Wyoming Unemployment Insurance Benefit Expenses

and Number of Recipients Decline in 2012

Total Unemployment Insurance (UI) benefits paid and UI recipients decreased in 2012 from the previous year, which indicates that fewer individuals lost jobs and claimed UI benefits. The cross-industry reduction in UI benefit exhaustion rates indicates better re-employment opportunities in Wyoming's labor market. However, the total number of UI recipients and benefits paid were still considerably higher than their 2008 levels, before Wyoming entered an economic downturn.

Wyoming's Unemployment Insurance (UI) covered employment increased for seven consecutive quarters from fourth quarter 2010 (2010Q4) to second quarter 2012 (2012Q2) as the state continued to recover from the recent economic downturn (Bullard & Brennan, 2013). The unemployment rate dropped from 5.6% in 2011 to 4.9% in 2012. This article examines UI statistics and provides additional information for a better understanding of Wyoming's current economy.

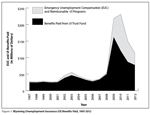

In 2012, the Unemployment Insurance Division of the Wyoming Department of Workforce Services paid a total of $113.8 million in UI benefits to unemployed workers. This was a 24.0% decrease from the $149.87 million in 2011. However, the total UI benefits paid in 2012 were still more than double those from any year prior to 2009, when Wyoming entered an economic downturn. The 2012 annual benefits paid were the fourth highest dating back to 1997, the earliest year for which comparable data are available (see Figure 1).

Of the total benefits paid, 31.9% were paid by the federal Emergency Unemployment Compensation (EUC) funds and other reimbursable UI programs, such as the federal UI program that provides benefits to federal employees. Wyoming's UI trust fund paid for $77.5 million (68.1%) of the total benefits, down from $86.8 million in 2011. On average, from 1997 to 2008, the state UI trust fund paid $33.0 million a year in UI benefits.

Industry Distribution

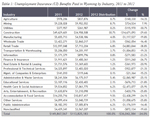

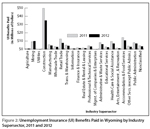

Nearly one-third (30.7%, or $35.0 million) of the total UI benefits in 2012 were paid to claimants in construction (see Table 1 and Figure 2). An additional 9.5% ($10.8 million) of all benefits was paid to those who worked in accommodation & food services, and 8.7% ($10.0 million) was paid to those who worked in mining. Mining was the only industry that experienced an over-the-year increase in benefits paid, up 7.9% in 2012 after dropping 59.5% from 2010 to 2011. The decline of natural gas and coal prices in 2012 is likely one of the main reasons this industry contracted.

Many industries experienced double-digit percentage decreases in UI benefit payments over the year (see Table 2). Significant decreases were seen in construction (-1,193, or -13.7%), accommodation & food services (-490, or -11.5%), and retail trade (-441, or -20.3%). These large decreases suggest that Wyoming's economy continued to improved from the recent economic downturn. However, the benefit expense levels in 2012 were still significantly higher than pre-recession levels.

UI Benefit Recipients and Exhaustees

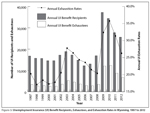

Figure 3 shows the historical trends of Wyoming UI benefit recipients, exhaustees, and exhaustion rates from 1997 to 2012. Across Wyoming, 25,617 unemployed workers received UI benefits in 2012, a decrease of 7.7% from the 27,756 recipients in 2011. The number of UI benefit recipients decreased for three consecutive years after peaking at 37,251 in 2009. This indicates that Wyoming's economy has been gradually improving with fewer layoffs each year.

The number of UI benefit recipients who exhausted their eligible regular benefits also decreased over the year. There were 6,725 UI exhaustees in 2012, compared to 8,710 in 2011, a decrease of 22.8%.

The exhaustion rate is calculated by dividing the number of exhaustees by the number of UI recipients in a given year. This indicates the degree of difficulty of re-employment for unemployed workers, and the exhaustion rate is usually higher during economic downturns. In 2012 Wyoming's exhaustion rate was 26.3%, down significantly from 35.8% in 2010, which was the highest exhaustion rate on record since 1997.

Out-of-state claimants made up nearly one-fourth (23.8%) of all UI recipients in Wyoming in 2012 (see Figure 4). Laramie County accounted for 12.3% of all UI recipients, followed by Natrona (10.6%) and Campbell (6.9%) counties. The number of UI recipients decreased in each county over the year except in Campbell and Sublette counties.

The number of unemployed workers collecting UI benefits decreased in all industries except three: wholesale trade (576, or 119.0%), mining (402, or 24.8%), and management of companies & enterprises (4, or 33.3%).

In terms of UI exhaustion rates, management of companies & enterprises showed the highest rate (43.8%) in 2012, although it had the fewest number of UI recipients (only 16 individuals). These numbers may suggest that very few people lost jobs in this industry, but once they lost jobs it was more difficult for them to be reemployed. Wholesale trade had the lowest exhaustion rate (13.8%) in 2012. As mentioned above, this industry had the largest increase in UI recipients in the year. However, a large proportion of the UI recipients from this industry were job attached. In other words, they were not permanent layoffs and went back to work before they exhausted their benefits. Overall, the exhaustion rate for UI benefit recipients decreased from 2011 to 2012 in every industry. This indicates a greater likelihood of reemployment, as more individuals were able to find a job before exhausting their UI benefits.

Table 3 shows more demographic information of UI recipients and the relationship with the UI exhaustion rates. For example, the data show that exhaustion rates increase with age, which indicates that in general older unemployed workers had more difficulty becoming re-employed than the younger individuals in Wyoming. Females were more likely to exhaust their qualified UI benefits than males. Table 3 also shows that the higher the wages an individual made before layoff, the lower the UI exhaustion rate. A higher pre-layoff wage would also make an individual qualify for more weeks of UI benefits. That's why the more weeks eligible for UI benefits is also linked with a lower exhaustion rate. The only exception is the group with the fewest weeks (0 to 9 weeks) of eligible UI benefits that showed a zero exhaustion rate. It could be possible that individuals in this group felt more pressure to find jobs sooner and would take any jobs they could get.

Conclusion

Wyoming's economy continued to improve in 2012, but still has a long way to go before returning to pre-economic downturn levels. Both UI benefit expenses and the number of UI recipients decreased in 2012, which indicates that fewer layoffs occurred than in 2011. The decreased UI exhaustion rates across all industries also suggest better re-employment opportunities in the state labor market. However, the level of UI benefits paid and the number of UI recipients were still much higher than their pre-recession levels.

Reference

Bullard, D. and Brennan, N. (2013). Local jobs and payroll in Wyoming: Construction continues to grow in 2012Q2. Wyoming Labor Force Trends, 50(1). Retrieved March 11, 2013, from http://doe.state.wy.us/LMI/trends/0113/toc.htm