Benefits Survey 2014: Fewer Jobs Offered Access to Benefits

This article, based on the Wyoming Employer Benefits Survey, examines employer-provided benefits in Wyoming in 2014. The data for this report are intended to provide a small example of the data available from this survey. Estimates for these data are calculated for employer class size, industry, region, and as a 20-quarter moving average, and are available online at http://doe.state.wy.us/LMI/benefits/benefits_2014.pdf.

Total employee compensation is a combination of direct compensation from wages and indirect compensation, which consists of any combination of benefits an employer may offer. These benefits may include health, dental, and vision insurance, retirement plans, and paid time off. Studies show that employees who are satisfied with the benefits they receive at work are also more likely to be satisfied with their jobs (Graves, 2015). Overall, employees tend to indicate that health insurance is the most important benefit an employer can offer (Fronstin & Helman, 2014).

As noted in the 2013 Wyoming Benefits publication (Knapp, 2014), the Patient Protection and Affordable Care Act (ACA) was signed into law in 2010. This law is intended to provide affordable health insurance options to people, especially those without access to employer-sponsored insurance (Buchmueller, Carey, & Levy, 2013). According to the most recent report by the U.S. Census Bureau (Smith & Medalia, 2015), the overall proportion of uninsured people in Wyoming dropped from 13.4% in 2013 to 12.0% in 2014. However, as shown in the results presented in this article, the proportion of Wyoming jobs that were offered health insurance benefits dropped during the same time period. The drop in jobs with access to health insurance benefits seems to be concentrated more among part-time jobs than full-time jobs (see Appendix at http://doe.state.wy.us/LMI/benefits/benefits_2014.pdf). Although there are penalties for larger employers who don’t offer benefits to their employees, the laws governing those penalties went into effect in 2015 for employers with 100 or more employees and won’t go into effect until 2016 for employers with 50 to 99 employees. Employers with fewer than 50 employees won’t face financial penalties for not providing health insurance (Blumenthal & Collins, 2014). Until these laws have been in effect for a period of time, it will be difficult to analyze what effect, if any, the ACA has on how employers offer workplace benefits.

The Wyoming Benefits Survey collects data on workforce benefits such as health insurance, paid leave benefits, dental and vision insurance, life and disability benefits, child care and education reimbursement, and retirement benefits. Retirement benefits are broken out into defined-contribution plans and defined-benefit plans. In a defined-contribution plan, employees and/or employers make specific contributions, such as a certain percentage of wages from each pay period. In contrast, defined-benefit plans (also known as pensions) specify the level of benefits retirees receive based upon the employee’s years of service and highest salary. For further discussion on the differences between these plans, please see http://doe.state.wy.us/LMI/benefits2012/health_and_retire.htm.

This article examines the proportion of full- and part-time jobs that were offered benefits in 2014; it also examines how the percentage of jobs that have been offered benefits has changed over the most recent five years, using a quarterly moving average. Tables and figures showing benefits offered by employer size class, industry, and geographic region for 2014 are available online at http://doe.state.wy.us/LMI/benefits.htm.

Methodology

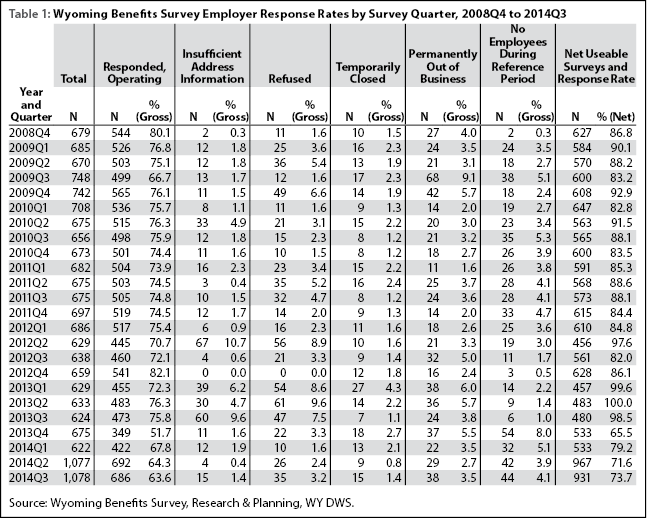

The Wyoming Benefits Survey is designed to collect data from Wyoming employers about the workplace benefits they offer their employees. The survey questionnaire is sent to a random sample of employers every quarter, and typically at least 71.0% of the questionnaires are completed and returned (see Table 1). The resulting estimates are based on the average employment in the state each quarter and the preceding seven quarters. The Benefits Survey is not structured to be a true time series, which would collect data from the same employers every quarter; rather, it collects data from a different sample of employers every quarter. A moving average of the results allows the data to be viewed over time to analyze changes in the way benefits are offered. For more information on the sampling and estimation process used to create the benefits survey estimates, please see http://doe.state.wy.us/LMI/benefits2013/benefits_2013.pdf.

This year, rather than a large, stand-alone Benefits publication, Research & Planning has decided to present the data and findings from this survey in this Wyoming Labor Force Trends article that provides an overview of the major trends in employer-sponsored workforce benefits. More detailed tables and graphs include breakdowns of benefits offered by full- and part-time jobs, employer size class, industry, and region, and can be found in an appendix at http://doe.state.wy.us/LMI/benefits/benefits_2014.pdf.

Analysis

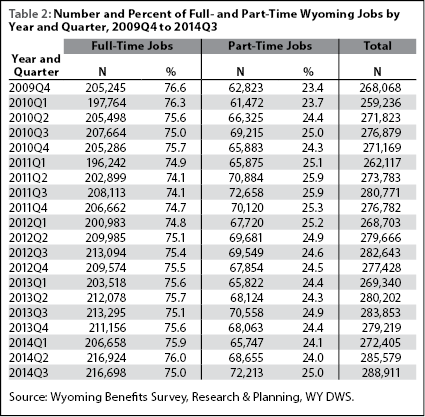

Approximately three-fourths of jobs in Wyoming are considered full-time (see Table 2). The number of jobs in these tables is roughly equal to the corresponding number of jobs counted by the Quarterly Census of Employment and Wages program for each quarter. There is some difference due to rounding error since these are employment estimates created from a sample survey. The proportion of full- and part-time employees is determined by how employers responded to the related question on the survey instrument.

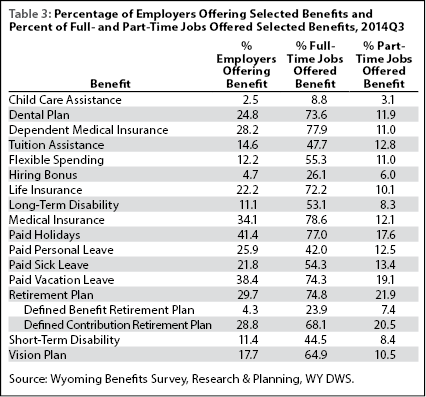

Table 3 shows the proportion of Wyoming employers who offered selected benefits as well as the proportion of jobs that were offered these benefits during the third quarter 2014. Just over one-third (34.1%) of employers offered medical insurance to their workers, nearly one-quarter (24.8%) offered a dental plan, and 17.7% offered a vision plan. Not quite one-third of employers offered a retirement plan (29.7%); the largest proportion of employers offering retirement plans offered a defined contribution plan (28.8%). Paid holiday leave (41.4%) and paid vacation leave (38.4%) were offered by the largest proportion of employers.

More than three-fourths of full-time jobs were offered medical insurance (78.6%) while nearly three-quarters were offered a dental plan and 64.9% were offered vision insurance. A retirement plan was offered to 74.8% of full-time jobs and a defined-contribution retirement plan was offered to a larger proportion of jobs (68.1%) than a defined-benefit plan (23.9%). Paid holiday leave (77.0%) and paid vacation leave (74.3%) were offered to a larger proportion of full-time jobs than paid personal leave (42.0%) or paid sick leave (54.3%).

Benefits were offered to a smaller proportion of part-time jobs. Only 12.1% of these jobs were offered medical insurance while 11.9% were offered dental plans and 10.5% were offered vision plans. One-fifth (21.9%) of these jobs were offered a retirement plan. Defined-contribution retirement plans were offered to a larger proportion of part-time jobs (20.5%). Paid holiday leave was offered to 17.6% of part-time jobs and paid vacation leave was offered to 19.1% of part-time jobs.

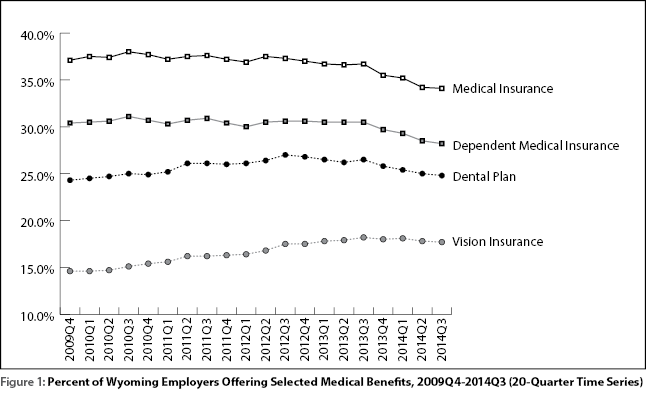

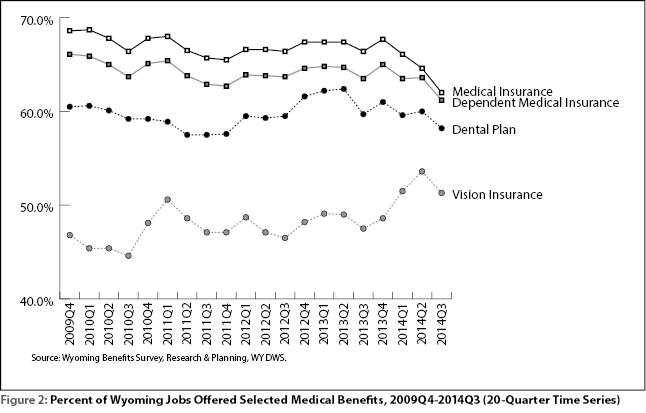

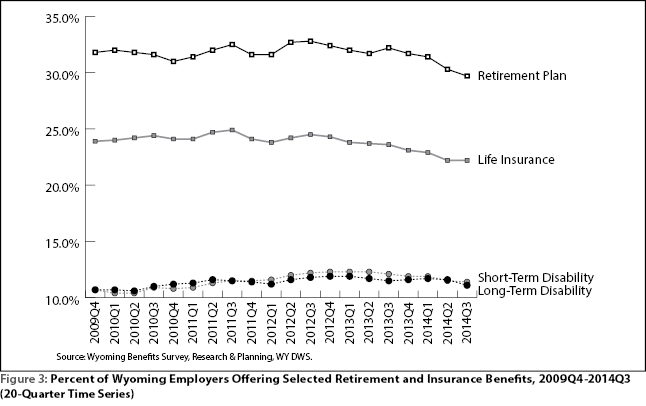

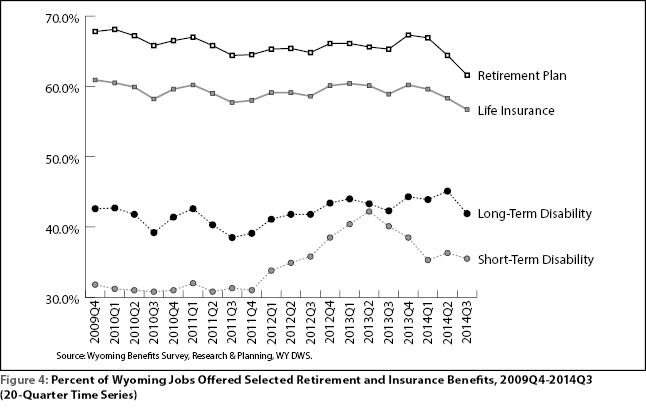

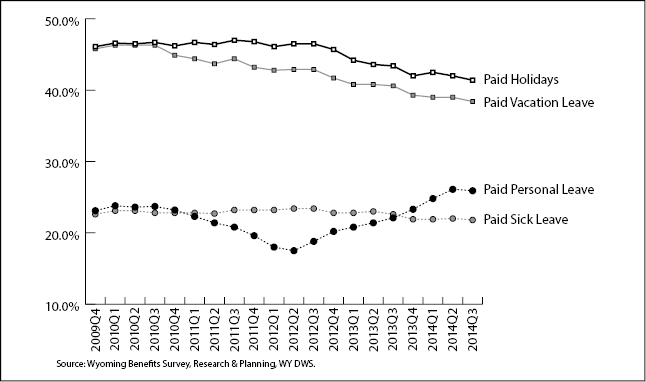

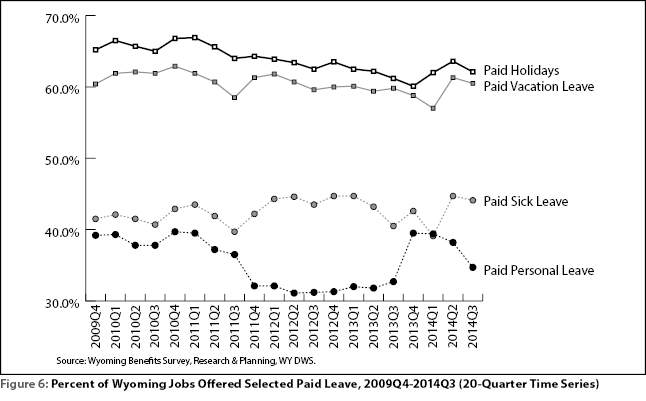

Figures 1-6 contain four-quarter moving averages for the distribution of selected benefits based on 20 quarters (five years) of survey data from fourth quarter 2009 (2009Q4) to third quarter 2014 (2014Q3). The data collected with the benefits survey are not a true-time series but these moving averages offer an alternative to the time-series.

Figure 1 contains the moving average over 20 quarters for Wyoming employers offering selected medical benefits. Approximately 37.0% of employers offered medical insurance between 2009Q4 and 2012Q4 but that proportion began to decline and, by 2014Q3, 34.1% of employers offered the benefit. Approximately 30.0% of employers offered dependent medical insurance to employees until 2013Q4 when that proportion began to fall. In 2014Q3, only 28.2% offered the benefit. Around one-fourth (24.3%) of employers offered dental plans in 2009Q4. That proportion increased to 27.0% in 2012Q3 before dropping back to 24.8% in 2014Q3. The proportion of employers who offered vision plans increased from 14.6% in 2009Q4 to 17.7% in 2014Q3.

The proportion of jobs offered medical insurance (see Figure 2) dropped from 68.6% in 2009Q4 to 62.0% in 2014Q3. Similarly, the proportion of jobs offered dependent medical insurance dropped from 66.1% to 61.2% in 2014Q3. Approximately 60.5% of all jobs were offered dental plans in 2009Q4 compared to 58.2% that were offered the benefit in 2014Q3. The proportion of jobs offered vision plans increased from 46.8% in 2009Q4 to 51.3% in 2014Q3.

Between 2009Q4 and 2014Q3, the proportion of employers offering retirement plans dropped from 31.8% to 29.7% (see Figure 3). The proportion of employers offering life insurance declined from 23.9% in 2009Q4 to 22.2% in 2014Q3. There was very little change in the proportion of employers who offered long-term or short-term disability insurance during this 20-quarter time frame.

In comparison, the proportion of jobs offered retirement plans declined from 67.8% in 2009Q4 to 61.6% in 2014Q3 (see Figure 4). The proportion of jobs offered life insurance was 60.9% in 2009Q4 and remained relatively steady until 2014Q3 when it dropped to 56.7%. There was very little change in the proportion of jobs offered long-term disability insurance during this period, but the proportion offered short-term disability insurance increased from 31.8% in 2009Q4 to 35.5% in 2014Q3.

As shown in Figure 5, the proportion of employers who offered paid holiday leave declined from 46.1% in 2009Q4 to 41.4% in 2014Q3. The proportion of employers who offered paid vacation leave also declined, from 45.8% in 2009Q4 to 38.4% in 2014Q3. The proportion of employers who offered paid sick leave remained relatively unchanged during this time, but the proportion who offered paid personal leave increased from 23.1% in 2009Q4 to 25.9% in 2014Q3.

There was some fluctuation in the proportion of jobs offered paid vacation leave, but that proportion stayed mostly steady with 60.4% of jobs offered the benefit in 2009Q4 and 60.5% in 2014Q3 (see Figure 6). During the same time, the proportion of jobs offered paid holiday leave declined from 65.2% in 2009Q4 to 62.1% in 2014Q3, and the proportion of jobs offered paid personal leave declined from 39.2% in 2009Q4 to a low of 31.1% in 2012Q2 before increasing to 38.2% in 2014Q2. The proportion of jobs offered paid sick leave increased from 41.5% in 2009Q4 to 44.1% in 2014Q3.

Conclusions

Overall, employer-sponsored workplace benefits were offered to a greater proportion of full-time jobs than part-time jobs. During the 20-quarter period between 2009Q4 and 2014Q3, there were declines in the proportion of jobs offered several benefits. These included health insurance, dependent medical insurance, dental insurance, retirement plans, and life insurance. These declines became more apparent after mid-2013. In contrast, there was an increase in the proportion of jobs that were offered short-term disability insurance and vision insurance.

References

Blumenthal, D., and Collins, S.R. (2014, July 2014). Health care coverage under the affordable care act: A progress report. The New England Journal of Medicine, 371(3): 275-281. Retrieved November 11, 2015 from http://www.nejm.org/doi/full/10.1056/NEJMhpr1405667

Buchmueller, T., Carey, C., & Levy, H.G. (2013, September). Will employers drop health insurance coverage because of the Affordable Care Act? Health Affairs, 32(9): 1522-1530. Retrieved November 11, 2015, from: http://www.ncbi.nlm.nih.gov/pubmed/24019355

Fronstin, P. & Helman, R. (2014). Views on the value of voluntary workplace benefits: Findings from the 2014 health and voluntary workplace benefits survey. Employee Benefit Research Institute Notes, 35(11). Retrieved November 11, 2015, from http://www.ebri.org/pdf/notespdf/EBRI_Notes_11_Nov-14_WBS.pdf

Graves, J. A. (2015, March 26). This is what the best companies do to keep their employees happy. U.S. News. Retrieved November 11, 2015, from http://money.usnews.com/money/careers/articles/2015/03/26/this-is-what-the-best-companies-do-to-keep-their-employees-happy

Knapp, L. (2015). Wyoming Benefits Survey. Retrieved November 11, 2015, from http://doe.state.wy.us/LMI/benefits2013/benefits_2013.pdf

Smith, J.C., & Medalia, C. (2015, September). Health Insurance Coverage in the United States: 2014. United States Census Bureau: Washington DC. Retrieved November 11, 2015, from https://www.census.gov/content/dam/Census/library/publications/2015/demo/p60-253.pdf