How Out-of-State Claimants Affect Wyoming’s Unemployment Rate

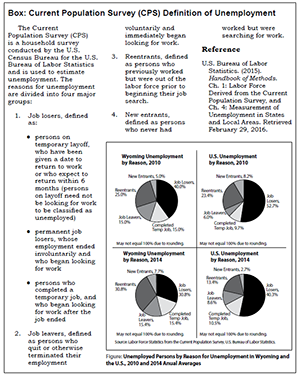

Box: CPS Definition of Unemployment

Related Article: What Does the State’s Unemployment Rate Really Mean?

With an economy heavily dependent on oil and gas, the spike in Unemployment Insurance (UI) claims in Wyoming was not unexpected when oil prices plunged in late 2014. Even with evidence of job losses across the state, especially in the mining industry, Wyoming’s unemployment rate remained steady between 4.0% and 4.2% without significant over-the-month changes from December 2014 to November 2015 (Bullard, 2016). This article looks at individuals all over the United States filing claims for UI benefits from a Wyoming employer and how they affect the unemployment rate.

According to Wyoming Statute 27-3-504, Unemployment Insurance (UI) benefits are awarded to eligible individuals based on the location of their former employer (UI claimants). An individual is eligible for unemployment insurance if he or she was involuntarily separated from an employer through no fault of the UI claimant. Individuals claiming UI must also meet monetary criteria, such as having earned sufficient wages in the first four of five calendar quarters prior to filing a claim (Wen, 2015). According to Wen, if every worker in Wyoming lost their job, about three-fourths would meet the monetary criteria needed to collect UI benefits. Wen also noted that 9.9% of all Wyoming workers are employed in the mining industry, the third largest private industry, and over 90% of these workers are eligible to claim unemployment insurance. In other words, if all workers from the mining industry (9.9% of total employment) lost their jobs, 90% — or more than 23,000 workers — would be eligible to collect UI benefits from an employer in Wyoming.

Unemployment Insurance claims are filed in the state where an individual earned wages. An out-of-state claimant is one who earned wages in Wyoming, filed for UI benefits against a Wyoming employer, but resided in another state. In this study, if a claimant filed for UI benefits in one state and then moved to another state, the claimant was counted in the state in which he or she resided during the earliest week of the month.

The Research & Planning (R&P) section of the Wyoming Department of Workforce Services publishes UI claims monthly in Wyoming Labor Force Trends and online at http://doe.state.wy.us/LMI/ui.htm. An initial claim takes place when an individual is separated from his or her job and files for unemployment (Harris, 2014). Continued claims are measured in total weeks claimed (Moore, 2015) and are more representative of the number of individuals who are collecting UI benefits than initial claims. If the individual is eligible to receive benefits, continued weeks claimed are counted.

This article, however, will focus on the persons, or unique claimants who have filed continued claims, with a special focus on claimants with a home address outside of Wyoming.

As previously mentioned, UI claims are counted based on location of employer. In contrast, the unemployment rate is estimated in the Local Area Unemployment Statistics (LAUS) program, which is based on the location of claimant residence, using interstate unemployment claims files given to states weekly by the U.S. Department of Labor (Bullard & Cowan, 2015). An individual who resides in Wyoming but loses a job in Colorado will count towards the Wyoming unemployment rate. For more information on LAUS, please see http://doe.state.wy.us/LMI/laus.htm and http://www.bls.gov/lau/.

|

Wyoming’s unemployment rate has remained well below the national unemployment rate and did not experience significant changes from December 2014 to December 2015, when it increased from 4.2% to 4.3% (Bullard, 2016; the unemployment news release can be found here). With the increase in UI claims indicating job losses, the unemployment rate would be expected to increase. But if a worker commutes to Wyoming to work and loses his job, he is not counted as unemployed in Wyoming. Approximately one-fourth of individuals claiming UI benefits in Wyoming are from another state and do not affect Wyoming’s unemployment rate. The types of unemployed, depicted in the Box and related article, reveal that job losers, and UI claimants as a subset of them, make up only a fraction of the unemployed.

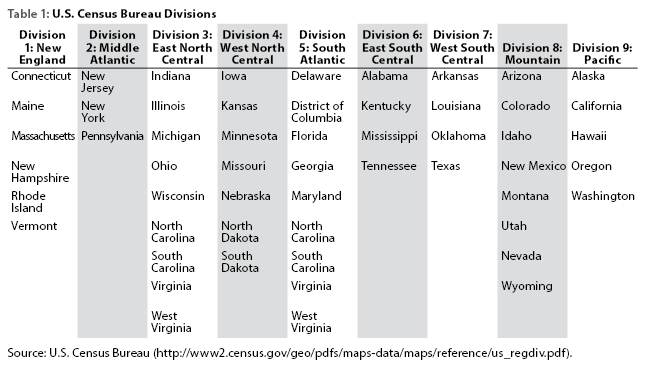

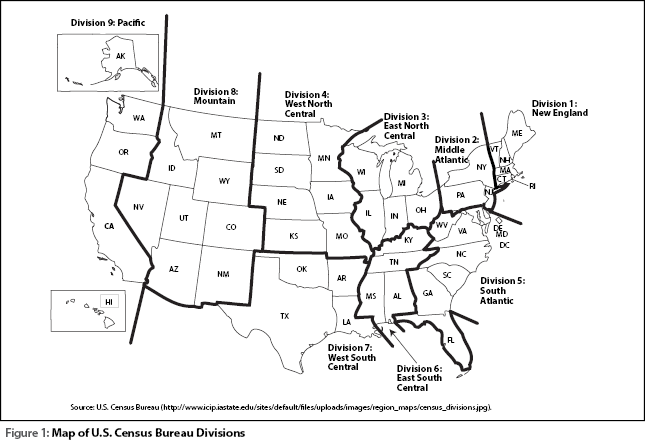

In this article, claims activity is organized using a multi-state, regional concept. The U.S. Census Bureau groups the states into nine different divisions (see Table 1 and Figure 1).

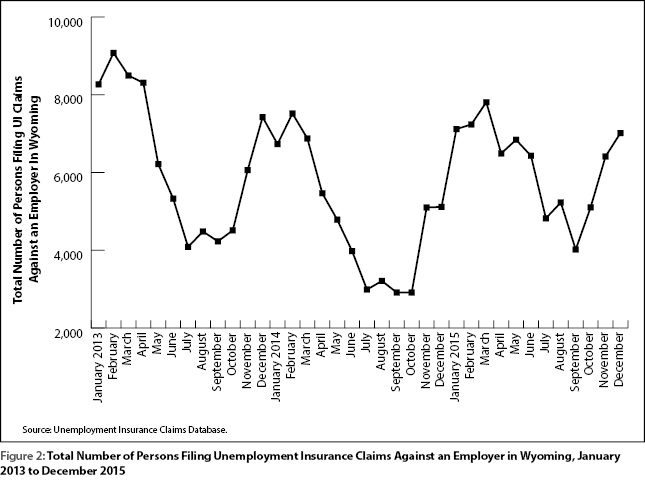

The number of persons claiming UI benefits against a Wyoming employer follows a seasonal pattern, with more individuals claiming in the winter and early spring months and fewer individuals claiming in the summer (see Figure 2). In 2013 and 2014, the number of claimants peaked in February, with 9,078 and 7,521 persons claiming, respectively. In 2015, the number of individuals claiming UI benefits increased in most months from the year before. The largest number of individuals filing for UI benefits in 2015 was 7,811 in March, a 13.5% increase from March 2014. The month with the fewest individuals claiming UI benefits was September, with 4,021 – a 37.9% increase from September 2014 (2,915; see Table 2a-2c).

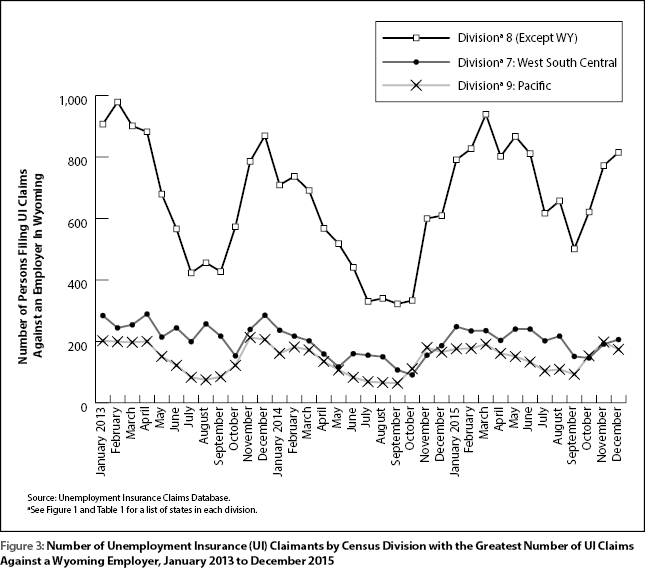

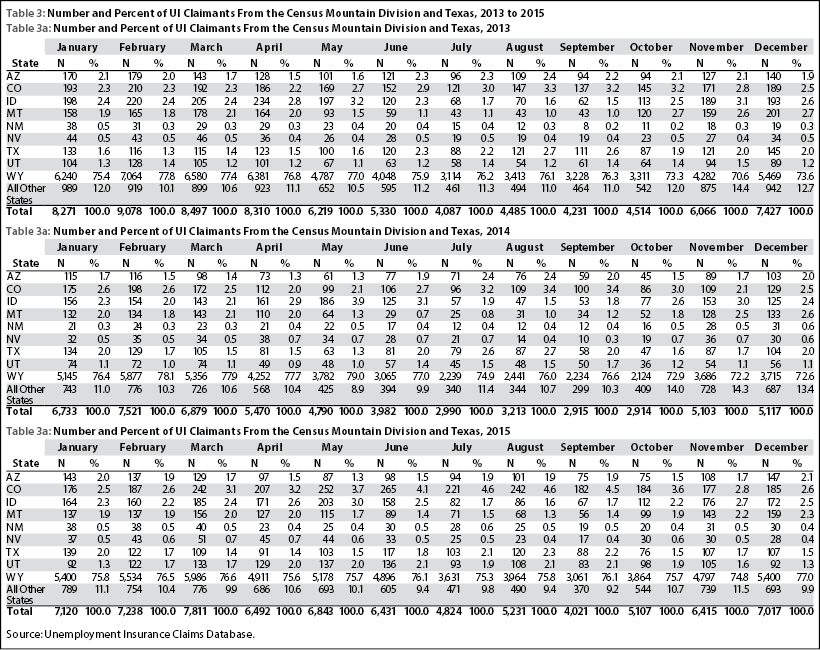

Figure 3 shows the number of claimants from three Census divisions with the largest number of claims against a Wyoming employer and how these numbers have changed over time. The Mountain Division (Division 8), the division to which Wyoming is assigned, made up about 88% of Wyoming UI claimants in 2015 (see Table 2a-2c). When eliminating Wyoming residents claiming UI benefits from this count, the states that make up Division 8 still contribute over 10% of persons claiming UI benefits. In every month during 2015, over 11% of UI claimants resided in the Mountain Division, but outside of Wyoming (see Table 2c). Five of the six states with the most individuals filing UI claims from a Wyoming employer are also included in the Mountain Division: Arizona, Colorado, Idaho, Montana, and Utah.

The number of claimants from the Mountain Division, excluding Wyoming, followed the same seasonal pattern as the total number of individuals filing for UI benefits in Wyoming and increased from 2014 to 2015. As shown in Tables 2a-2c, there were 901 unique out-of-state claimants that filed continued claims in March 2013, and 691 unique out-of-state claimants in March 2014. In March 2015, the number of unique out-of-state claimants increased 35.9% to 939; this was the month during which the largest number of individuals from the Mountain Division filed for UI benefits in 2015.

In September 2015 – the month with the fewest unique individuals claiming UI benefits against a Wyoming employer in 2015 – there were 501 unique claimants, a increase of 55.6% increase from 322 in September 2014.

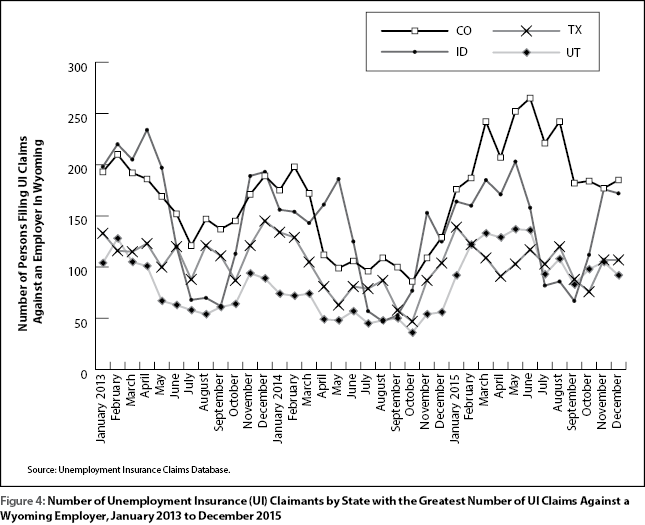

The four states with the largest number of residents claiming UI benefits against a Wyoming employer were Colorado, Idaho, Utah, and Texas; this is shown in Figure 4.

The largest number of unique out-of-state claimants came from Colorado. Since 2013, Colorado has contributed at least 2.0% of all UI claimants in Wyoming, with 242 claimants (4.6% of the total) in August 2015 (see Table 3a-3c). The number of Colorado residents claiming UI benefits against a Wyoming employer in 2015 peaked in June (265 claimants, an increase of 150.0% from 106 claimants in June 2014).

As shown in Table 3a-3c, individuals from Idaho filing for UI benefits against a Wyoming employer also made up a higher percentage of Wyoming UI claimants than most other states. The percentage of claimants residing in Idaho peaked in May and again in November every year since 2013. In May 2014, 186 (3.9%) out-of-state claimants were from Idaho and in November 2014, 153 (3.0%) claimants resided in Idaho. The number of individuals residing in Idaho claiming UI benefits against a Wyoming employer reached 203 claimants (3.0%) in May 2015 and 176 claimants (2.7%) in November 2015. This pattern could be due to individuals filing for unemployment benefits after their seasonal jobs in the northwestern region of Wyoming end when the tourist season is in decline.

Figure 4 also shows that the number of claimants from Utah fluctuated much less with the seasons compared to claimants from other states. The number of claimants from Utah increased from prior year levels in January 2015, a trend that continued throughout the year. The drop in oil prices and related layoffs in oil fields in southwestern Wyoming may have influenced this increase in the number of claimants from Utah.

Division 7, or the West South Central Division, includes Arkansas, Louisiana, Oklahoma, and Texas (see Table 1 and Figure 1) and had the second highest number of claimants in Wyoming. The West South Scentral Division accounted for 2.9% to 4.2% of persons claiming UI benefits against a Wyoming employer each month in 2015, the second highest of all Census divisions (see Table 2a-2c). In May 2015, 240 individuals from Division 7 filed a claim, a 105.1 % increase from May 2014. The high number of West South Central Division claimants in Wyoming may be due to the predominance of oil and gas in that division’s economy.

Approximately half of the individuals claiming from Division 7 resided in Texas, one of the six states with the largest number of persons claiming UI benefits against a Wyoming employer. The number of claimants from Texas increased 63.5%, from 63 claimants in May 2014 to 103 in May 2015 (see Table 3a-3c).

The division with the third highest number of out-of-state claimants was Division 9, or the Pacific Division (see Figure 3). This division includes Alaska, California, Hawaii, Oregon, and Washington. The Pacific Division made up at least 2.1% of all individuals claiming UI benefits against a Wyoming employer in 2015 (see Table 2c). During the summer months of 2015, the number of claimants increased by nearly 50% from the previous year.

Conclusion

Wyoming’s economy attracts workers from all over the country, especially from states that share a border with Wyoming and those states with economies that also depend on oil, coal, and gas. When workers migrate into Wyoming to work in the mining industry, they could also bring family members to work in other industry sectors. While it appears from UI claims that the number of unemployed individuals has increased significantly in the state, approximately one-fourth of those unemployed may have returned to their home state and do not affect the unemployment rate in Wyoming.

References

Bullard, D., & Cowan, C. (2015, April). Understanding how commuting flows and job losses in other states could affect Wyoming’s unemployment rate. Wyoming Labor Force Trends, 52(4). Retrieved February 12, 2016, from http://doe.state.wy.us/LMI/trends/0415/a2.htm

Bullard, D. (2016, January 26). Wyoming unemployment rate rises to 4.3% in December 2015. Wyoming Department of Workforce Services, Research & Planning. Retrieved February 12, 2016, from http://doe.state.wy.us/LMI/news.htm

Harris, P. (2014, November). Unemployment insurance (UI) claimant labor market behavior: Length of benefit collection and the likelihood of exiting the labor market. Wyoming Labor Force Trends, 51(11). Retrieved February 12, 2016, from http://doe.state.wy.us/LMI/trends/1114/a1.htm

Moore, M. (2015, July). Continued unemployment insurance claims increase in 2015. Wyoming Labor Force Trends, 52(7). Retrieved February 12, 2016, from http://doe.state.wy.us/LMI/trends/0715/a3.htm

Wen, S. (2015, September). Unemployment insurance benefits: what proportion of Wyoming workers would be eligible if they lost their jobs? Wyoming Labor Force Trends, 52(9). Retrieved February 12, 2016, from http://doe.state.wy.us/LMI/trends/0915/a1.htm

Wyo. Stat. Sec. 27-3-504. (n.d.). Retrieved October 26, 2015, from http://legisweb.state.wy.us/NXT/gateway.dll?f=templates&fn=default.htm