Covered Employment and Wages for Fourth Quarter 2007: Double-Digit Growth in Total Payroll

From fourth quarter 2006 to fourth quarter 2007, Unemployment Insurance (UI) covered payroll grew marginally faster than its five-year average. Total payroll increased at double-digit rates in approximately half of Wyoming’s 23 counties and decreased in only 1.

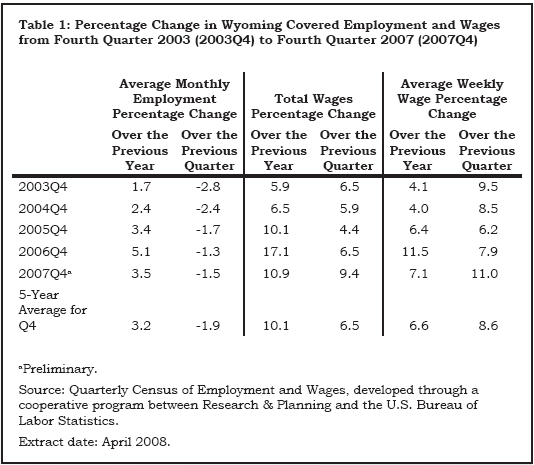

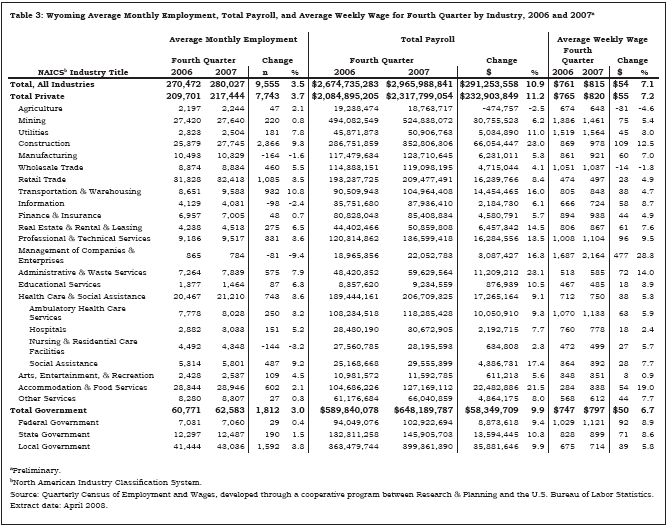

From fourth quarter 2006 to fourth quarter 2007, total UI covered payroll grew by $291.3 million (10.9%), marginally faster than its five-year average (10.1%; see Table 1). UI covered payroll represents approximately 92% of all wage and salary disbursements and 45% of personal income in the state (U.S. Bureau of Economic Analysis, 2007). The state’s average weekly wage rose by $54 (7.1%), also faster than its five-year average (6.6%). Employment increased by 9,555 jobs (3.5%).

The covered payroll and employment data in this article are measured by place of work as compared to the labor force estimates, which are a measure of employed and unemployed persons by place of residence. On R&P’s website there are now tables that show employment and wages broken out by age and gender for each of Wyoming’s 23 counties (http://doe.state.wy.us/LMI/earnings/toc.htm). There are two sets of tables for each county, one by place of residence and another by place of employment.

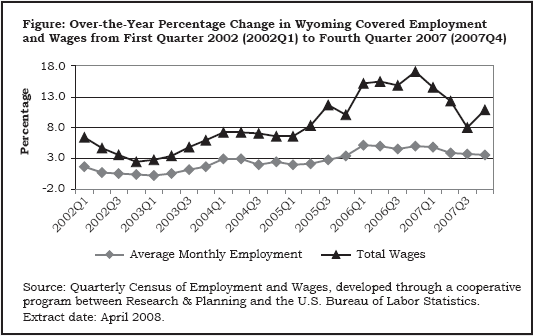

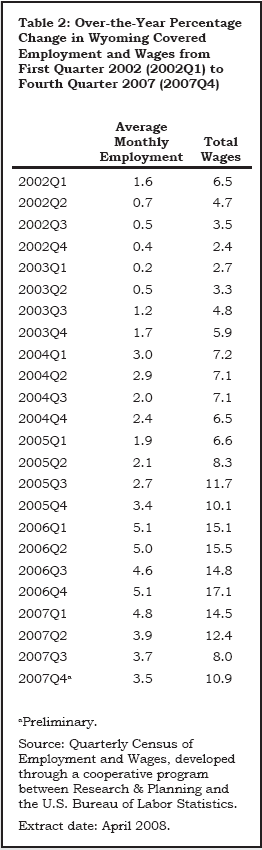

The Figure shows that payroll growth peaked at 17.1% in fourth quarter 2006, decreased to 8.0% in third quarter 2007, and rebounded to 10.9% in the current quarter. Employment growth was near 5.0% during 2006, but has since slowed slightly to 3.5% in fourth quarter 2007 (see Table 2).

Statewide Employment and Wages by IndustryThe purpose of this article is to show employment and payroll changes between fourth quarter 2006 and fourth quarter 2007. These economic changes help us gauge the overall strength of Wyoming’s economy and identify the fastest and slowest growing industries and geographic areas.

Table 3 shows that construction again posted the largest job gains. It was followed by local government (including public schools, colleges, & hospitals), retail trade, transportation & warehousing, and health care & social assistance.

Construction added 2,366 jobs (9.3%) in fourth quarter, and total payroll increased by $66 million (23.0%). Employment fell slightly in construction of buildings, but increased rapidly in both heavy & civil engineering construction (approximately 900 jobs) and specialty trade contractors (approximately 1,500 jobs). As in previous quarters, strong job growth was seen in oil & gas pipeline & related structures construction.

Local government’s total payroll increased by $35.9 million (9.9%) and employment grew by 1,592 jobs (3.8%). Educational services (including public schools and colleges) gained almost 600 jobs, public administration (including cities, towns, and counties) gained more than 500 jobs, and public hospitals gained more than 250 jobs. Arts, entertainment, & recreation (including gambling) added approximately 100 jobs.

In fourth quarter, retail trade gained 1,085 jobs (3.5%). Its total payroll grew by $16.2 million (8.4%). Large job gains were seen in motor vehicle & parts dealers (more than 150 jobs), building material & garden supply stores (more than 150 jobs), gasoline stations (more than 150 jobs), and general merchandise stores (including warehouse stores and supercenters; more than 250 jobs).

Total payroll in transportation & warehousing increased by $14.5 million (16.0%) and employment grew by 932 jobs (10.8%). The largest job growth occurred in warehousing & storage (more than 500 jobs) and truck transportation (more than 200 jobs). Employment also increased in air transportation (approximately 50 jobs), support activities for transportation (more than 50 jobs), and couriers & messengers (approximately 50 jobs).

Health care & social assistance added 743 jobs (3.6%) and its total payroll grew by $17.3 million (9.1%). Social assistance had the largest job growth (487 jobs, or 9.2%), followed by ambulatory health care services (250 jobs, or 3.2%).

Even though employment growth in mining (including oil & gas) was slow (adding 220 jobs, or 0.8%), its total payroll increased by $30.8 million (6.2%). Coal mining added more than 400 jobs and oil & gas extraction added approximately 200 jobs. Employment in support activities for mining (including drilling oil & gas wells) fell by approximately 450 jobs.

Employment fell in manufacturing, information, and management of companies & enterprises, but total payroll increased in each of these sectors.

Manufacturing employment decreased by 164 jobs (-1.6%) in fourth quarter. Job losses were seen in wood product manufacturing (approximately 200 jobs), beverage & tobacco product manufacturing (fewer than 50 jobs), and printing & related support activities (fewer than 50 jobs). Employment increased in petroleum & coal products manufacturing (more than 50 jobs) and machinery manufacturing (approximately 50 jobs).

Total payroll in the information sector rose by $2.2 million (6.1%), but employment fell by 98 jobs (-2.4%). This employment decrease was partially related to noneconomic code changes, including the introduction of the North American Industry Classification System 2007 (see article, page 11). Some firms previously classified in this sector were moved to administrative & waste services.

Employment in management of companies & enterprises fell by 81 jobs (-9.4%). Most of the job losses were in corporate, subsidiary, & regional managing offices. Total payroll increased by $3.1 million (16.3%) and average weekly wage rose by $477 (28.3%), mostly because of a large bonus in fourth quarter.

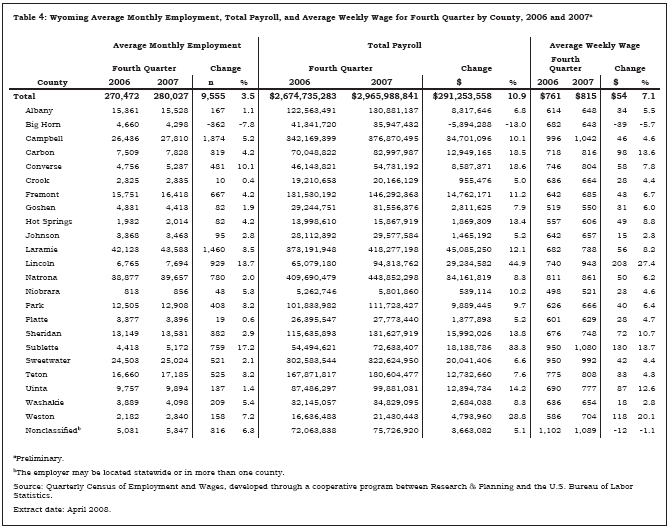

Employment and Wages by CountyTable 4 shows total payroll increased at double-digit rates in approximately half of Wyoming’s 23 counties and decreased in only 1. Job growth was seen in almost every area of the state, with only Big Horn County reporting lower total payroll and employment in fourth quarter 2007.

Campbell County’s total payroll increased by $34.7 million (10.1%) and employment grew by 1,374 jobs (5.2%). The largest job gains were in construction (almost 500 jobs) and mining (approximately 200 jobs), but strong growth was also seen in retail trade, other services, and local government (including public schools, colleges, and hospitals).

In Lincoln County total payroll rose by $29.2 million (44.9%) and employment increased by 929 jobs (13.7%). Job gains were seen in many sectors, but the largest increase occurred in construction (approximately 750 jobs).

In fourth quarter, Sublette County added 759 jobs (17.2%) and its total payroll increased by $18.1 million (33.3%). Mining (including oil & gas) posted the largest job gains (approximately 500 jobs), but substantial growth was also seen in construction, wholesale trade, transportation & warehousing, and administrative & waste services.

The number of jobs in Fremont County increased by 667 (4.2%) and total payroll grew by $14.8 million (11.2%). Large job gains occurred in local government (approximately 200 jobs), construction (approximately 150 jobs), and mining (approximately 100 jobs).

In fourth quarter, employment fell by 362 jobs (-7.8%) in Big Horn County. Its total payroll decreased by $5.4 million (-13.0%). These decreases were mostly related to a noneconomic code change. A large firm was reclassified to Sublette County, where a majority of its employees were working.

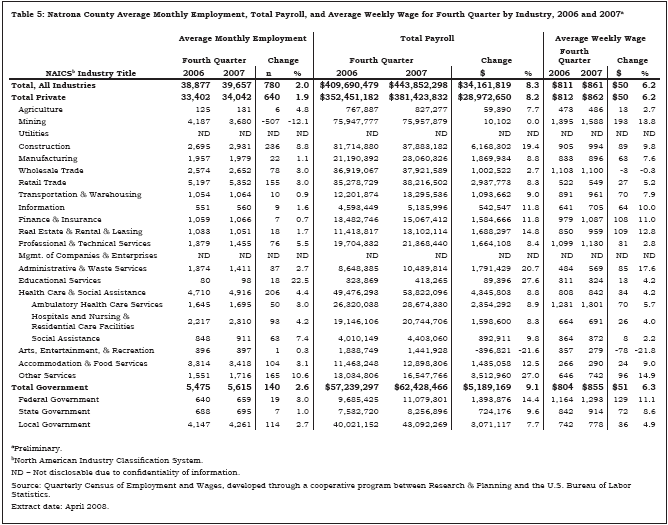

Table 5 shows that Natrona County added 780 jobs (2.0%) in fourth quarter and total payroll increased by $34.2 million (8.3%). The largest job growth occurred in construction (236 jobs, or 8.8%), health care & social assistance (206 jobs, or 4.4%), and other services (165 jobs, or 10.6%). The apparent job loss in mining (-507 jobs, or -12.1%) was actually the result of the reclassification of a large firm out of Natrona County into the nonclassified region.

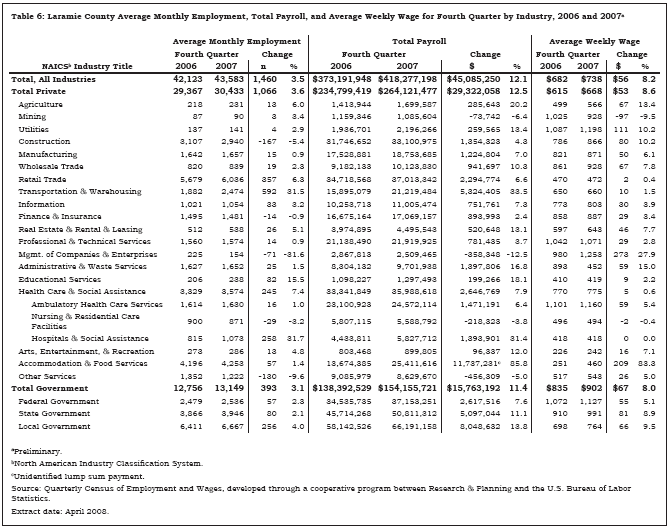

Laramie County’s total payroll increased by $45.1 million (12.1%) and employment grew by 1,460 jobs (3.5%; see Table 6). There was substantial job growth in transportation & warehousing (592 jobs, or 31.5%), retail trade (357 jobs, or 6.3%), local government (including public schools, colleges, and hospitals; 256 jobs, or 4.0%), and health care & social assistance (245 jobs, or 7.4%). Employment fell in construction (-167 jobs, or -5.4%), finance & insurance (-14 jobs, or -0.9%), management of companies & enterprises (-71 jobs, or -31.6%), and other services (-130 jobs, or -9.6%).

In summary, Wyoming’s economy continued to exhibit solid growth in fourth quarter. Total payroll and employment increased in practically every area of the state. The three largest contributors to total payroll growth were construction, local government (including public schools, colleges, and hospitals), and mining (including oil & gas).

ReferencesU.S. Bureau of Economic Analysis. (2007, May 15). SA04 State income and employment summary - Wyoming. Retrieved May 15, 2007, from http://www.bea.gov/regional/spi/action.cfm

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Last modified on

by April Szuch.