Chapter 5: Wyoming Employment Growth Lags Behind Surrounding States

Wyoming has a porous labor market and competes for labor with other states that have more complex economies. Some Wyoming residents commute to other states for work, and Wyoming employers rely on workers from other states to fill a relatively large number of jobs. Cowan and Bullard (2015) found that, during each quarter from 2012Q3 to 2013Q2, Wyoming residents commuted to a surrounding state in each quarter to work in retail trade (more than 2,500 in each quarter), accommodation & food services (approximately 2,500 in each quarter), health care & social assistance (nearly 2,500 in each quarter), and construction (approximately 2,000 in each quarter). This analysis is available here.

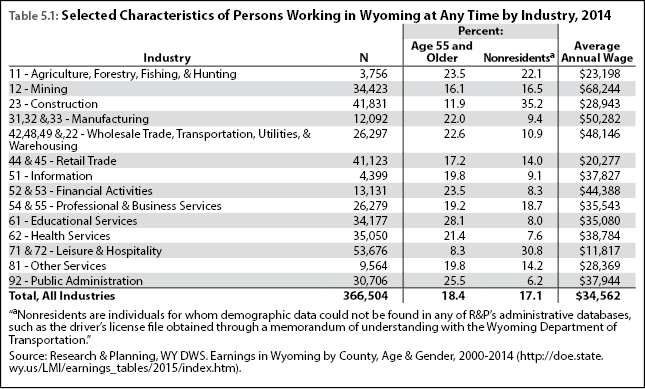

As shown in Table 5.1, Wyoming sectors such as construction, mining, and leisure & hospitality (tourism) are reliant on nonresident labor. For example, in 2014, 35.2% of the 41,831 individuals working in Wyoming’s construction industry were nonresidents, as were 30.8% of the 53,676 individuals working in leisure & hospitality.

As illustrated in Figure 5.1, in 2015 employment growth in Wyoming lagged behind the U.S., Colorado, Utah, Idaho, Montana, Nebraska, and South Dakota. During 2015Q3, employment growth for Colorado and Utah was nearly 4% from 2014Q2, while Wyoming’s employment contracted by nearly 2%.

|

National and regional conditions during the economic slowdown that occurred in Wyoming from 2014Q2 to 2015Q2 were considerably different from those that occurred during the U.S. Great Recession from November 2007 to June 2009 and Wyoming’s economic downturn that lasted from 2009Q1 to 2010Q1. As Figure 5.1 shows, by the time Wyoming entered into its economic downturn in 2009Q1, all of the surrounding states and the U.S. in general had already felt the effects of the Great Recession and experienced a decline in employment. During that time, Wyoming did not face much competition for labor from surrounding states.

However, in 2015Q2 and 2015Q3, all of Wyoming’s surrounding states experienced over-the-year growth in employment. As previously explained in the introduction, even though employment in Wyoming’s mining sector declined by approximately 5,000 jobs from September 2014 to September 2015, only one in four of those lost jobs produced an individual claiming UI benefits. Given the growth in surrounding states, it is possible that those who who lost jobs in Wyoming were able to find work in another state.