Employment and Wage Changes in Wyoming’s Private Coal Mining Sector

In June 2015, the U.S. Energy Information Administration predicted a 7% decrease in coal consumption in the national electric power sector, citing competition from lower natural gas prices and increased production of solar, wind, and other renewable energy (EIA, 2015). Also in June, PacifiCorp – the parent company of Rocky Mountain Power, Wyoming’s largest utility – announced in its Integrated Resource Plan that the company plans reduce its reliance on coal through 2029 (PacifiCorp, 2015).

According to the Wyoming State Geological Survey, Wyoming is the country’s top coal producer, accounting for 39% of all coal mined in the U.S. (Carol, 2015). Data from the Quarterly Census of Employment and Wages (QCEW) show that Wyoming’s private coal mining accounts for a substantial amount of total employment within the state’s mining, quarrying, oil & gas extraction industry. In third quarter 2014 (2014Q3), for example, the average monthly employment in coal mining (6,508) accounted for 23.6% of the mining industry’s average monthly employment (27,582).

|

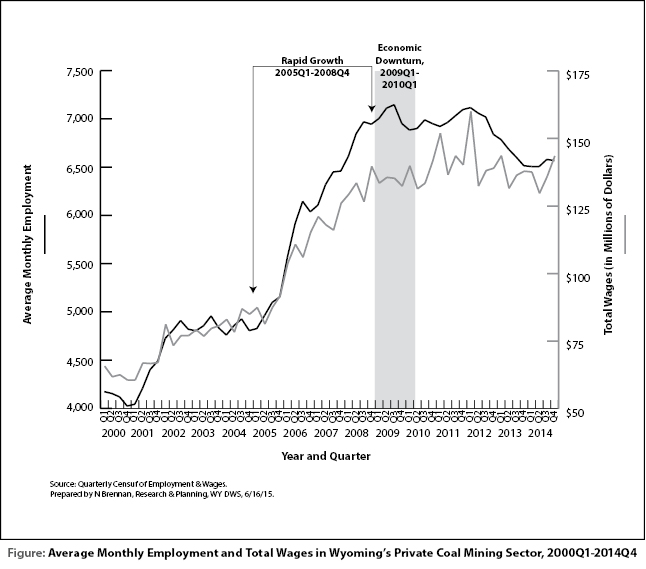

As shown in the Figure, Wyoming’s economy experienced a period of rapid growth from 2005 to 2008. During this time, employment and wages in Wyoming’s private coal mining sector grew substantially. Employment increased from 4,828 in 2005Q1 to 6,945 in 2008Q4, an increase of 2,117 jobs (43.8%). During that same period, total wages increased from $87.4 million to $139.7 million (59.7%).

Wyoming then experienced an economic downturn that lasted from 2009Q1 to 2010Q1. Job losses in the private coal mining sector were not as severe as those seen in other types of mining activities, or in other industries in Wyoming, such as construction and retail trade (Bullard, 2010).

As shown in the Figure, however, employment in Wyoming’s private coal mining sector has decreased steadily over the last few years. Average monthly employment decreased from 7,117 in 2012Q1 to 6,569 in 2014Q4, a change of -458, or -6.4%. The full effects of the recent news of decreased coal consumption likely are not reflected in the most recent employment and wage data from the QCEW. This information is updated quarterly and is available from the Research & Planning (R&P) section of the Wyoming Department of Workforce Services at http://doe.state.wy.us/LMI/toc_202.htm.

References

Bullard, D. (2010). Covered employment and wages for fourth quarter 2009: Total payroll declines in 16 Wyoming counties. Wyoming Labor Force Trends, 47(7). Retrieved June 17, 2015, from http://doe.state.wy.us/LMI/0710/a1.htm

Carol, C. (2015, February). Wyoming’s coal resources: Summary report. Wyoming State Geological Survey. Retrieved June 17, 2015, from http://www.wsgs.wyo.gov/public-info/onlinepubs/docs/2015-coal-summary.pdf

Pacificorp (2015, June). PacifiCorp long range energy plan calls for less coal, more energy efficiency. Retrieved June 17, 2015, from http://www.pacificorp.com/about/newsroom/2015nrl/irp-energy-plan.html

U.S. Energy Information Administration. (2015, June). Short-term energy outlook. Retrieved June 17, 2015, from http://www.eia.gov/forecasts/steo/pdf/steo_full.pdf