Need a Nurse? Examining Labor Sources for Health Care

Studying the administrative records of registered nurses (RNs) working in health care reveals both in-state and out-of-state sources of labor and illuminates the interrelationships among health care subsectors in the use of RN labor. Understanding market hiring patterns may be particularly useful for establishments looking to fill RN vacancies.

Examining the work history of RNs in health care helps define the labor market for RNs working in Wyoming. The analysis reveals both in-state and out-of-state sources of labor and illuminates the dependencies and interrelationships among health care subsectors in the use of RN labor. Understanding market hiring patterns may be particularly useful for establishments looking to fill RN vacancies. This article is a subsection of a larger study produced under contract by Research & Planning (R&P) to the Wyoming Healthcare Commission.

Data Sources and Time Period

Data used for this study included Unemployment Insurance (UI) wage records for Wyoming and partner research states (identified below), the Wyoming Quarterly Census of Employment and Wages (QCEW), the Wyoming Department of Transportation’s Driver’s License database, and the Nursing Licensure database provided by the Wyoming State Board of Nursing. The UI wage records identified a person’s work history and employers, while the QCEW identified the employer’s industry and ownership. Driver’s license records showed a worker’s age and gender, and the nursing database identified RNs. Second quarter 2006 was the reference quarter for this study. This period represented the most recent quarter for which all requisite data were available.

Category DefinitionsThe source of hires was determined by methodologies developed previously (Glover, 2001; Harris, 2006). In brief, it examined the four quarters prior to the reference quarter and identified the most recent primary employer (i.e., the employer paying the most wages). Those falling into the not found working category had no work history in the prior four quarters as determined by examining R&P UI wage records (including those from partner research states).

Partner research states, for purposes of this analysis, included Alaska, Colorado, Idaho, Montana, Nebraska, New Mexico, South Dakota, and Utah. This category applied to persons who most recently and primarily worked in a partner research state. No report was made of the industry or ownership status of the out-of-state firms in question.

Wyoming resident status (resident and nonresident) was determined by a methodology developed by Jones (2004). Resident status applied during the reference quarter (2006Q2).

Health care establishments included three North American Industry Classification System (NAICS) subsectors; specifically, ambulatory health care services, hospitals, and nursing & residential care facilities.

Government included establishments that were publicly owned. Health care establishments can be publicly owned (such as a county-owned hospital), but for purposes of this analysis were not included in government. Likewise, private sector represented privately owned Wyoming establishments but not health care establishments.

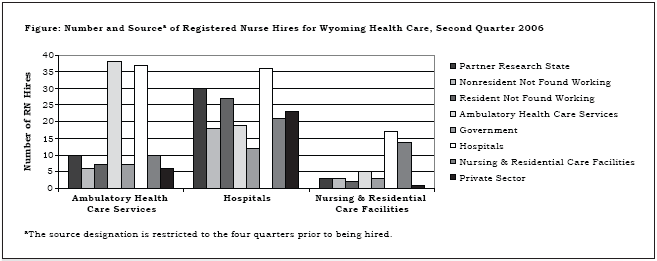

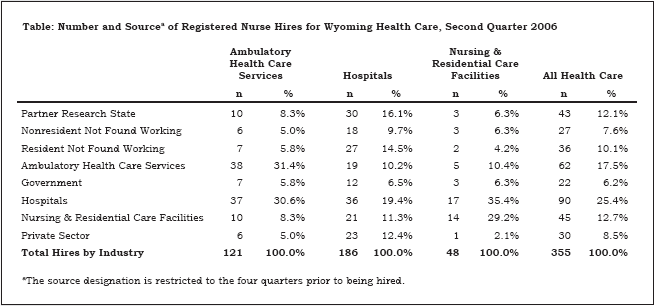

FindingsAll three health care subsectors in Wyoming hired RNs from a variety of sources (see Figure). However, ambulatory health care and nursing & residential care establishments hired proportionately more RNs from fewer sources than hospitals. Ambulatory health care services hired nearly a third of nurses from other establishments in the same NAICS subsector (31.4%; see Table) and 30.6% from hospitals. Similarly, nursing & residential care facilities hired 29.2% of nurses from establishments within the same subsector and even more from hospitals (35.4%).

Although hospitals drew the largest percentage of nurse hires from other hospitals (19.4%), several other sources factored prominently in the hiring equation as well. Other prominent sources outside of health care included RNs working previously in a partner research state (16.1%) and in Wyoming’s private sector (12.4%). RNs who were not found working in R&P databases during the previous quarter, both residents and nonresidents, also contributed a number of RN hires to hospitals (14.5% and 9.7%, respectively). Some of the nonresidents may have been working, but in a state that did not share data with R&P. Some of the residents may have been nurses who recently completed college RN degrees in Wyoming. Government provided the fewest RNs to hospitals (6.5%).

SummaryAmbulatory health care services and nursing & residential care facilities were heavily dependent upon the circulation of RNs within their own industry subsectors but were also reliant upon hospitals as a source of RNs. Apparently, firms in ambulatory health care services and nursing & residential care facilities relied upon the local health care labor market to fill vacancies.

Although there was substantial internal circulation of RNs among all three health care subsectors, hospitals remained the predominant source of RN hires into health care (25.4%). The primary path was from hospitals to ambulatory health care services and nursing & residential care facilities. Ambulatory health care services, in particular, drew heavily from hospitals as a source of nurses.

As the primary source of RNs into health care, hospitals likely incurred an additional workload as a training and experiential environment for RNs. Additionally, the data presented here indicate that hospitals need to reach into the broader local and regional interstate market in order to fill nurse vacancies. Regional interstate competition and local private sector boom conditions likely place heavier strains on hospitals for recruiting nurses than on ambulatory health care or nursing & residential care establishments.

ReferencesGlover, W. (2001). Turnover analysis: Definitions, process, and quantifications. Retrieved June 22, 2007, from http://doe.state.wy.us/lmi/w_r_research/Turnover_Methodology.pdf

Harris, M. A. (2006). Where do they come from and where do they go: Wyoming employers compete for older workers. Wyoming Labor Force Trends, 43(12). Retrieved June 22, 2007, from http://doe.state.wy.us/lmi/1206/a1.htm

Jones, S. (2004). Worker residency determination — Wyoming stepwise procedure. Wyoming Labor Force Trends, 41(8). Retrieved June 22, 2007, from http://doe.state.wy.us/lmi/0804/a1supp.htm

Return to textReturn to text

Return to text

Last modified on

by April Szuch.