© Copyright 2007 by the Wyoming Department of Employment, Research & Planning

Vol. 43 No. 11

Among 15,245 Wyoming firms in the study, 8.8% (1,342 firms) were identified as having high seasonal labor demand, with at least a 50% labor demand reduction during their off-seasons. Based on their experience in 2005, these firms need about 12,659 seasonal workers annually. Finding and retaining labor for seasonal business needs is a challenge for Wyoming employers.

Because of current energy development and economic expansion, many Wyoming employers have found it increasingly difficult to find workers to meet their business needs. Research indicates that an increasing number of nonresident workers have come to the state to fill job openings the past several years (Jones, 2006). Despite the influx of nonresident workers, the labor shortage situation remains. Many firms have slowed their expansions and some have cut business hours (Casper Star-Tribune, 2006) because they were unable to fully staff their operations. Recruiting and retaining part-time, temporary, or seasonal workers has become a greater challenge to employers and local economic development agencies.

Understanding the labor demand situation among Wyoming firms would be helpful in the effort to maintain a well-functioning labor market. It also may help economic developers better understand which types of firms may be desirable for local economic goals and conditions. In this article we examine firms and variations in the seasonal demand for labor.

Methodology

Seasonality refers to the changing pattern of employment repeated every year. Nine quarters of Quarterly Census of Employment and Wages files, from third quarter 2003 (2003Q3) to third quarter 2005 (2005Q3), were combined to build a longitudinal study database. In order to be considered a firm with seasonal labor demand variation, the firm must have had the same seasonal behavior for two consecutive years. Additionally, our study only considered firms with at least a 50% labor demand reduction in off seasons.

Peak seasonal employment is the average of the two consecutive quarters with the highest employment during the year. Firms in different industries may exhibit completely different peak seasonal employment patterns during the year. For example, the second and third quarters of the year (the warmer months) may be the peak employment period for construction firms, but would be the off-season for ski resorts.

We defined two types of seasonal patterns for this study: Type One and Type Two. Type One seasonal patterns were defined as patterns exhibited by those firms that hired employees only for the same one or two quarters each year and had zero employment during the rest of the year. These firms depended entirely on seasonal workers during their peak seasons. Type Two seasonal patterns identified firms that had employment all year long but retained 50% or less of their peak-season employment levels for at least two quarters during the year. These firms relied heavily, but not entirely, on seasonal workers. Type One and Type Two seasonal patterns are collectively referred to as high seasonal labor demand variation.

A total of 20,064 firms were initially included in our study. We excluded all firms with zero employment for any four consecutive quarters during the selected nine quarters. Firms with public (i.e., government) ownership were also excluded. The final study was based on 15,245 active, privately owned firms.

To determine which jobs were seasonal, we subtracted the total jobs in the off season from the total jobs in the peak season for each firm. In reality, the number of seasonal jobs is not exactly the same as seasonal job holders because one job could be held by more than one person due to turnover, and one person also could hold multiple jobs. However, in order to provide an estimate, we assumed one job per person.

Results and Discussion:

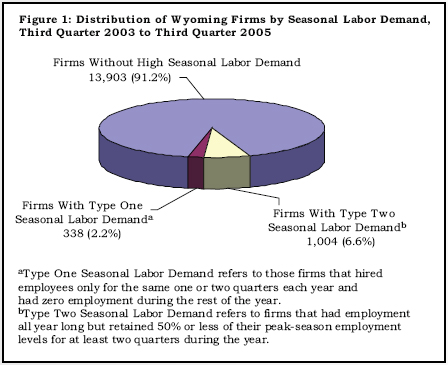

Of the 15,245 Wyoming firms included in the study, 1,342 (8.8%) were determined to have high seasonal labor demand. Among these, 338 Type One firms (25.1%) essentially closed with zero employment during their off-seasons, while 1,004 Type Two firms reduced their employment levels by 50% or more. Figure 1 shows the proportion of firms with Type One and Type Two seasonal labor demand compared to firms that do not have high seasonal labor demand.

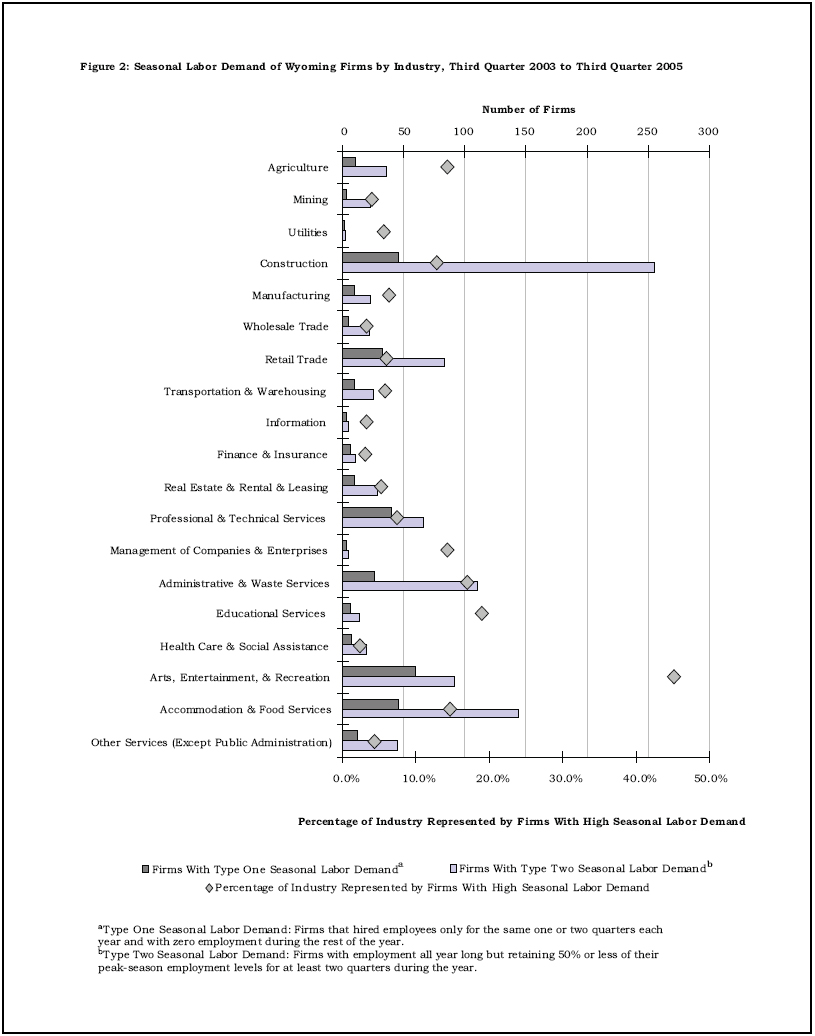

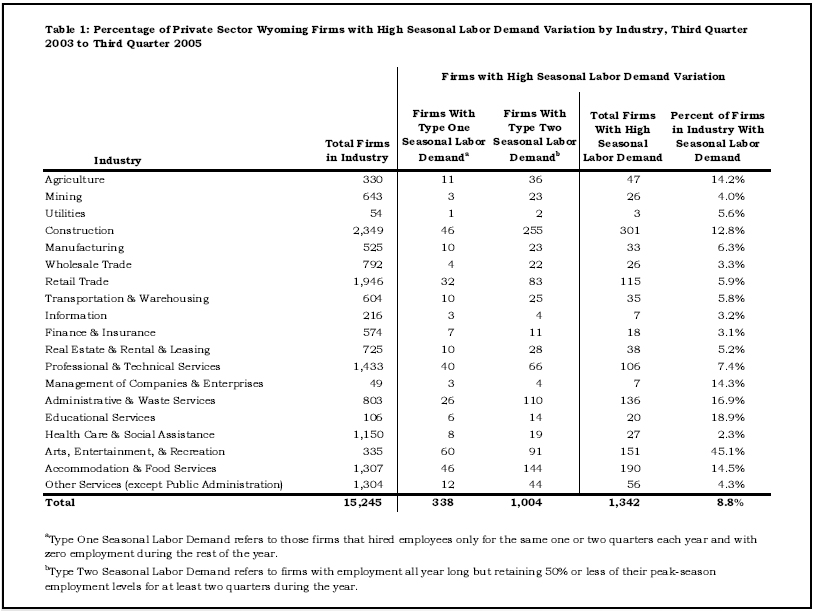

Among industries, nearly half (45.1%) of the firms in Arts, Entertainment, & Recreation had high seasonal labor demand (see Figure 2. Private Educational Services had the second highest percentage (18.9%), followed by Administrative & Waste Services (16.9%). Industries with the least dependence on seasonal workers were Health Care & Social Assistance and Finance & Insurance, with only 2.3% and 3.1% of their respective industry totals.

Table 1 shows that of the 1,342 firms with high seasonal labor demand, the Construction industry had the most firms (301 firms; 22.4%). Accommodation & Food Services had the second largest share with 190 firms (14.2%), followed by Arts, Entertainment, & Recreation with 151 firms (11.3%). Arts, Entertainment, & Recreation had the most firms (60) with Type One seasonal patterns (closed during the off-season). Both Construction and Accommodation & Food Services followed with 46 Type One firms. The Construction industry had the most Type Two firms (255), followed by Accommodation & Food Services (144).

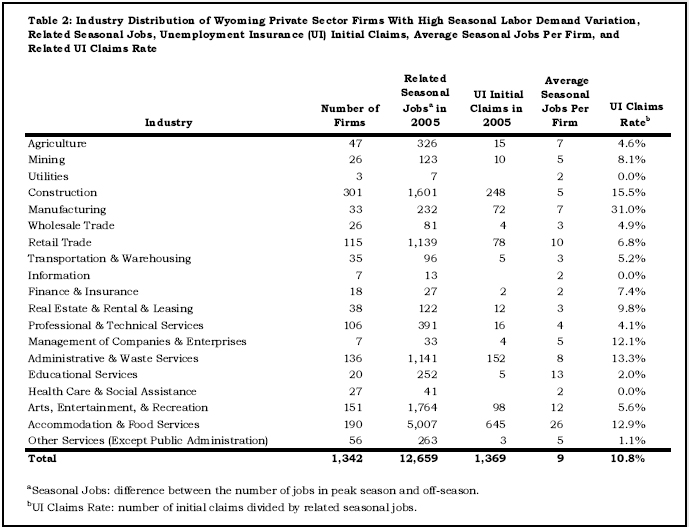

The 1,342 firms with high seasonal labor demand in 2005 provided an average of nine jobs per firm (see Table 2). Accommodation & Food Services had the most seasonal employment, with 5,007 jobs. Arts, Entertainment, & Recreation and Construction followed with 1,764 and 1,601 jobs, respectively. Two other industries with large seasonal employment were Administrative & Waste Services (1,141 jobs) and Retail Trade (1,139 jobs).

An important issue for firms with high seasonal labor demand is how to recruit and retain workers for the next season, especially skilled workers. Potential recruiting resources for seasonal jobs may include students seeking summer or winter jobs, retired persons wanting part-time work or who want to work only part of the year, seasonal workers from other industries during their off-seasons, and workers from other states. However, some seasonal jobs need special skills or experience and firms depend on these trained workers to return the next season. There are several ways firms can improve the chance that seasonal workers will return to work for them, including providing incentives to encourage return (e.g., higher salary, bonus, promotion, financial assistance during the off-season), assisting employees in finding opposite-season work, or helping employees find social or government programs to acquire income assistance during their off-seasons. Unemployment Insurance (UI) is one program that has played a role in retaining seasonal workers in local communities to carry them over to the next season.

Using the UI claims file, we found that 1,369 individuals who lost jobs and applied for UI benefits (UI initial claimants) came from the 1,342 firms with high seasonal labor demand in 2005. This accounts for about 11% of the related seasonal jobs. We refer to this as the UI claims rate (number of initial claims or claimants divided by number of related seasonal jobs or workers). Table 2 shows that the UI claims rate for Manufacturing was the highest among industries (31.0 %). Nearly one-third of the seasonal workers in this industry applied for UI during the off-season in 2005. The UI claims rate was 15.5% in Construction and 13.3% in Administrative & Waste Services. Relative to the total number of seasonal jobs, the claims rates appear to be low. Possible reasons for the low rate may be that some unemployed seasonal workers found other jobs (temporary, seasonal, or permanent); returned to school; or left the work force for a variety of reasons. A study from 2000 found that “a large proportion (71.3%) of seasonal claimants returned to work in the same industry and over half (51.4%) were hired back by the same employers. Claimants who were re-employed in the same industry or by the same employer had a higher probability of receiving a larger gain in their wages than those who were hired in different industries or by different employers” (Wen, 2000).

Summary

Among the 15,245 Wyoming firms in the study, 8.8% (1,342) were identified as having high seasonal labor demand. Arts, Entertainment, & Recreation had the highest percentage (45.1%) of firms in this category. Among these firms, approximately 12,659 seasonal workers annually were needed to staff firms during their peak seasons. More than one-third of all jobs were needed in Accommodation & Food Services. Recruiting and retaining seasonal workers is a challenge, especially in a labor market with low unemployment.

References

Jones, S. D. (2006). States of origin for Wyoming workers. Wyoming Labor Force Trends 43 (4). Retrieved November 29, 2006, from http://doe.state.wy.us/lmi/0406/toc.htm

Lipska, Lesley. (2006). Missing manpower. Casper Star-Tribune, August 4, 2006.

Wen, Sherry. (2000). Re-employment experiences of unemployment insurance claimants part two. Wyoming Labor Force Trends 37 (5). Retrieved November 29, 2006, from http://doe.state.wy. us/lmi/0500/toc.htm

Table of Contents | Labor Market Information | Wyoming

Job Network | Send Us Mail

Last modified on

by Phil Ellsworth.