© Copyright 2007 by the Wyoming Department of Employment, Research & Planning

Vol. 44 No. 4

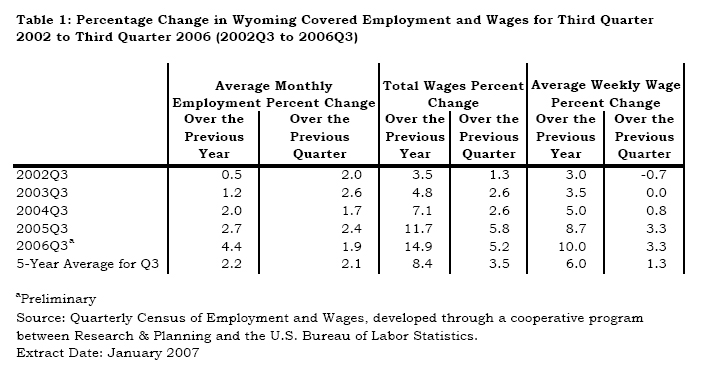

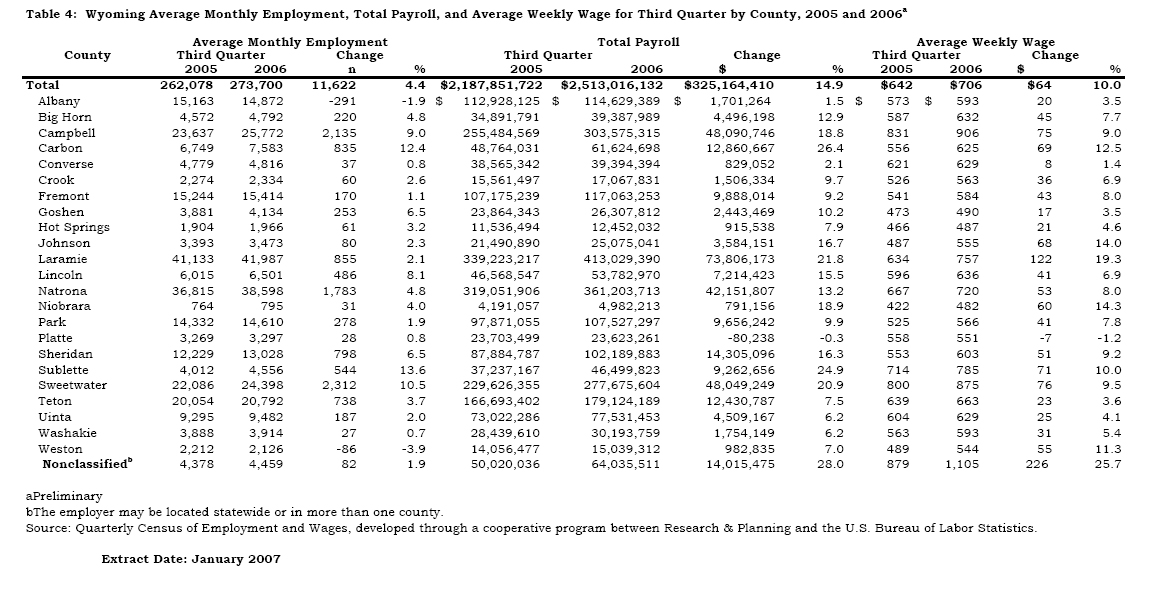

From third quarter 2005 to third quarter 2006, total Unemployment Insurance (UI) covered payroll grew by $325.2 million or 14.9%, much faster than its five-year average (8.4%, see Table 1). UI covered payroll represents approximately 92% of all wage and salary disbursements in the state and 45% of personal income (U.S. Bureau of Economic Analysis, 2007). Wyoming's average weekly wage increased by $64 or 10.0%, well above its five-year average (6.0%). Total employment rose by 11,622 jobs or 4.4%, double its five-year average (2.2%).

The covered payroll and employment data in this article is measured by place of work as compared to the labor force estimates which are a measure of employed and unemployed persons by place of residence.

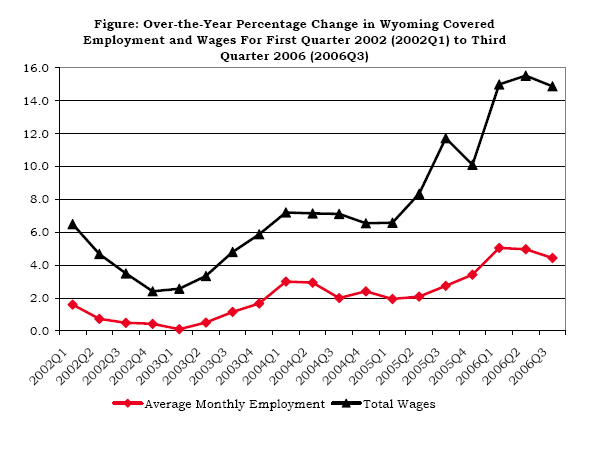

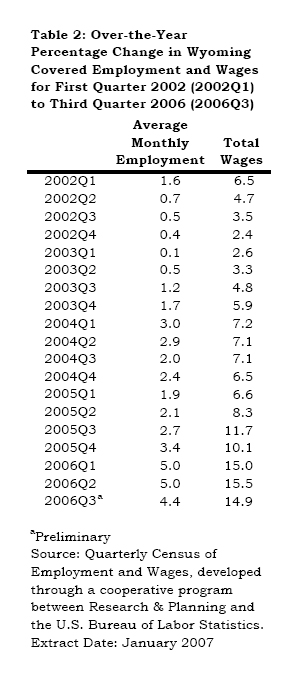

The Figure shows that employment growth accelerated from 0.1% in first quarter 2003 to 5.0% in first and second quarter 2006, then decreased slightly to 4.4% in third quarter 2006. Growth in total wages increased from 2.4% in fourth quarter 2002 to 15.5% in second quarter 2006 then decreased slightly to 14.9% in third quarter 2006 (see Table 2).

Statewide Employment and Wages by Industry

The purpose of this article is to show employment and payroll changes between third quarter 2005 and third quarter 2006. These economic changes help us gauge the strength of Wyoming's economy and identify the fastest and slowest growing industries and geographic areas.

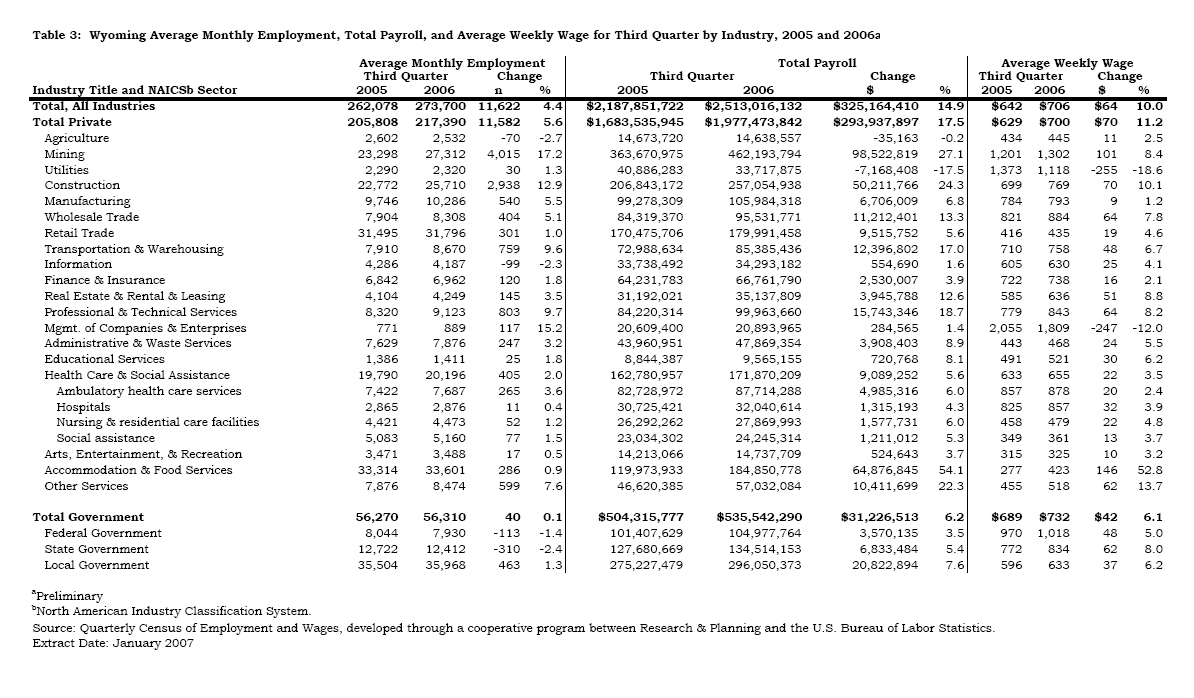

In third quarter the largest job gains occurred in Mining, Construction, Professional & Technical Services, Transportation & Warehousing, Other Services, and Manufacturing (see Table 3).

Employment increased in all areas of Mining during third quarter (4,015 jobs or 17.2%). Oil & gas extraction added over 300 jobs, mining, except oil & gas added over 1,100 jobs, and support activities for mining added over 2,500 jobs. Mining payroll grew by $98.5 million, the largest growth of any sector. Average weekly wage in Mining increased by $101 or 8.4%.

Construction gained 2,938 jobs (12.9%) and its total payroll increased by $50.2 million (24.3%). Job gains were widespread in construction of buildings (over 350 jobs), heavy & civil engineering construction (over 1,200 jobs), and specialty trade contractors (over 1,300 jobs). Much of the growth in heavy & civil engineering construction is related to pipelines, refineries, and power plants.

Professional & Technical Services employment grew by 803 jobs (9.7%) in third quarter. Its total payroll rose by $15.7 million (18.7%). The fastest growing subsectors were architectural & engineering services, management & technical consulting services, and other professional & technical services. Employment fell slightly in scientific research & development services and advertising & related services.

Total payroll in Transportation & Warehousing increased by $12.4 million or 17.0% and employment rose by 759 jobs or 9.6%. The largest jobs gains were in truck transportation and warehousing & storage.

Other Services added 599 jobs in third quarter (7.6%) and its total payroll increased by $10.4 million or 22.3%. Repair and maintenance services gained about 550 jobs, while much smaller gains were seen in personal & laundry services and membership associations & organizations. Employment fell slightly in private households. The average weekly wage in Other Services rose by $62 or 13.7%, partially as a result of higher-paying job gains in repair and maintenance services.

Manufacturing employment rose by 540 jobs or 5.5%. Job gains appeared in most Manufacturing subsectors, but the largest gains were in fabricated metal product manufacturing, petroleum & coal products manufacturing, and wood product manufacturing. Employment fell modestly in food manufacturing. Total payroll increased by $6.7 million or 6.8% and average weekly wage increased by $9 or 1.2%.

Within Health Care & Social Assistance the largest job gains appeared in ambulatory health care services (265 jobs or 3.6%). Employment remained stable in private hospitals (11 jobs or 0.4%), nursing & residential care facilities (52 jobs or 1.2%) and social assistance (77 jobs or 1.5%). Total payroll increased by $9.1 million and average weekly wage increased by $22 or 3.5%.

At the statewide level, average weekly wage increased by $64 or 10.0%, but wage gains across the industries were somewhat varied (see Table 3). Mining posted the largest increase in average weekly wage ($101 or 8.4%) and it was followed by Construction ($70 or 10.1%), Wholesale Trade ($64 or 7.8%), and Professional & Technical Services ($64 or 8.2%). Wage gains of $10-$30 per week occurred in a large number of sectors. Average weekly wage fell in two relatively small sectors: Utilities and Management of Companies and Enterprises.

Employment fell in Agriculture, Information, Federal Government, and State Government. Agriculture job losses were mainly in agriculture & forestry support activities. Within the Information sector the largest job losses occurred in ISPs, search portals, & data processing, but employment also fell slightly in publishing and broadcasting. Federal Government employment fell by 113 jobs or 1.4%. It appears that employment decreased slightly at many federal agencies. State Government employment decreased by 310 jobs (-2.4%), but total payroll increased by $6.8 million or 5.4%.

Employment and Wages by County

Total payroll increased in every area of the state except Platte County (see Table 4), and employment increased everywhere except Albany and Weston counties. This suggests that the current economic expansion is positively affecting most of the state.

Increases in the average weekly wage at the county level varied greatly. Platte County's average wage fell by $7 or 1.2%, while wages increased rapidly in six counties (Campbell, Carbon, Johnson, Laramie, Sublette, and Sweetwater). With the exception of Laramie County, which was affected by a large bonus, it appears that wages increased the fastest in counties affected by the current energy boom.

Sweetwater County added 2,312 jobs (10.5%) in third quarter. Mining (including oil & gas) gained about 800 jobs, Construction gained over 400 jobs, and Other Services gained about 350 jobs. Total payroll increased by $48 million or 20.9%.

Employment in Campbell County increased by 2,135 jobs (9.0%). Growth was strongest in Mining (including oil & gas-almost 950 jobs), Construction (over 350 jobs), Wholesale Trade (about 200 jobs), and Accommodation & Food Services (about 200 jobs). Average weekly wage increased by $75 or 9.0% and total payroll increased by $48.1 million or 18.8%.

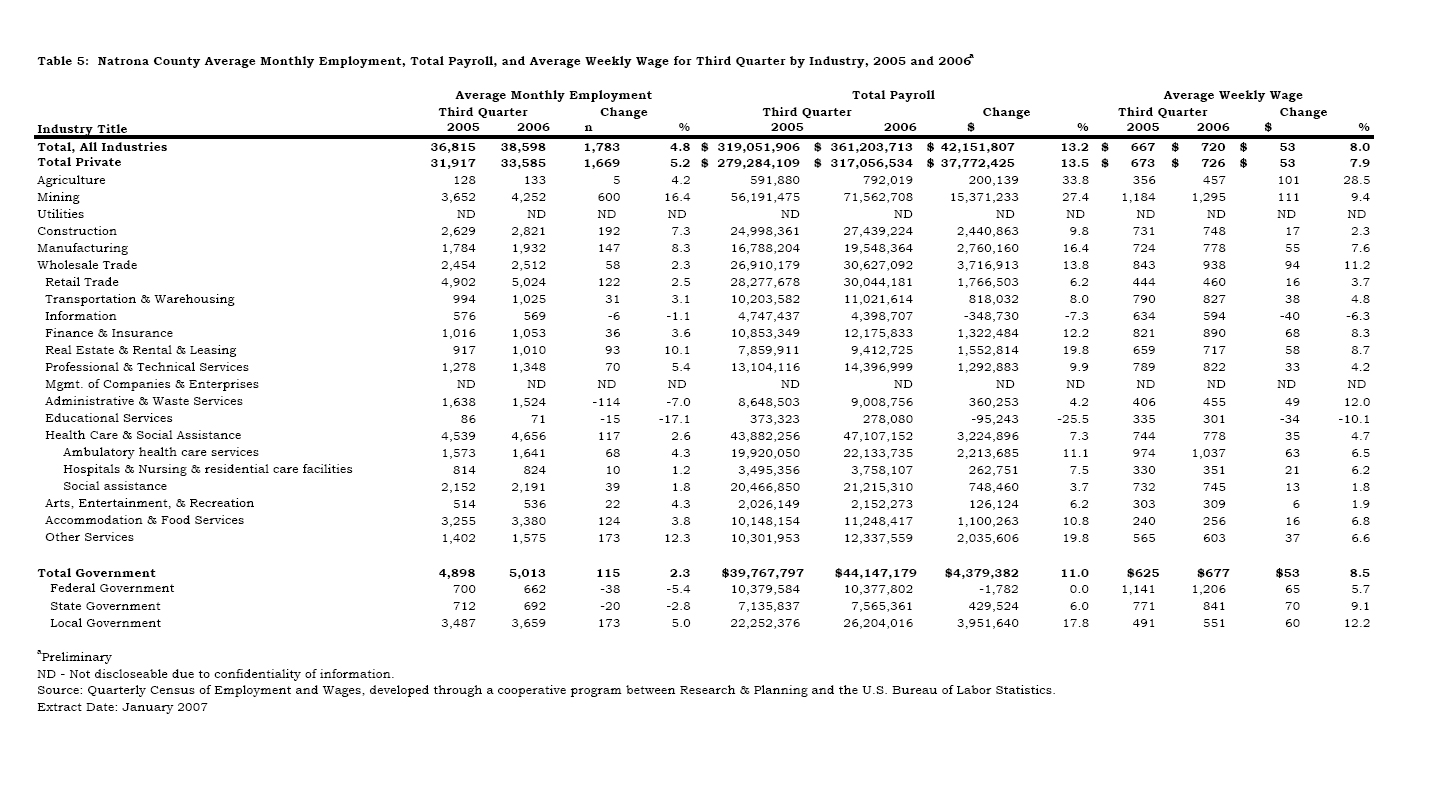

Table 5 shows that Natrona County's total payroll increased by $42.2 million or 13.2%. The largest growth in total payroll occurred in Mining ($15.4 million or 27.4%), Local Government (including public schools; $3.9 million or 17.8%), and Wholesale Trade ($3.7 million or 13.8%). Employment rose by 1,783 jobs (4.8%). Mining (including oil & gas) added 600 jobs (16.4%), Construction added 192 jobs (7.3%), Other Services added 173 jobs (12.3%), and Local Government added 173 jobs (5.0%). Health Care & Social Assistance gained 117 jobs (2.6%) and its total payroll increased by $3.2 million (7.3%). Employment fell substantially in Administrative & Waste Services (-114 jobs or -7.0%), the sector which includes telemarketing firms. Job losses were also seen in Information (-6 jobs or -1.1%), Private Educational Services (-15 jobs or -17.1%), Federal Government (-38 jobs or -5.4%), and State Government (-20 jobs or -2.8%).

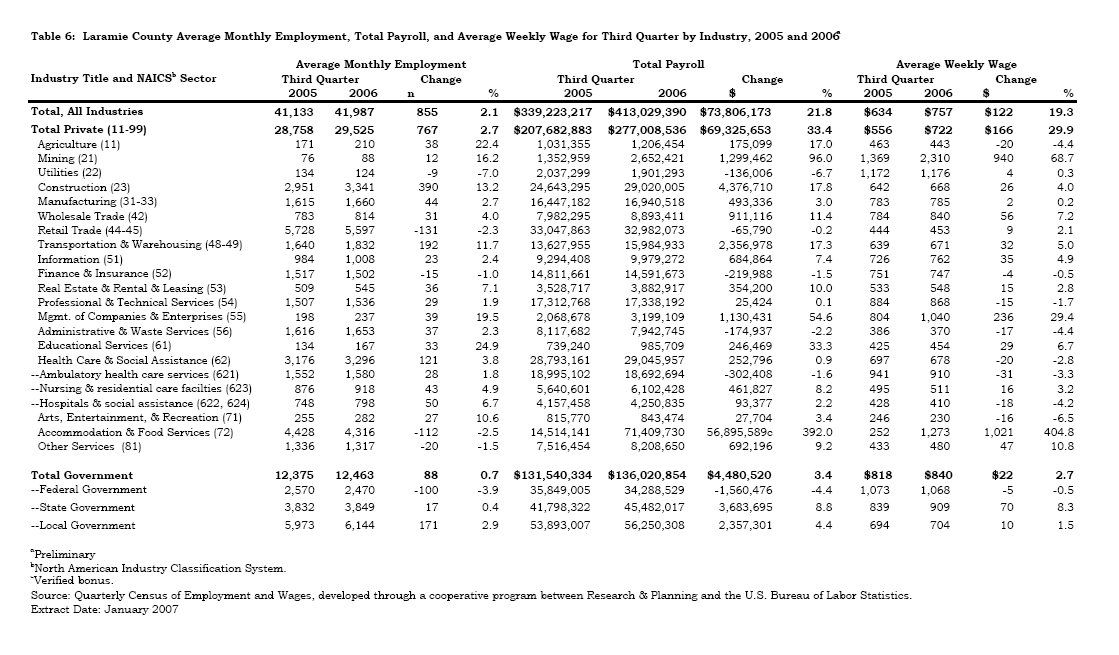

Total Payroll increased by $73.8 million (21.8%) in Laramie County mostly because of a large bonus in Accommodation & Food Services (see Table 6). Employment increased by 855 jobs (2.1%). Substantial job gains were seen in Construction (390 jobs or 13.2%), Transportation & Warehousing (192 jobs or 11.7%), Local Government (171 jobs or 2.9%), and Health Care & Social Assistance (121 jobs or 3.8%). Employment fell in Utilities (-9 jobs or -7.0%), Retail Trade (-131 jobs or -2.3%), Finance & Insurance (-15 jobs or -1.0%), Accommodation & Food Services (-112 jobs or -2.5%), and Federal Government (-100 jobs or -3.9%).

In third quarter Carbon County gained 835 jobs (12.4%). Construction employment increased by over 500 jobs, but growth also occurred in Local Government, Transportation & Warehousing, and Retail Trade. The growth in total payroll ($12.9 million or 26.4%) appears related to the rapid increase in high paying construction jobs.

Sheridan County saw employment increase by 798 jobs (6.5%) and total payroll increase by $14.3 million or 16.3%. The largest job gains occurred in Mining (including oil & gas), Construction, Retail Trade, and Professional & Technical Services.

Teton County's total payroll increased by $12.4 million or 7.5% and employment grew by 738 jobs (3.7%). Substantial job gains were seen in Construction, Accommodation & Food Services, and Retail Trade.

Employment fell slightly in Weston and Albany counties, but total payroll and average weekly wage both increased. In Albany County, job losses in State Government, Retail Trade, Information, and Administrative & Waste Services were partially offset by gains in Construction, Manufacturing, and Professional & Technical Services. In Weston County employment fell in Federal Government, Mining, Accommodation & Food Services, and Administrative & Waste Services.

In summary, Wyoming's economy expanded at a rapid pace in third quarter. Employment and total payroll both increased much faster than their five-year average rates, and growth was seen across many industry sectors and geographic areas of the state.

References

U.S. Bureau of Economic Analysis. (2007, May 15). SA04 State income and employment summary -- Wyoming. Retrieved May 15, 2007, from http://www.bea.gov/regional/spi/action.cfm

Table of Contents | Labor Market Information | Wyoming

At Work | Send Us Mail

Last modified on

by Phil Ellsworth.