Small Businesses Play a Big Role in Wyoming's Economy

See Related Tables and Figures

Note: Due to space considerations, Figures 1a, 2a, and 3a do not appear in the printed version.

More than half (51.5%) of all businesses in Wyoming in 2011 had just one to three employees. Some of these micro-sized firms provided higher annual wages on average in their industries than larger firms. Larger Wyoming employers (those with 50 or more employees) made up just 4.1% of all businesses but contributed 57.0% of the state's jobs and 63.4% of Wyoming's total wages in 2011.

Wyoming is the least populated state in the U.S. (U.S. Census Records), so it seems logical that most of the state's businesses are small in size -- but how small? What proportion of these small businesses make up the state's economy? This article provides insight on Wyoming employers by firm size, including their impact on the state's jobs and wages. Also discussed in this article are the potential impacts on workers in terms of unemployment insurance (UI) benefits and tax contributions to the UI trust fund.

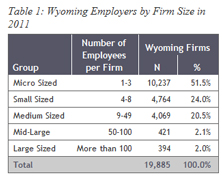

This research uses data collected through the Wyoming Quarterly Census of Employment and Wages (QCEW). In Wyoming, UI covered employment represents 95.3% of the state's total wage and salary employment (Bullard, 2012). The firm sizes defined in this article are specifically based on Wyoming employers' statistical distribution characteristics, since there are many different definitions internationally and within the U.S. (U.S. Small Business Administration, 2013). The firm sizes used in this article are presented in Table 1.

According to the QCEW, there were 19,885 employers in Wyoming in 2011. One employer may have had multiple work sites or branches, such as chain stores. Wyoming's employers provided an annual average of 274,482 jobs and $11.9 billion in wages to the state's economy. They also provided $128.8 million in UI tax revenues in 2011.

Distribution of Employers by Firm Size

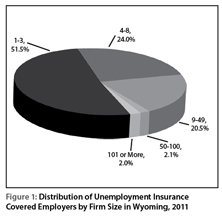

More than half (51.5%) of Wyoming's 19,885 employers in 2011 were micro-sized firms, with 1-3 employees (see Table 2 and Figures 1 and 1a). Another 24.0% were small-sized firms with 4-8 employees and 20.5% were medium-sized firms with 9-49 employees. Only 4.1% of all Wyoming employers were mid-large (50-100 employees) and large (more than 100) in size. This distribution shows that the majority (75.5%) of Wyoming employers were micro-sized or small-sized and provided eight or fewer jobs.

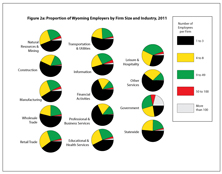

In industries such as financial activities and professional & business services, more than two- thirds of firms were micro-sized. Except for leisure & hospitality and government, micro-sized firms also accounted for the largest proportion in all other industries.

Employment by Firm Size

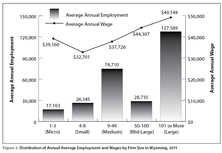

Of the 274,482 jobs in Wyoming in 2011, more than half (57.0%, or 156,324) were at mid-large and large firms (see Table 2 and Figures 2 and 2a), even though these firms only accounted for 4.1% of all firms in Wyoming. An additional 27.2% (74,710 jobs) were found in medium-sized firms with 9-49 employees. Only 15.8 percent (43,448 jobs) were provided by micro-sized and small-sized firms. The distribution of jobs is the opposite of the distribution of employers.

The distribution of jobs and employers differs by industry. For example, 60.9% of all jobs in natural resources & mining were provided by large-sized firms, while medium-sized firms provided the most jobs in construction (41.4%), wholesale trade (44.6%), professional & business services (41.5%), and leisure & hospitality (46.4%).

Wages and UI Benefits for Unemployed Workers

Figures 2 and 2a show that in general, average annual wages increased with the size of the firm, from $32,701 for small-sized firms to $49,149 for large firms. The only exception was the average annual wage for micro-sized firms ($39,160), which was higher than the average annual wage for small-sized ($32,701) and medium-sized ($37,726) firms. However, the wage levels by firm size varied substantially among different industries. In some industries, such as information, professional & business services, and educational & health services, the micro-sized firms actually paid higher wages than any other sized firms (see Table 2). In other industries, such as construction and retail trade, the micro-sized firms paid the lowest wages.

Higher wages are directly linked with higher UI benefits when employees lose jobs. By law, the weekly UI benefit that an individual can receive is equal to 4% of his or her highest quarterly wage during the base period, and the maximum benefit the individual could receive for a year is 30% of his or her base period wage or 26 times his or her weekly benefit, whichever is less (Wen, 2005).

Total Wages and UI Tax

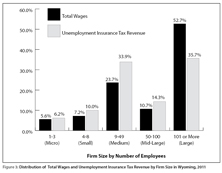

Wyoming's large firms provided more than half of the state's total wages in 2011 (52.7%, or $6.3 billion), while medium-sized firms provided nearly a quarter (23.7%, or $2.8 billion). Micro-sized firms were responsible for just 5.6% ($0.7 billion) of Wyoming's total wages in 2011.

Wage distribution in each industry was very similar to its job distribution. Large firms in natural resources & mining provided most of the wages (68.4%) in that industry. Medium-sized firms paid the largest share of industry wages in construction (42.1%), wholesale trade (41.6%), professional & business services (40.4%), and leisure & hospitality (42.7%).

Figure 3 shows that large firms contributed more than one-third (35.7%) of Wyoming's $128.8 million UI tax revenue in 2011. An additional one-third (33.9%) came from medium-sized firms. Small-sized and middle-large firms accounted for 10.0% and 14.3%, respectively, while micro-sized firms contributed 6.2%.

The amount of UI tax collected is directly affected by employment, wages, UI tax rates, and the frequency of turnover. Any one of these factors may affect the amount of UI tax collected by each firm size. For example, this research shows that large firms in Wyoming provided considerably more jobs (127,589) and higher annual wages on average ($49,149) than medium-sized firms (74,710 jobs and $37,726 average annual wage). However, these two groups provided a similar share of the UI tax revenue. One explanation is that medium-sized firms may not be as stable as large firms. As a result, they may have had more layoff events, which would lead to a higher UI tax rate and more taxes. Medium-sized firms were responsible for the largest share of UI tax in their respective industries, such as those in construction (40.2%), wholesale trade (47.7%), and other services (41.1%).

Summary

The majority of Wyoming employers (75.5%) in 2011 were micro-sized and small-sized firms (see Figure 3a). In some industries, micro-sized firms actually paid the highest average annual wages. Only a small percentage (4.1%) of Wyoming employers were mid-large and large firms. However, these mid-large and large firms contributed the most jobs (57.0%) and wages (63.4%) to the state's economy.

References

U.S. Census Records. Last retrieved on 12/20/12 at http://localistica.com/usa/states/least-populated-states/

Bullard, D. (2012, July). Local jobs and payroll in Wyoming: Job growth accelerates in 2011Q4. Wyoming Labor Force Trends, 49(7). Accessed March 25, 2013, from http://doe.state.wy.us/LMI/trends/0712/a1.htm

U.S. Small Business Administration. Firm Size Data. Last retrieved on January 10, 2013, from http://www.sba.gov/advocacy/849/12162

Wen, S. (2005, January). An Analysis of Wyoming Unemployment Insurance Monetary Eligibility, 1993 and 2003. Occasional Paper No. 2. Accessed March 25, 2013, from http://doe.state.wy.us/LMI/Occasional/No2/toc.htm