Methodological Note: A Caution Regarding Employer Reports to the Current Employment Statistics Program

The Current Employment Statistics (CES) program is a monthly survey of employers. Reports from this sample of employers are used to make estimates of employment by sector (e.g., natural resources & mining, construction, manufacturing). Employment across the sectors is summed to equal total nonagricultural employment. Both the sector-level estimates and the total are available for states, the nation, and selected metropolitan areas, and are widely used as economic indicators. Estimates for Wyoming are found on page 18 of this issue of Trends. Each year, CES estimates are revised to incorporate data from the Quarterly Census of Employment and Wages in a process known as benchmarking.

In trying to reconcile January’s large increase in unemployment insurance (UI) claims with the relatively stable CES employment data, analysts wondered if there were quality issues with the employment data reported to the CES program. Specifically, they suspected some employers might put their workers on a temporary (job-attached) layoff and still count them as employed in the CES survey.

Analysts combined the UI claims files for the first four weeks of 2009 and found that 1,471 individuals filed initial claims with a job-attached status. There were 53 firms with at least five initial job-attached claims filed against them during this period.

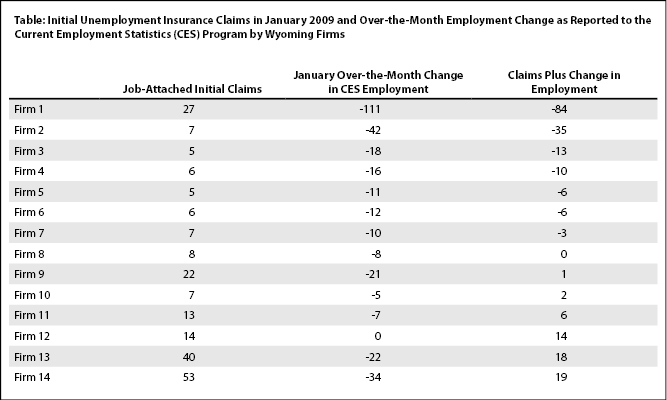

Of these 53 firms, 14 had CES-matched sample data (employment reported for both December 2008 and January 2009). This allowed analysts to compare the number of UI claims to the change in employment from December to January. The Table shows the employer-level data for these 14 firms. At seven firms the net decrease in employment was larger than the number of UI claims. This was what analysts normally expect, because not all individuals who lose their jobs file a claim. At one firm, the number of UI claims exactly matched the net decrease in employment (there were eight initial claims and employment decreased by eight jobs).

At the remaining six firms, there were more UI claims than one might expect by looking at the decrease in employment. Thus, there is some basis to believe that firms may sometimes put their employees on temporary layoff and still count them as employed in the CES survey. The most extreme case involved 53 job-attached initial UI claims filed against an employer whose employment decreased by 34 jobs. At another employer, there were 40 claimants, but employment only decreased by 22 jobs. Finally, there were 14 claimants at an employer that reported no change in employment from December to January.

Of course, there are alternative explanations. The CES program asks respondents for a count of jobs at a point in time. In theory, a firm could accurately report stable employment to CES each month, but still generate claims activity. In other words, the same individuals may not be filling the same jobs month after month. However, as there are costs to both hiring and laying off employees, many firms attempt to minimize turnover.

Further, the reference periods are not the same. The CES reference period is the payroll period including the 12th of the month, but Research & Planning somewhat arbitrarily used four weeks of UI claims. There is no requirement that workers immediately file a UI claim upon being laid off. Some may delay filing for various reasons.

Data users would be wise to take UI claims activity into account when evaluating the CES estimates. Large increases in claims generally suggest a decrease in employment.

Fortunately, the CES sample is large enough (approximately 1,500 employers) that reporting errors at a handful of firms will not have much effect on total employment estimates. Still, potential reporting errors in the CES program represent an important area for future research.

Return to text

Last modified on

by April Szuch.