Wyoming Long-Term Industry and Occupational Projections, 2014-2024

Industry Projections (PDF) Occupational Projections (PDF)

Industry Projections (Excel) Occupational Projections (Excel)

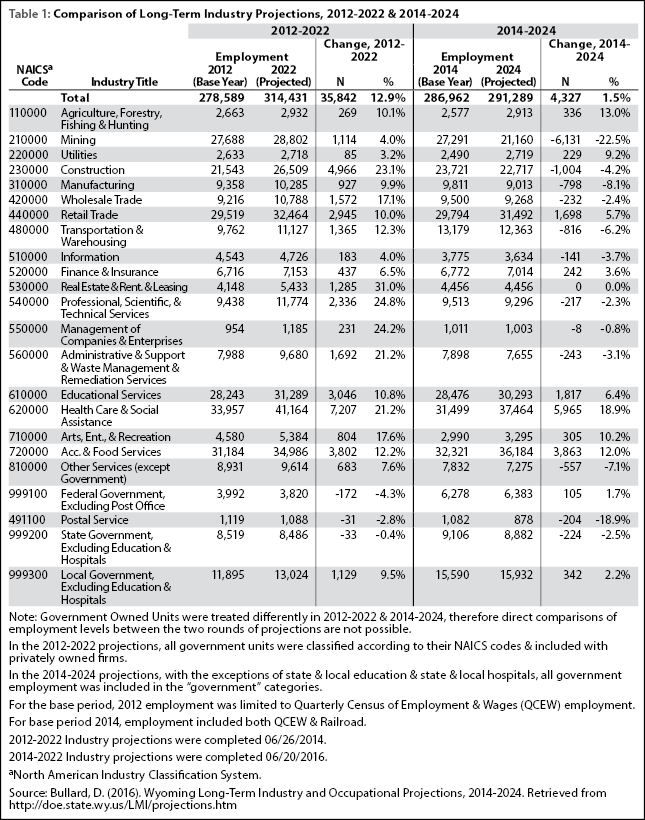

The latest long-term projections from the Research & Planning (R&P) section of the Wyoming Department of Workforce Services show very slow growth from 2014-2024. The industry projections suggest that the state will experience net growth of 4,327 jobs (1.5%) over the 10-year period (see Table 1). Our analysis indicates large job losses in mining (including oil & gas; -6,131 jobs, or -22.5%), construction (-1,004 jobs, or -4.2%), transportation & warehousing (-816 jobs, or -6.2%), and manufacturing (-798 jobs, or -8.1%). Net job losses in these sectors are directly and indirectly related to low energy prices.

|

However, these projections suggest that those job losses will be offset by job gains in health care & social assistance (5,965 jobs, or 18.9%), accommodation & food services (3,863 jobs, or 12.0%), educational services (1,817 jobs, or 6.4%), and retail trade (1,698 jobs, or 5.7%). For many years, Wyoming’s health care sector has experienced strong growth, and the most recent projections indicate that growth is expected to continue, although at a slower pace than in the past. In Table 1, employment in social assistance is included with the health care sector. “Social assistance” includes organizations involved in providing community food services, community housing services, vocational rehabilitation services, and child day care services. Jobs in the state’s tourism sector are also projected to increase, as low gasoline prices and an expanding national economy encourage visits to the state. The educational services sector includes all levels of education, from kindergarten through graduate school and other educational services. It includes both private and public schools, colleges, and other educational institutions. Similar to health care, this sector has experienced strong growth in the past, and is expected to continue to grow.

There are several things that data users should keep in mind when reviewing the long-term projections. First, 2014 represented something of a high-water mark for Wyoming employment, as energy prices peaked in summer 2014 and then fell dramatically. From fourth quarter 2014 to fourth quarter 2015, employment fell by 6,600 jobs (-2.3%; R&P, 2016a). Additionally, recent data show that Wyoming’s unemployment rate rose from 3.8% in February 2015 to 5.6% in May 2016 (R&P, 2016b). The 2014-2024 Long-Term Industry Projections Table shows the detailed industry projections that were summed up to arrive at the projections shown in Table 1. Projections for each detailed industry were developed independently.

R&P used Projections Suite software to develop these projections. This software is utilized by most states when developing their state and area industry and occupational employment projections. Annual employment data for 1990 to 2014 were loaded into the software and used in producing the projections. Later, as more recent employment data became available from the Quarterly Census of Employment and Wages program (http://doe.state.wy.us/LMI/toc_202.htm), analysts used SPSS to produce another set of projections, which incorporated input data reaching through December 2015.

|

|

Figure 1 shows total covered employment in Wyoming from 2001 to 2015. However, because of the seasonality in the data, it can be difficult to discern the underlying trend. Figure 2 illustrates the over-the-year percentage job growth from 2001 it 2015. It is clear from Figure 2 that the employment situation in Wyoming deteriorated rapidly from 2014 to 2015. During the summer of 2014, job growth was running near 2.0%, but growth slowed dramatically during 2015, and by December, employment was 2.9% below its previous year level. Projections from SPSS were compared to those produced in Projections Suite and analyst judgement was used to adjust projections. Industry projections were completed on June 20, 2016. Projections were largely based on trend and implicitly assume no policy changes.

A cautionary note that was included in the state’s Workforce Innovation and Opportunity Act Unified State Plan also applies to these employment projections:

"Each data point of supply and demand used in this analysis is constantly changing. Data components are measured weekly, monthly, quarterly and sometimes less often. As these measures of supply and demand become available, they are published in news release (http://doe.state.wy.us/LMI/news.htm) or in full, or as product announcements in Trends (http://doe.state.wy.us/LMI/trends.htm). The reader may choose to follow published updates and apply their impact to the course of analysis presented here over the 2016-2020 analysis period.

"Every labor market analysis errs. The questions are: whether or not the underlying economic and demographic assumptions are largely sound, and whether or not the producer and consumer of the analysis exercises due diligence in monitoring the market outlook over the plan period. The economic and demographic analysis presented here represents one potential step in a longer term process and serves as one vehicle to generate information from other reliable sources such as employers, labor, academia, members of the media and the public as a whole (Wyoming Department of Workforce Services, 2016)."

Table 1 compares the previous 2012-2022 projections to the current 2014-2024 projections. At the total level, 10-year expected job growth fell from 12.9% in the 2012-2022 projections to 1.5% in the 2014-2024 projections. Expected growth is much lower in the vast majority of industry sectors. For example, educational services, which was expected to grow 10.8% from 2012-2022 is now expected to grow 6.4% from 2014-2024.

References

Research & Planning, Wyoming Department of Workforce Services. (2016a). Local jobs and payroll in Wyoming in third quarter 2015: total payroll falls by $75 million. Retrieved June 29, 2016, from http://doe.state.wy.us/LMI/qcewnews.htm

Research & Planning, Wyoming Department of Workforce Services. (2016b). Wyoming unemployment rate rises to 5.6% in May 2016. Retrieved July 14, 2016, from http://doe.state.wy.us/LMI/news.htm

Wyoming Department of Workforce Services. (2016). Workforce Innovation and Opportunity Act (WIOA) Unified State Plan. Retrieved July 11, 2016, from http://wyowdc.wyo.gov/unified-state-plan-1