Covered Employment and Wages for Third Quarter 2007: Payroll Growth Moderates Further

In third quarter 2007, payroll growth moderated from the rapid growth seen during 2006 and the first part of 2007. Employment and payroll increased in most areas of the state. These economic changes help us gauge the strength of Wyoming's economy and identify the fastest and slowest growing industries and geographic areas.

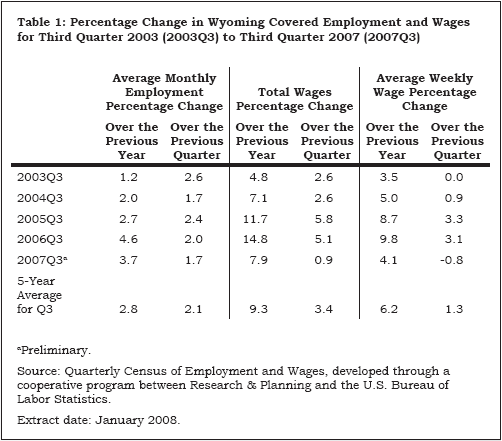

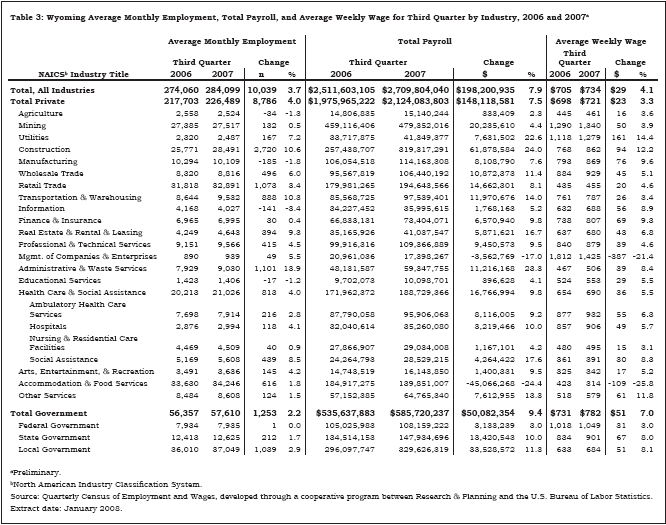

While employment in Wyoming continued to grow faster than its five-year average, payroll growth moderated from the rapid growth seen during 2006 and the first part of 2007. From third quarter 2006 to third quarter 2007, total Unemployment Insurance (UI) covered payroll grew by $198.2 million (7.9%), marginally slower than its five-year average (9.3%; see Table 1). UI covered payroll represents approximately 92% of all wage and salary disbursements and 45% of personal income in the state (U.S. Bureau of Economic Analysis, 2007). The average weekly wage rose by $29 (4.1%), also slower than its five-year average (6.2%). Employment increased by 10,039 jobs (3.7%), almost a full percentage point faster than its five-year average (2.8%).

The covered payroll and employment data in this article are measured by place of work as compared to the labor force estimates (see page 21), which are a measure of employed and unemployed persons by place of residence.

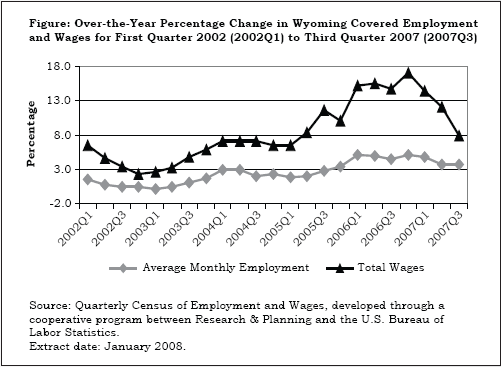

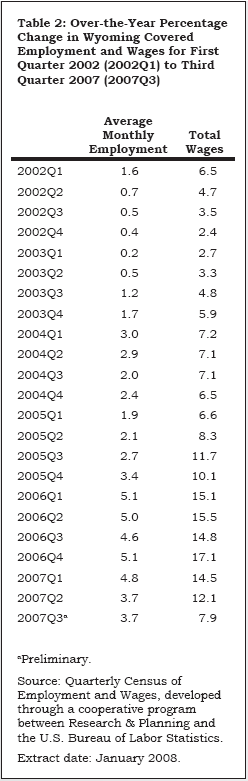

The Figure shows that growth in total payroll peaked at 17.1% in fourth quarter 2006. It has since slowed to 7.9% in third quarter 2007 (see Table 2). Job growth, which averaged approximately 5% from first quarter 2006 to first quarter 2007, appears to have stabilized at 3.7% in both second and third quarter 2007. The slowdown in payroll growth may be related to a decrease in oil & gas drilling activity during 2007.

Statewide Employment and Wages by IndustryThe purpose of this article is to show employment and payroll changes between third quarter 2006 and third quarter 2007. These economic changes help us gauge the strength of Wyoming's economy and identify the fastest and slowest growing industries and geographic areas.

The largest job gains were found in construction, administrative & waste services, retail trade, local government (including public schools, colleges, and hospitals), and transportation & warehousing (see Table 3).

Employment in Wyoming's construction sector increased by 2,720 jobs (10.6%) and its total payroll grew by $61.9 million (24.0%). Heavy & civil engineering construction gained approximately 1,800 jobs, with nearly 1,200 of those jobs being in oil & gas pipeline and related structures construction. Employment fell slightly in construction of buildings, but increased in specialty trade contractors (approximately 900 jobs).

Total payroll in administrative & waste services increased by $11.2 million (23.3%) and employment increased by 1,101 jobs (13.9%). Strong job growth was seen in temporary help services and telephone call centers.

Retail trade added 1,073 jobs (3.4%) and its total payroll increased by $14.7 million (8.1%). The largest job growth occurred in general merchandise stores (including warehouse clubs & supercenters), building material & garden equipment & supplies dealers, and motor vehicle & parts dealers.

Employment in local government increased by 1,039 jobs (2.9%) in third quarter. Total payroll grew by $33.5 million (11.3%). Educational services (including school districts and community colleges) added approximately 300 jobs, public hospitals added approximately 300 jobs, and public administration (including cities, towns, and counties) added approximately 250 jobs. Arts, entertainment, & recreation (including gambling) gained approximately 100 jobs.

Transportation & warehousing added 888 jobs (10.3%) and its total payroll increased by $12.0 million (14.0%). The largest job gains were found in warehousing & storage (nearly 600 jobs) and truck transportation (approximately 250 jobs). Employment fell slightly in transit & ground passenger transportation and pipeline transportation.

Employment fell in manufacturing, information, agriculture, and private educational services. Total payroll decreased in management of companies & enterprises and accommodation & food services.

Even though total payroll rose by $8.1 million (7.6%) in manufacturing, employment decreased by 185 jobs (-1.8%). Modest job gains in petroleum & coal products manufacturing, fabricated metal product manufacturing, and machinery manufacturing were more than offset by job losses in wood product manufacturing, printing & related support activities, and transportation equipment manufacturing.

Employment fell by 141 jobs (-3.4%) in Wyoming's information sector. This employment decrease was partially related to noneconomic code changes, including the introduction of the North American Industry Classification System 2007 (see article, page 11). Some firms previously classified in this sector were moved to administrative & waste services.

Agriculture employment fell slightly (-34 jobs, or -1.3%) and its total payroll increased marginally ($333,409, or 2.3%). Job losses were seen in crop production and support activities for agriculture & forestry.

In private educational services, employment decreased by 17 jobs (-1.2%). Job losses in elementary & secondary schools and technical & trade schools were almost offset by job gains in other schools & instruction.

Management of companies & enterprises added 49 jobs (5.5%), but its total payroll fell by $3.6 million (-17.0%). A large bonus paid in third quarter 2006 was not repeated in third quarter 2007.

Accommodation & food services gained 616 jobs (1.8%) in third quarter. Its total payroll, however, decreased by $45.1 million (-24.4%). This decrease was related to a large bonus paid in third quarter 2006.

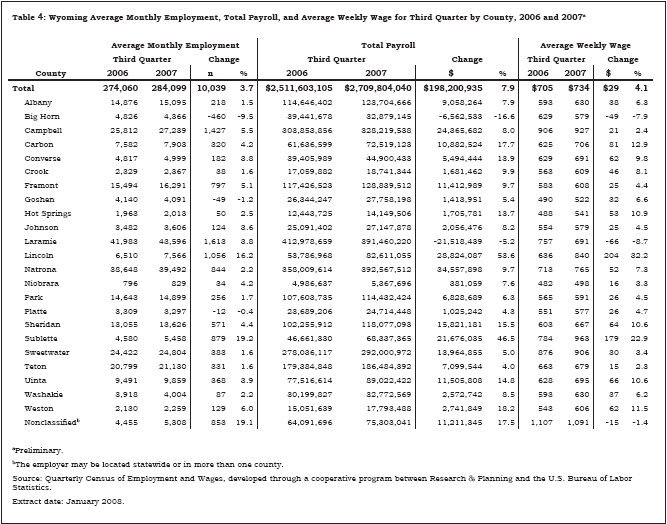

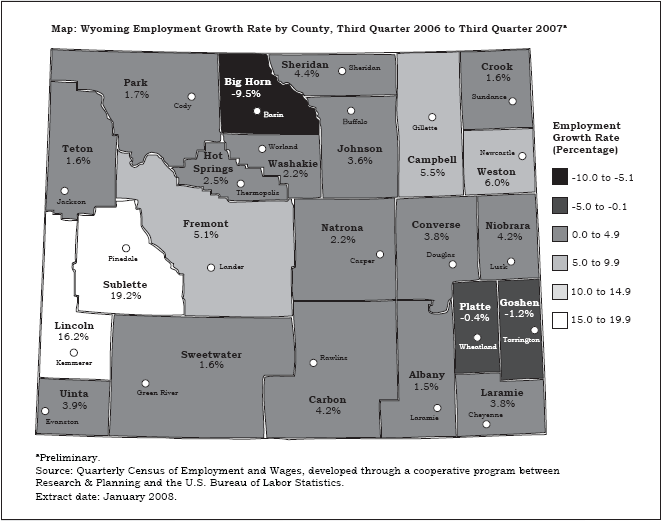

Employment and Wages by CountyTable 4 shows that employment and payroll increased in most areas of the state. Employment fell in only three counties (Big Horn, Goshen, and Platte) and total payroll decreased in only two (Big Horn and Laramie).

Campbell County added 1,427 jobs (5.5%; see the Map) and its total payroll grew by $24.4 million (8.0%). Employment fell slightly in mining, but grew rapidly in construction, retail trade, other services, and local government.

Employment grew by 1,056 jobs (16.2%) in Lincoln County and total payroll increased by $28.8 million (53.6%). Construction was responsible for the largest part of the increase in employment (approximately 950 jobs).

Sublette County's employment also rose rapidly, increasing by 879 jobs (19.2%) in third quarter. Large job gains were seen in mining (including oil & gas; approximately 550 jobs) and construction (more than 100 jobs). Total payroll grew by $21.7 million (46.5%).

Fremont County added 797 jobs (5.1%) and its total payroll grew by $11.4 million (9.7%). Mining, construction, and local government posted the largest job gains.

In Sheridan County, employment rose by 571 jobs (4.4%) and total payroll increased by $15.8 million (15.5%). Strong job growth was seen in construction, retail trade, local government, and mining (including oil & gas).

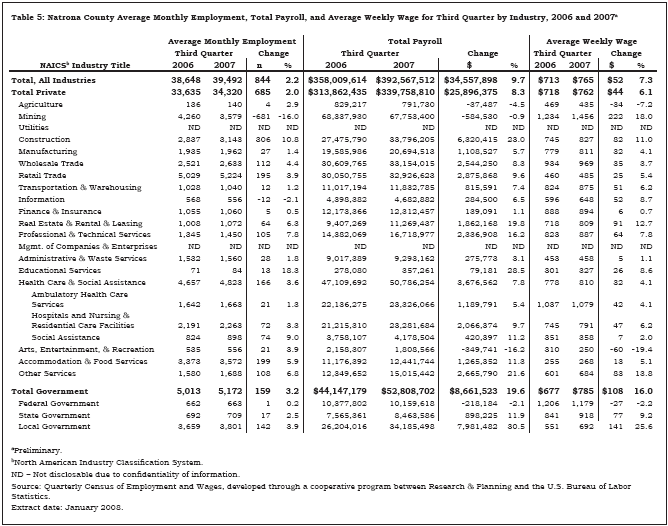

Natrona County's total payroll increased by $34.6 million (9.7%) and employment grew by 844 jobs (2.2%; see Table 5). Large job gains were seen in construction (306 jobs, or 10.8%), accommodation & food services (199 jobs, or 5.9%), retail trade (195 jobs, or 3.9%), and health care & social assistance (166 jobs, or 3.6%). The apparent large job loss in mining (-681 jobs, or -16.0%) was actually the result of the reclassification of a large firm out of Natrona County into the nonclassified region.

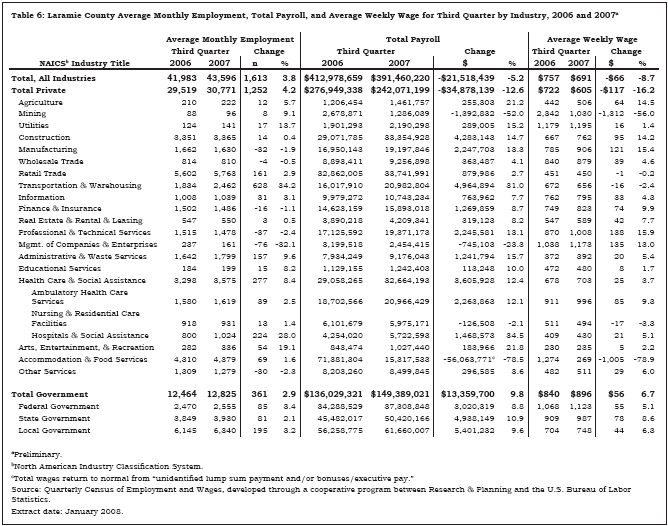

Table 6 shows that Laramie County's employment rose by 1,613 jobs (3.8%) in third quarter. Total payroll fell by $21.5 million (-5.2%), mostly because of a large lump sum payment, or bonus, in accommodation & food services that was paid in third quarter 2006 but not repeated in 2007. The largest job gains occurred in transportation & warehousing (628 jobs, or 34.2%), health care & social assistance (277 jobs, or 8.4%), local government (including public schools, colleges, and hospitals; 195 jobs, or 3.2%), and retail trade (161 jobs, or 2.9%). Large increases in total payroll were seen in local government ($5.4 million, or 9.6%), transportation & warehousing ($5.0 million, or 31.0%), state government ($4.9 million, or 10.9%), construction ($4.3 million, or 14.7%), and health care & social assistance ($3.6 million, or 12.4%).

Big Horn County's employment fell by 460 jobs (-9.5%) and payroll fell by $6.6 million (-16.6%), but this was mostly related to a noneconomic code change. A large firm was reclassified to Sublette County, where a majority of its employees were working.

In third quarter, employment fell by 49 jobs (-1.2%) in Goshen County. Total payroll increased by $1.4 million (5.4%). Minor job losses were seen in a number of sectors including construction; retail trade; transportation & warehousing; and arts, entertainment, & recreation.

In Platte County, employment decreased by 12 jobs (-0.4%) but total payroll grew by $1.0 million (4.3%). Employment fell slightly in wholesale trade, transportation & warehousing, administrative & waste services, and health care & social assistance.

In summary, payroll growth has moderated from the rapid pace set during 2006. Strong job growth continues in many sectors, especially construction, and in most areas of the state.

ReferencesU.S. Bureau of Economic Analysis. (2007, May 15). SA04 State income and employment summary - Wyoming. Retrieved May 15, 2007, from http://www.bea.gov/regional/spi/action.cfm

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Last modified on

by April Szuch.