Local Jobs and Payroll in Wyoming: Modest Improvement in Job Growth in Third Quarter 2013

The purpose of this article is to illustrate and describe employment and payroll changes between third quarter 2012 and third quarter 2013. These economic changes help gauge the overall strength of Wyoming’s economy and identify the fastest and slowest growing sectors and geographic areas.

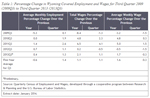

Total unemployment insurance (UI) covered payroll increased by $65.7 million (2.1%) in third quarter 2013. Employment rose by 1,269 jobs (0.4%) and average weekly wage increased by $14 (1.7%). In third quarter, employment grew faster than its five year average (0.4% compared to -0.6%), total wages grew faster than their five-year average (2.1% compared to 1.1%), and average weekly wage grew marginally faster than its five year average (1.7% compared to 1.6%; see Table 1). Job losses in the mining sector (including oil & gas; -729 jobs, or -2.7%; see Table 7, page 11) were much smaller than in second quarter (-1,469 jobs, or -5.3%) and overall job growth was slightly better than in second quarter. In terms of dollars, UI covered payroll represents approximately 91.5% of all wage and salary disbursements and 43.8% of personal income in the state (U.S. Bureau of Economic Analysis, 2013). Analysts have noted that “minerals related employment is one of the key predictors of sales and use tax revenue” in Wyoming (CREG 2010).

Despite the recent growth, overall employment remained approximately 8,450 jobs (2.9%) below its third quarter 2008 level. In short, the state has yet to make up all the job losses of 2009 and 2010.

Construction employment increased statewide (134 jobs, or 0.6%; see Table 7), in Natrona County (209 jobs, or 6.7%; see Table 5), and in Laramie County (690 jobs, or 22.6%; see Table 6).

The covered payroll and employment data in this article are tabulated by place of work, in contrast to the labor force estimates which are a measure of employed and unemployed persons by place of residence. Also, the employment data presented in this article represent a count of jobs, not persons. When individuals work more than one job, each job is counted separately. Finally, job growth (or decline) is stated in terms of net change. The Quarterly Turnover Statistics by Industry table presents alternative measures of job gains and losses using the same data sources and calculated to describe the components of change.

Figure 1 shows Wyoming wage & salary employment by covered/non-covered status. Approximately 92% of wage & salary jobs in the state are covered by state unemployment insurance, while 2.6% of jobs are covered by federal unemployment insurance, and 0.9% are covered by unemployment insurance administered by the railroad retirement board. There are several categories of non-covered jobs, and together they account for approximately 5% of wage & salary jobs in the state. Some examples of non-covered employment include elected officials, students working at educational institutions, employees of churches, and workers at small non-profit organizations.

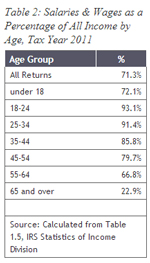

Some may wonder how important wage & salary income is to most households. The answer, of course, depends on a number of factors, such as age and income level. Young people, who have had less time to amass wealth, tend to be highly dependent on wages as a source of income. Table 2 shows that for 18-to 25-year-olds, salaries & wages made up 93.1% of total income. Older individuals, who may have retirement income as well as earnings from investments, etc., rely less on salaries & wages. For individuals over 65, only 22.9% of their income was from wages (Internal Revenue Service, 2014).

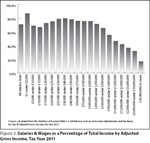

Households with incomes in the middle ranges tend to rely heavily on salaries & wages (see Figure 2). On average, only in the upper income ranges, where adjusted gross income exceeds $1 million, do salaries & wages make up less than half of total income. In 2011, median household income in the United States was $51,100 (U.S. Census Bureau, 2013). For a median household, salaries & wages accounted for 76.3% of total income.

The data in Table 2 and Figure 2 support the idea that wages & salaries are indeed the most important component of personal income for working age people, and for those in the middle of the income distribution.

Figure 3 shows that the level of job growth fell from 2.5% in first quarter 2012 to 0.2% in second quarter 2013, its slowest pace since third quarter 2010. Job growth rebounded very modestly in third quarter, increasing to 0.4%. Total payroll growth rose from 0.6% in second quarter to 2.1% in third quarter (see Table 3).

Employment

and Wages by County

Employment rose in 12 counties and fell in 11 counties (see Table 4). Total payroll increased in 21 counties and decreased in only two counties.

Teton County added 872 jobs (4.3%) and its total payroll rose by $7.5 million (4.0%). Job growth was seen in retail trade; construction; administrative & waste services; arts, entertainment, & recreation; and health care & social assistance.

Carbon County gained 222 jobs (3.1%) and its total payroll increased by $5.0 million (6.9%). Several sectors added jobs, including construction, health care & social assistance, transportation & warehousing, and accommodation & food services.

Employment rose by 213 jobs (6.6%) in Platte County and total payroll increased by $3.6 million (12.0%). The largest job gains were seen in construction, administrative & waste services, transportation & warehousing, and state government.

Sheridan County added 157 jobs (1.2%) and its total payroll rose by $2.5 million (2.1%). Job gains in construction, accommodation & food services, and retail trade were partially offset by job losses in mining (including oil & gas), other services, and health care & social assistance.

Park County lost 427 jobs (-2.7%), but its total payroll rose by $6.3 million (4.7%). Employment fell in retail trade, construction, federal government, health care & social assistance, and accommodation & food services.

Employment fell by 369 jobs (-1.3%) in Campbell County, but total payroll increased by $4.0 million (1.1%). The largest job losses occurred in coal mining (more than 400 jobs) and employment also fell in construction, other services, and administrative & waste services. Job gains were seen in accommodation & food services, local government (including public schools & hospitals), and manufacturing.

Sweetwater County saw its employment fall by 225 jobs (-0.9%), but its total payroll rose by $11.2 million (3.3%). Construction lost nearly 400 jobs and mining (including oil & gas) lost approximately 150 jobs. Employment increased in real estate & rental & leasing, management of companies & enterprises, and manufacturing.

Fremont County lost 187 jobs (-1.1%) and its total payroll was practically unchanged (+$264,691, or +0.2%). Job losses were seen in construction, local government (including public schools & colleges), and wholesale trade.

Employment fell by 182 jobs (-3.4%) in Sublette County, but total payroll increased by $2.1 million (2.9%). Job losses in mining (including oil & gas) and several other sectors were partially offset by job gains in construction.

Uinta County lost 160 jobs (-1.8%) and its total payroll fell by $1.6 million (-1.8%). Modest job losses were seen in many sectors, including construction, mining, health care & social assistance, information, and real estate & rental & leasing.

Table 5 shows that Natrona County gained 717 jobs (1.7%) and its total payroll rose by $11.8 million (2.4%). The largest job growth occurred in accommodation & food services (373 jobs, or 9.5%), construction (209 jobs, or 6.7%), health care & social assistance (166 jobs, or 3.0%), and wholesale trade (101 jobs, or 3.7%). Job losses were seen in other services (-285 jobs, or 13.3%) and manufacturing (-160 jobs, or -8.5%).

Laramie County added 1,583 jobs (3.6%), which was the largest increase of any county (see Table 6). Total payroll grew by $26.4 million (5.8%), also the largest increase in the state. Notable job gains were seen in construction (690 jobs, or 22.6%), retail trade (304 jobs, or 5.6%), professional & technical services (129 jobs, or 8.9%), and accommodation & food services (123 jobs, or 2.9%).

Statewide Employment and Wages by Industry

At the statewide level, the largest job gains occurred in accommodation & food services (621 jobs, or 1.8%), retail trade (497 jobs, or 1.6%), real estate & rental & leasing (282 jobs, or 6.7%), transportation & warehousing (276 jobs, or 2.9%), and health care & social assistance (241 jobs, or 1.0%; see Table 7). Employment decreased in mining (including oil & gas; -729 jobs, or -2.7%), other services (-489 jobs, or -5.5%), federal government (-145 jobs, or -1.8%), and information (-122 jobs, or -3.1%).

Accommodation & food services added 621 jobs (1.8%) and its total payroll rose by $5.4 million (3.4%). Food services & drinking places gained nearly 550 jobs, while accommodation gained more than 50 jobs.

Employment in retail trade rose by 497 jobs (1.6%) and its total payroll increased by $5.9 million (2.9%). The largest job gains were seen in building material & garden equipment & supplies dealers (approximately 300 jobs); food & beverage stores (approximately 250 jobs); and sporting goods, hobby, musical instrument & book stores (nearly 200 jobs). Employment fell in general merchandise stores (including warehouse clubs and supercenters; more than 250 jobs).

Real estate & rental & leasing gained 282 jobs (6.7%) and its total payroll increased by $3.1 million (6.9%). Employment in real estate rose by more than 50 jobs and employment in rental & leasing rose by more than 200 jobs.

Transportation & warehousing added 276 jobs (2.9%) and its total payroll increased by $5.9 million (5.2%). Job gains in truck transportation (nearly 200 jobs), support activities for transportation (more than 50 jobs), and warehousing & storage (more than 50 jobs) were partially offset by small job losses in air transportation and pipeline transportation.

Employment in health care & social assistance grew by 241 jobs (1.0%) and its total payroll rose by $4.3 million (1.9%). Ambulatory health care services added 178 jobs (1.9%) and social assistance added 133 jobs (2.0%). Job losses were seen in private hospitals (-56 jobs, or -1.8%) and nursing & residential care facilities (-14 jobs, or -0.3%).

The mining sector lost 729 jobs (-2.7%), but its total payroll rose by $3.7 million (0.7%). Coal mining lost more than 400 jobs and support activities for mining (including oil & gas well drilling) lost approximately 250 jobs.

Employment in other services fell by 489 jobs (-5.5%) and its total payroll decreased by $3.5 million (-4.5%). Job losses were seen in repair & maintenance services (more than 300 jobs) and private households (more than 150 jobs).

Federal government lost 145 jobs (-1.8%) and its total payroll fell by $1.0 million (-0.9%). Employment fell in administration of environmental quality programs.

The information sector lost 122 jobs (-3.1%) and its total payroll fell slightly (-$152,738, or -0.4%). Small employment decreases were seen in publishing industries, motion picture & sound recording industries, broadcasting, and telecommunications.

In summary, overall job growth increased very slightly from second quarter to third quarter (up from 0.2% to 0.4%). Job losses in mining (including oil & gas) slowed and strong growth continued in accommodation & food services and retail trade. Employment increased in approximately half of the state’s counties and fell in the other half.

References

Consensus Revenue Estimating Group (CREG; 2010, October) Wyoming state government revenue forecast fiscal year 2011-fiscal year 2016. Retrieved February 17, 2011 from http://eadiv.state.wy.us/creg/GreenCREG_Oct10.pdf

U.S. Bureau of Economic Analysis. (2013, January 16). SA04 State income and employment summary. Retrieved January 16, 2013, from http://www.bea.gov/iTable/iTable.cfm?ReqID=70&step=1&isuri=1&acrdn=4

U.S. Census Bureau (2013, September 17). “Income, Poverty and Health Insurance Coverage in the United States: 2012. Retrieved March 24, 2014 from https://www.census.gov/newsroom/releases/archives/income_wealth/cb13-165.html

U.S. Internal Revenue Service (2014) Statistics of Income, Table 1.5 All returns, sources of income, adjustments and tax items by age. Retrieved March 24, 2014 from http://www.irs.gov/file_source/pub/irs-soi/11in15ag.xls

U.S. Internal Revenue Service (2014) Statistics of Income, Table 1.4 All Returns: Sources of Income, Adjustments, and Tax Items, by Size of Adjusted Gross Income, Tax Year 2011 Retrieved March 24, 2014 from http://www.irs.gov/file_source/pub/irs-soi/11in14ar.xls