Excerpt from Wyoming Benefits Survey

Benefits such as health insurance and retirement plans are important for recruiting and retaining employees, but in recent years employers have changed the way they offer these benefits in order to keep up with rising costs. (The Wages and Benefits in Wyoming publication is at http://doe.state.wy.us/LMI/benefits.htm.)

According to the Government Accountability Office (GAO, 2006), over the past decade the cost of offering benefits to employees grew at a much greater rate than employee wages. Benefits such as health insurance and retirement plans are important for recruiting and retaining employees, but in recent years employers have changed the way they offer these benefits in order to keep up with rising costs.

Studies by the GAO (2007) found the cost of health insurance increased by approximately 60% in the past five years, mainly due to an increased need for services, new technology, and an aging population. To counteract these rising costs, employers have shifted costs to employees by increasing premiums and deductibles, increasing co-pays, and decreasing benefits.

Retirement benefits typically come in two forms: defined benefit and defined contribution. Defined-benefit plans, such as pensions, are often funded by employers and the employee receives a set payment every month following retirement based on age, tenure, and salary. In comparison, defined-contribution plans are funded through monthly withholdings from the employee’s salary and often a contribution from the employer. Today only approximately 20% of the nation’s private sector employees are offered a defined-benefit retirement plan and the number of defined-contribution plans offered has increased since 1985.

MethodologyThe data for the 2006 Benefits Survey were collected from a stratified random sample of Wyoming employers. These employers were classified by their North American Industry Classification System code and by the firm size in order to ensure a representative sample for the state. Approximately 2.5% of the available employer records as shown in the Quarterly Census of Employment and Wages were sampled each quarter.

Employers in the sample were sent an advance letter to notify them of the upcoming survey and to serve as a form of address refinement. They were then sent a copy of the survey instrument. If they did not respond within three weeks they were sent another copy of the survey instrument, and those who did not respond to the second copy were sent a third copy. Finally, follow-up telephone calls were made to increase the response rate. Overall, the response rate for 2006 was 65.6%. The response rate increased to 73.2% after removing nonresponse categories such as refusals, firms with insufficient address information, and firms that were not in business during the time of the survey.

Results and DiscussionWhen comparing data for different years, change can be due to two factors: statistical error and real change. Statistical change can be caused by a number of things including the number of responses received during the survey period and the distribution of response values.

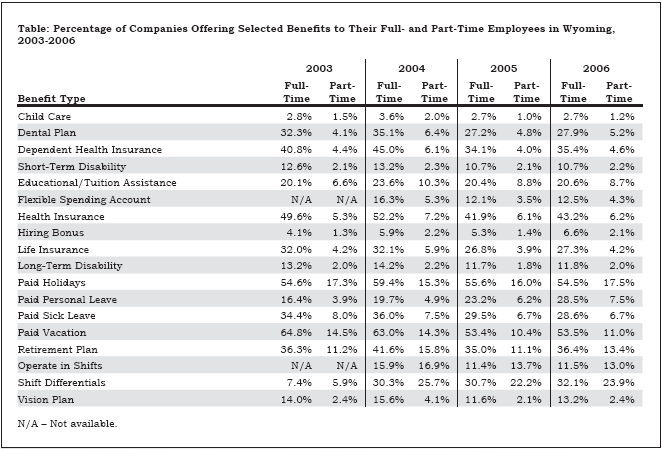

Companies Offering Selected Benefits to Workers: A Comparison to Past YearsThe Table shows how the percentage of companies offering benefits changed over four years. In 2003, 49.6% of employers offered their full-time employees health insurance, 64.8% offered paid vacation, 32.0% offered life insurance, and 32.3% offered dental insurance. By 2006 the percentages of employers offering these and other benefits decreased. In 2006 only 43.2% offered health insurance and only 53.5% offered paid vacation.

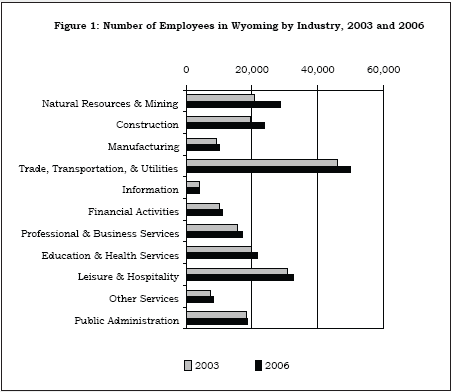

Some of the difference in the proportion of employers offering benefits and employees offered benefits between 2003 and 2006 may be explained by the rising costs of these benefits. However, some of the change may be due to the types of companies coming into the state. Figure 1 shows the number of employees by industry. The largest growth was in natural resources & mining, but there was also significant growth in construction and in leisure & hospitality, neither of which is as likely to offer benefits as other industries. A 2005 study conducted by Research & Planning for the Wyoming Healthcare Commission found that employers in both construction and leisure & hospitality were less likely to provide benefits because of the transitory nature of the jobs. Turnover tends to be high and tenure tends to be low in these industries, which in turn makes benefit packages more costly for companies.

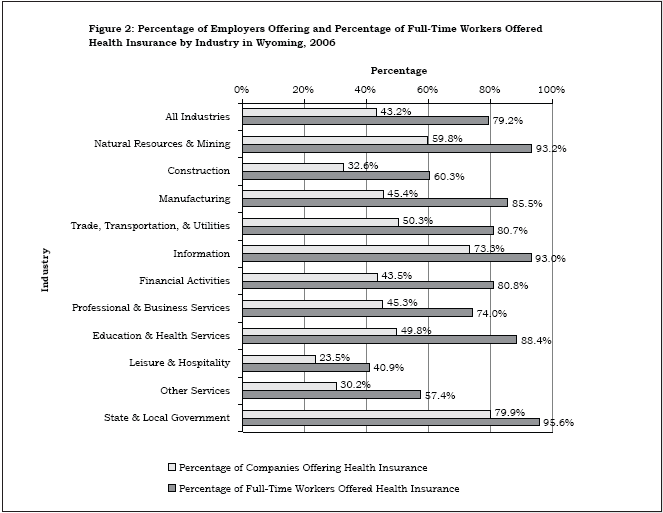

Industry-Level Benefits Analysis, Full-Time WorkersAs shown in Figure 2, in 2006 43.2% of employers in all industries offered full-time employees health insurance and 79.2% of these employees were offered the benefit. Companies in state & local government (79.9%), information (73.3%), and natural resources & mining (59.8%) were most likely to offer health insurance while companies in leisure & hospitality (23.5%), other services (30.2%), and construction (32.6%) were least likely. Likewise, full-time employees were most likely to be offered health insurance if they worked in state & local government (95.6%), natural resources & mining (93.2%), or information (93.0%). They were least likely to be offered health insurance if they worked in leisure & hospitality (40.9%), other services (57.4%), or construction (60.3%). These three industries also were the least likely to have firms that offered health benefits to any employee.

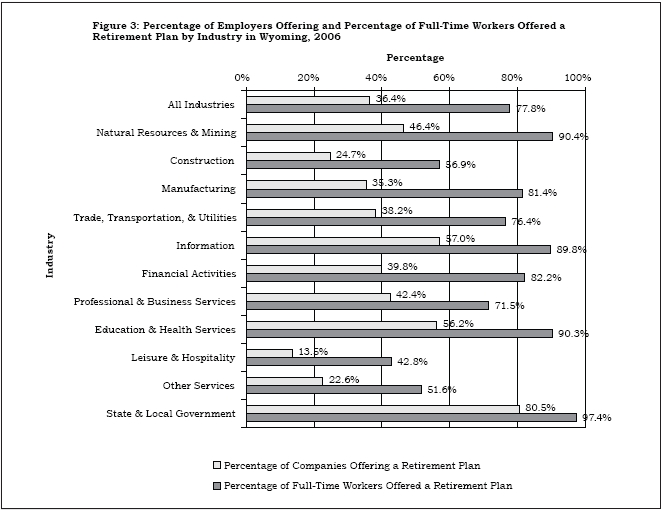

Figure 3 shows the percentage of companies by industry offering retirement benefits to full-time workers and the percentage of workers within these firms who were offered the benefit. Firms in state & local government (80.5%), information (57.0%), and education & health services (56.2%) were most likely to offer retirement plans. Full-time employees in state & local government (97.4%), natural resources & mining (90.4%), and education & health services (90.3%) were most likely to be offered retirement benefits. In contrast, firms in leisure & hospitality (13.5%), other services (22.6%), and construction (24.7%) were least likely to offer retirement benefits and full-time employees in these firms were least likely to be offered a retirement plan.

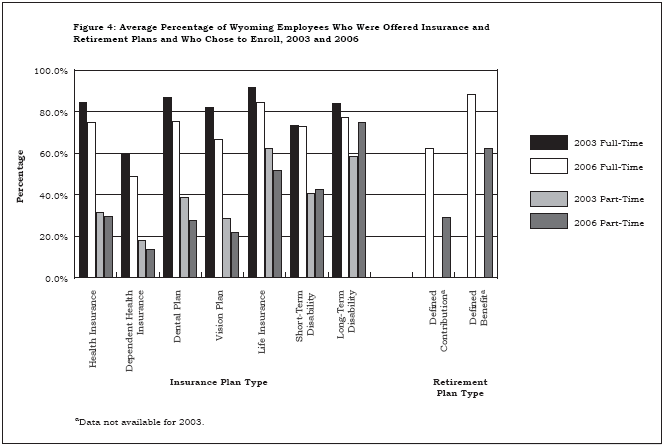

Take-Up Rates for Selected BenefitsFigure 4 shows the percentage of employees who enrolled in benefits when offered (take-up rate) for selected benefits. The percentage of workers who enrolled in dependent health insurance, dental plans, and vision plans has decreased by at least 10% since 2003, and the take-up rate for all other benefits also has declined. In 2006, full-time employees were most likely to enroll in life insurance (84.6%) and long-term disability insurance (77.4%), probably because these benefits usually cost the worker little. Employees were least likely to enroll in dependent health insurance (49.1%) and vision plans (66.9%). More employees were likely to enroll in defined-benefit retirement plans (88.3%) than defined-contribution plans (62.6%), likely because defined-benefit plans are typically 100% employer paid, often without an opt-out alternative.

The GAO (2007) found that across the nation the cost of health insurance and the cost of defined-benefit retirement plans have both increased steadily over time. This has caused fewer employers to offer these benefits, choosing either to offer less costly higher-deductible insurance plans or none at all, and offering defined-contribution plans rather than the more expensive defined-benefit plans. These trends toward benefit erosion can be seen in this analysis of Wyoming employment. Over the past four years the percentage of total compensation costs that go toward health care insurance has increased while the percentage that pays for retirement benefits has decreased. The number of employers who offer most benefits decreased from 2003 to 2006, and fewer employees are now offered these benefits. In addition, the percentage of employees who chose to enroll in benefits has declined for all benefits.

ReferencesGallagher, T., Harris, M., Hiatt, M., Leonard, D., Saulcy, S., & Shinkle, K. (2005). Private sector employee access to health insurance and the potential Wyo-Care market. Wyoming Department of Employment, Research & Planning.

Hauf, D., Leonard, D., & Knapp, L. (2006). Wages and benefits in Wyoming. Retrieved December 14, 2007, from http://doe.state.wy.us/LMI/OESBen2006.pdf

United States Government Accountability Office. (2006, February). GAO-06-285 Employee compensation: Employer spending on benefits has grown faster than wages, due largely to rising costs for health insurance and retirement benefits. Retrieved October 1, 2007, from http://www.gao.gov/new.items/d06285.pdf

United States Government Accountability Office. (2007, March). GAO-07-355 Employer-sponsored health and retirement benefits: Efforts to control employer costs and the implications for workers. Retrieved October 1, 2007, from http://www.gao.gov/new.items/d07355.pdf

Return to text

Return to text

Return to text

Return to text

Return to text

Last modified on

by April Szuch.