Barriers to Growth in Wyoming’s Economy

The opportunities and concerns associated with rapid economic expansion include aging, health care, inflation, housing, labor competition, and mineral production, among others.

Generally, population and infrastructure evolve slowly and do not easily accommodate rapid economic change – in colloquial terms, a boom. The recent surge in Wyoming’s economy created a substantial number of jobs in recent years. At the same time, the supply of resident labor declined, leading to an influx of nonresidents to fill available jobs (Jones, 2007). Along with increased job growth, wage growth increased, leading to greater purchasing power for many workers. Increased purchasing power enables workers to buy more goods, including housing. In some areas of the state the demand for housing exceeds the supply, thereby placing upward pressure on prices and wages for a myriad of occupations. Against the backdrop of economic expansion, Wyoming’s population is aging rapidly and the ability of the state’s health care institutions to respond to the challenge is in question (Research & Planning, 2008). In this article, we examine the opportunities and concerns associated with rapid economic expansion, such as aging, health care, inflation, purchasing power, and mineral production, to place them in the proper context.

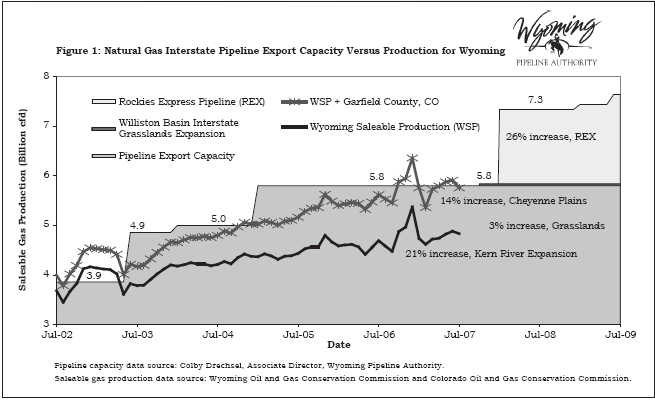

Energy Prices and Transport CapacityMuch of the current economic expansion is due to natural gas production. However, prices obtained by Wyoming suppliers are determined not only by aggregate national demand, but also by the ability to efficiently move produced gas to market through pipelines (takeaway capacity). Whenever the amount of produced gas exceeds the state’s takeaway capacity, prices can decline rapidly, reducing producer profitability and state revenues from mineral royalties and taxes. Additionally, drilling activity tends to decrease along with prices.

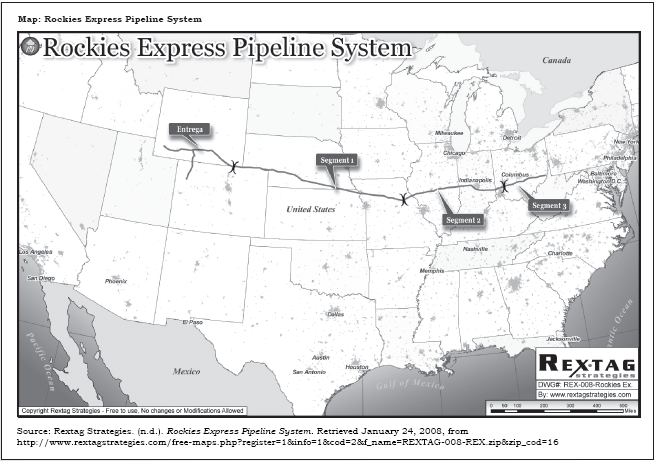

The interaction of these market forces is shown in Figure 1, which illustrates occasions when the volume of produced gas has exceeded pipeline capacity. When this happens, production usually falls until supply and takeaway capacity roughly equalize. This phenomenon has occurred twice in the past, from late 2002 into 2003 and again in 2006. Note that the figure shows Wyoming production and Garfield County, CO, production. This is because gas flows north from western Colorado into pipelines in Wyoming, thereby using an incremental amount of capacity. Figure 1 suggests that current area natural gas production will soon exceed supply. This will continue until natural gas is transmitted via new pipelines, most notably the Rockies Express (REX) project (see Map). REX will connect Wyoming and Colorado suppliers to customers in the eastern United States (Kinder Morgan, n.d.). Future pipeline projects may include Spectra Energy’s Bronco Pipeline (n.d.) and El Paso Corporation’s Ruby Pipeline (2007). News releases indicate both projects will originate in southwestern Wyoming and terminate at a natural gas trading hub in Oregon.

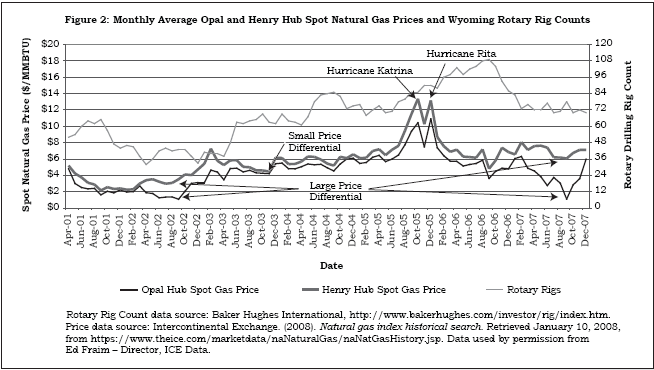

While Figure 1 illustrates the supply-demand balance for Wyoming natural gas, Figure 2 illustrates gas price fluctuations and their effect on the number of rotary drilling rigs operating in the state. The two dark lines represent the production price to send natural gas to market from two locations, Opal, WY, and Henry Hub, LA. Industry experts regard Henry Hub as the benchmark for natural gas prices in the continental United States (Sabine Pipeline, LLC, 2008).

Figure 2 illustrates the volatility of natural gas prices during the last six years. The two large price spikes in 2005 were primarily due to the effects of Hurricanes Katrina and Rita. Considering those two events, we can see how the supply-demand balance affects prices. Note that the Opal price was less than the Henry Hub price for the entire time. We define differential as the difference in natural gas prices at the two hubs. When the differential is large, supply generally exceeds takeaway capacity; when the differential is small, they are roughly equal. In addition, the differential represents a potential cost to the state because of lost revenue. Depending on production levels, the state could experience a loss of millions of dollars per day when the differential is relatively large. This negatively affects funding for highways, schools, and other services the state provides to its citizens.

Natural gas prices directly influence the number of rotary drilling rigs operating in the state and, consequently, employment in the oil & gas industry (Wen, 2005). One interesting feature of the time series is that changes in the number of rigs tend to lag changes in gas prices. This illustrates how quickly production companies respond to price changes. Although the statewide rotary rig count is currently 30% less than its 2006 peak, the level of drilling activity is nearly equal to 2005 levels.

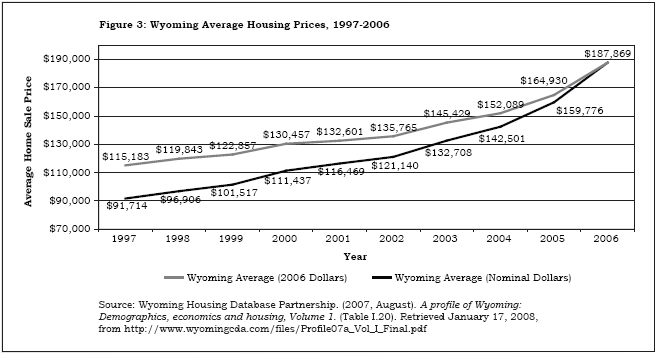

Housing Prices and AvailabilityFigure 3 shows the statewide annual average sales price for single-family homes in Wyoming from 1997 to 2006 (Wyoming Housing Database Partnership [WHDP], 2007). The lower line represents the actual price paid by home buyers and the top line represents the inflation-adjusted purchase price. The inflation-adjusted purchase price shows how much more purchasing power is required to buy a single-family home each year. Prices were adjusted for inflation using the Consumer Price Index for All Urban Consumers (CPI-U; Bureau of Labor Statistics, 2008). Although housing prices increased steadily in real and nominal terms from 1997-2002 (7.7% average annual increase), the current economic expansion accelerated prices from 2002-2006 (11.5% average annual increase). Rapid increases in home prices can place additional strain on first-time buyers and those with comparatively lower incomes. Furthermore, people moving to the state may have difficulty finding affordable housing. Lastly, persons on fixed incomes may not be able to keep their homes because property tax assessments rise as home values increase.

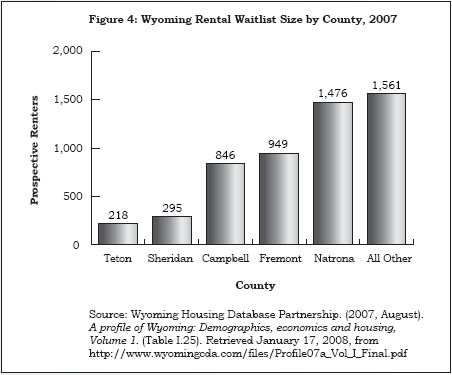

If home prices become unaffordable, particularly for new residents, the demand for rental housing may also increase. Figure 4 shows the estimated number of prospective renters on waiting lists in 2007 (WHDP, 2007). The WHDP estimated that 5,345 potential renters were on waiting lists statewide in 2007, with nearly 28% of the total in Natrona County alone. Given the demand from renters and home buyers, it is becoming increasingly difficult for those new to the market to find housing. If workers are unable to find suitable housing, they may leave their jobs and return to their states of origin, thereby exacerbating the current labor shortage.

Two groups benefiting from the price increases are existing homeowners and rental property owners. Increasing prices have allowed existing homeowners to acquire newer homes, remodel using home equity lines of credit, or refinance at lower interest rates. Increasing rents have raised the investment returns and profits from rental properties, spurring the construction of multiunit housing complexes. The results are gains in construction employment and revenues to construction supply providers.

Regional Labor CompetitionWyoming’s resident labor supply is finite. At some point, the supply of locally available labor needed to fill new jobs will be exhausted. New residents or nonresident workers must then be recruited. Neighboring states theoretically can provide such labor if their economies and employment growth remain weak relative to Wyoming’s. However, when all regional economies expand, including those of neighboring states, filling new jobs in Wyoming becomes more difficult.

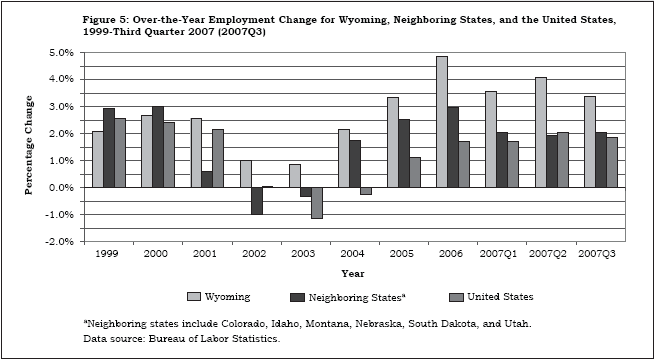

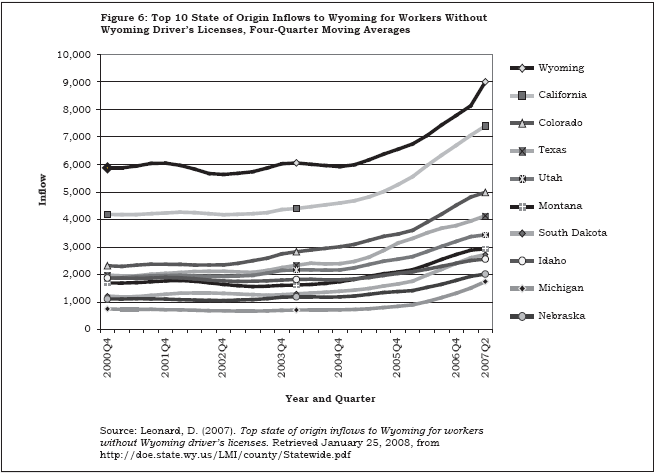

Figure 5 compares annual employment growth rates for the United States, Wyoming, and surrounding states (Colorado, Idaho, Montana, Nebraska, South Dakota, and Utah; Bureau of Labor Statistics, 2007a). Wyoming growth rates generally lagged those of the rest of the region until the early part of the decade. At the end of the dot-com boom (in 2000), the environment changed. Since then, Wyoming’s growth has greatly exceeded that of surrounding states. However, as the economies of those states began to recover in 2004, regional competition for labor increased. Because of the improving regional economy, Wyoming employers likely had greater difficulty filling positions in 2006 than in 2001 compared to employers in other states (Bureau of Labor Statistics, 2007a). Wyoming’s dependence on nonresident labor is illustrated in Figure 6. As the state’s economy expanded more rapidly in 2005 than in 2002, the number of people working here without Wyoming-issued driver’s licenses increased. Although people born in Wyoming and returning to the state comprised the largest proportion of this group, a substantial number of native Californians and Coloradans worked here as well. Should the state’s economy suffer because of decreased energy demand, these workers would likely be the first to leave.

The U.S. economy may enter a recession in the near future (al-Khalidi, 2008). As a result, declining energy consumption may negatively affect Wyoming’s economy. Although this may relieve some of the pressure on the labor market, decreased energy demand could reduce employment and state revenues, depending on the severity and duration of a decline.

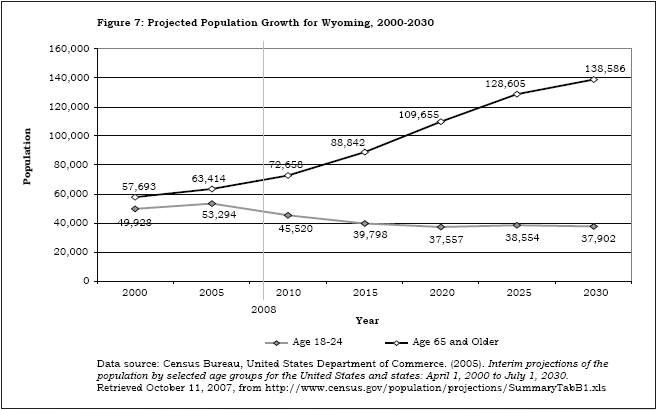

Health Care Services Affordability and AvailabilityWyoming’s population is aging rapidly. To provide an example regarding how this is likely to play out in the labor market, we examine the outlook for registered nurses (RNs). As Figure 7 shows, the proportion of Wyoming’s population age 65 and older will more than double between 2005 and 2030. This change poses challenges for the state’s health care delivery system as well as the labor market. As people age the frequency of need for health care increases, as do the severity and length of treatment (Bennett & Flaherty-Robb, 2003). With large numbers of health care professionals at or near retirement age, the integrity of the health care delivery system may be in jeopardy.

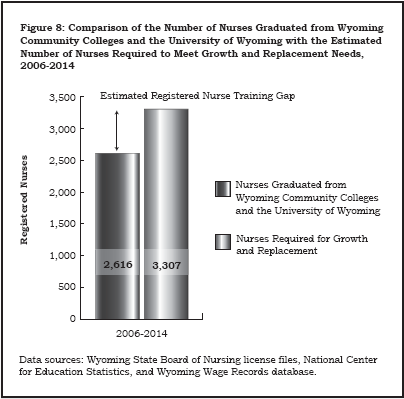

We predict a substantial gap between the projected supply and projected demand for RNs statewide. Figure 8 compares the projected number of RNs needed (Leonard, 2008) and the projected number of RNs supplied by Wyoming’s postsecondary educational institutions through 2014. The estimates assume that all nursing program completers remain in the state from 2006-2014 and remain employed as nurses during the entire period.

If these assumptions hold true, in 2014 Wyoming will need 636 more RNs than the state’s education system can supply in its current form. To fill these gaps, RNs will need to be recruited either for permanent relocation to Wyoming or from traveling nurse agencies. The diminished availability of RNs reduces the amount of time they can spend with each patient, which may negatively influence the level of care given. In addition, health care costs may increase more rapidly due to wage inflation. Generally, labor shortages drive up wages to attract workers into certain occupations – in this case, nursing. When health care firms increase wages to attract or retain staff, their costs increase. Most likely, these costs will be passed on to health care consumers.

Given this scenario, it appears that both the state’s health care training system and the state’s health care delivery system are insufficiently prepared for the future. For further details, see Research & Planning’s reports to the Wyoming Healthcare Commission on nursing demand, retention, and supply (Research & Planning, 2008).

ConclusionWyoming’s current economic expansion presents policymakers with opportunities and challenges. The balance between gas production and export capacity in coming years will likely affect whether Wyoming’s economic expansion continues. Additionally, housing prices and the relative strength of neighboring states’ economies will affect in-migration. Some challenges, such as pipeline export capacity, will be addressed by private infrastructure investments. Other issues, such as health care quality, affordability, and availability, may require policy changes to avert future system breakdowns.

Referencesal-Khalidi, S. (2008). Probability of U.S. recession growing: Energy secretary. Reuters UK News Service. Retrieved January 17, 2008, from http://uk.reuters.com/article/oilRpt/idUKL1721711220080117

Baker Hughes International. (2008). Rotary rig counts. Retrieved January 10, 2008, from http://www.bakerhughes.com/investor/rig/index.htm

Bennett, J., & Flaherty-Robb, M. (2003). Issues affecting the health of older citizens: Meeting the challenge. Online Journal of Issues in Nursing. Retrieved October 15, 2007, from http://nursingworld.org/MainMenuCategories/ANAMarketplace

/ANAPeriodicals/OJIN/TableofContents/Volume82003/Num2May31_2003

/OlderCitizensHealthIssues.aspx

Bureau of Labor Statistics, United States Department of Labor. (2007a). Employment, hours, and earnings from the Current Employment Statistics survey (national). Retrieved January 17, 2008, from http://data.bls.gov/PDQ/outside.jsp?survey=ce

Bureau of Labor Statistics, United States Department of Labor. (2007b). Employment, hours, and earnings from the Current Employment Statistics survey (state & metro area). Retrieved January 17, 2008, from http://www.bls.gov/sae/home.htm

Bureau of Labor Statistics, United States Department of Labor. (2008). Consumer Price Index for all urban consumers. Retrieved January 15, 2008, from http://data.bls.gov/cgi-bin/dsrv?cu

Colorado Oil and Gas Conservation Commission. (2008). Saleable gas production for Garfield County, CO. Retrieved January 10, 2008, from http://www.oil-gas.state.co.us

El Paso Corporation. (2007, December 27). PG&E Corporation to acquire 25.5 percent interest in Ruby Pipeline. Retrieved January 10, 2008, from http://investor.elpaso.com/phoenix.zhtml?c=97166&p=irol-newsArticle&ID=1090004&highlight

Jones, S.D. (2007, April). Demographic effects of Wyoming’s energy-related expansion. Wyoming Labor Force Trends, 44(4). Retrieved April 24, 2008, from http://doe.state.wy.us/LMI/0407/a1.htm

Kinder Morgan. (n.d.). Rockies Express Pipeline. Retrieved January 10, 2008, from http://www.kindermorgan.com/business/gas_pipelines/rockies_express

Leonard, D. (2008, March). Projections of registered nurses needed to 2014. In Nurses in demand: A statement of the problem (chap. 2). Retrieved April 24, 2008, from http://doe.state.wy.us/LMI/nursing_demand_08.pdf

Research & Planning. (2008). Nurses in demand: A statement of the problem. Retrieved April 24, 2008, from http://doe.state.wy.us/LMI/nursing_demand_08.pdf; Further reports will be available at http://doe.state.wy.us/LMI/nursing.htm

Rextag Strategies. (n.d.). Rockies Express Pipeline System. Retrieved January 24, 2008, from http://www.rextagstrategies.com/free-maps.php?register=1&info=1&cod=2&f_name=REXTAG-008-REX.zip&zip_cod=16

Sabine Pipeline, LLC. (2008). The Henry Hub. Retrieved January 10, 2008, from http://www.sabinepipeline.com/public/henry.asp

Spectra Energy. (n.d.). Bronco Pipeline. Retrieved January 10, 2008, from http://www.spectraenergy.com/businesses/projects/bronco

United States Department of Education, National Center for Education Statistics. (2008). College navigator, program completer data. Retrieved January 18, 2008, from http://nces.ed.gov/collegenavigator

Wen, S. (2005, September). Oil and gas production and the relationship between prices and employment in Wyoming. Wyoming Labor Force Trends, 42(9). Retrieved January 24, 2008, from http://doe.state.wy.us/LMI/0905/a1.htm

Wyoming Housing Database Partnership. (2007, August). A profile of Wyoming: Demographics, economics and housing, Volume 1. Retrieved January 17, 2008, from http://www.wyomingcda.com/files/Profile07a_Vol_I_Final.pdf

Wyoming Oil and Gas Conservation Commission. (2008). Gas sales. Retrieved January 17, 2008, from http://wogcc.state.wy.us

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Return to text

Last modified on

by April Szuch.