UI claims in Wyoming’s mining sector can be found in the March 2016 issue of Wyoming Labor Force Trends.

Other industries that experienced significant increases in new initial claims from 2014 to 2015 included real estate & rental & leasing services (89.8%, or 246 more claims) and transportation & warehousing (73.7%, or 567 more claims). These two sectors may have been indirectly impacted by lower energy prices due to their relation to the mining sector.

Industries that experienced double-digit decreases in new initial claims from 2014 to 2015 included agriculture (-25.7%, or 43 fewer claims); finance & insurance (-24.8%, or 59 fewer claims); health care & social assistance (-11.6%, or 162 fewer claims); arts, entertainment, & recreation (-11.4%, or 31 fewer claims); and accommodation & food services (-11.2%, 337 fewer claims).

In conclusion, lower prices for crude oil, natural gas, and coal contributed to more job losses and a contraction of Wyoming’s economy in 2015 (Storrow, 2015). Current UI claims data indicate that the downturn from 2014 to 2015 was far less severe than the downturn from 2008 to 2009. However, it is uncertain whether these economic trends will continue, or whether they have hit their lowest point; this will be influenced by political changes and the international and domestic market supply and demand situation. Although UI claims have decreased over the last seven years, they have never returned to pre-2009 levels.

References

Moore, M. (2016). Employment and wage change for selected industries in Wyoming, 2005Q3-2015Q3. Wyoming Labor Force Trends, 53(1). Retrieved March 22, 2016, from http://doe.state.wy.us/LMI/trends/0116/a2.htm

Storrow, B. (2015, December 12). Wyoming one of four states with shrinking economy. Casper Star-Tribune. Retrieved March 22, 2016, from http://tinyurl.com/trib0316